Mortgage Rates

Explore current mortgage rates and discover the best loan options for your home purchase or refinance. Our team offers personalized advice to help you secure the most favorable terms, whether you're a first-time buyer or refinancing your existing mortgage. Stay up-to-date with the latest market trends and get a free quote to start your journey to homeownership or saving on your mortgage today.

If you have any questions or need more information, simply input your details here, and we’ll be in touch to assist you.

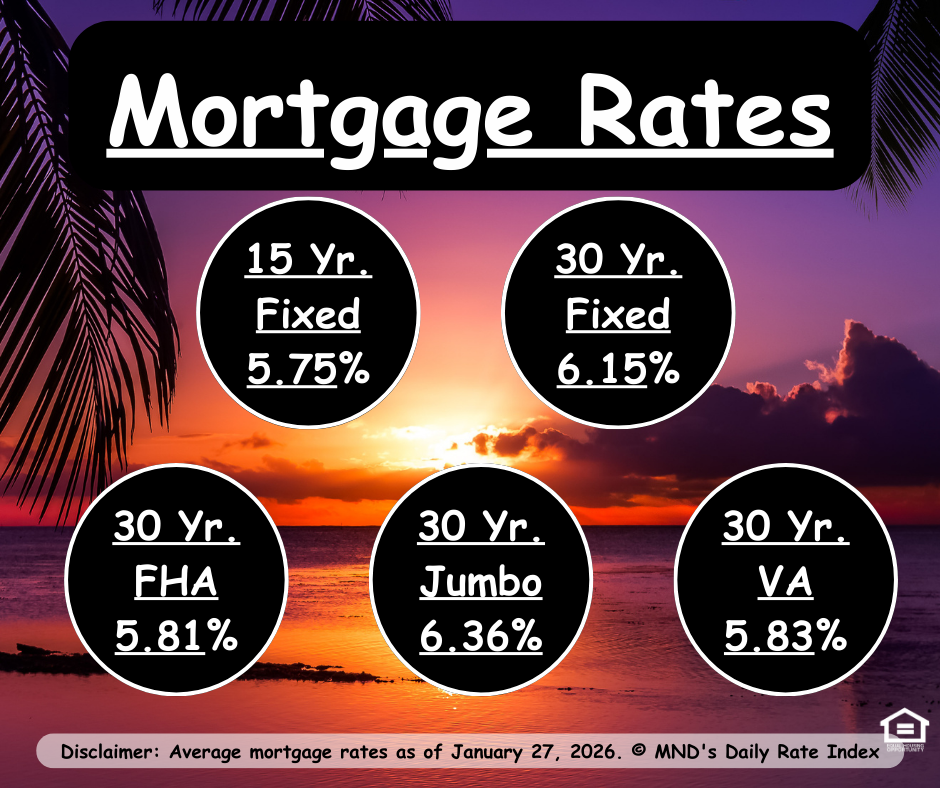

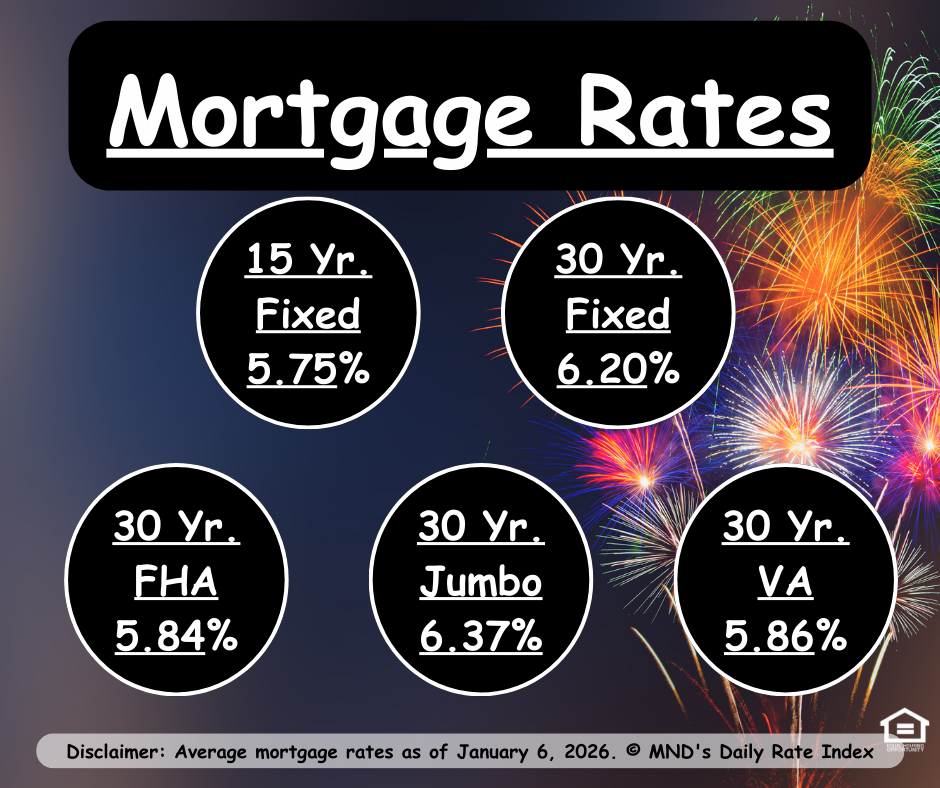

January 27, 2026

Mortgage rates quietly moved lower for the fifth day in a row, proving that sometimes a calm, boring market can still bring good news for borrowers.

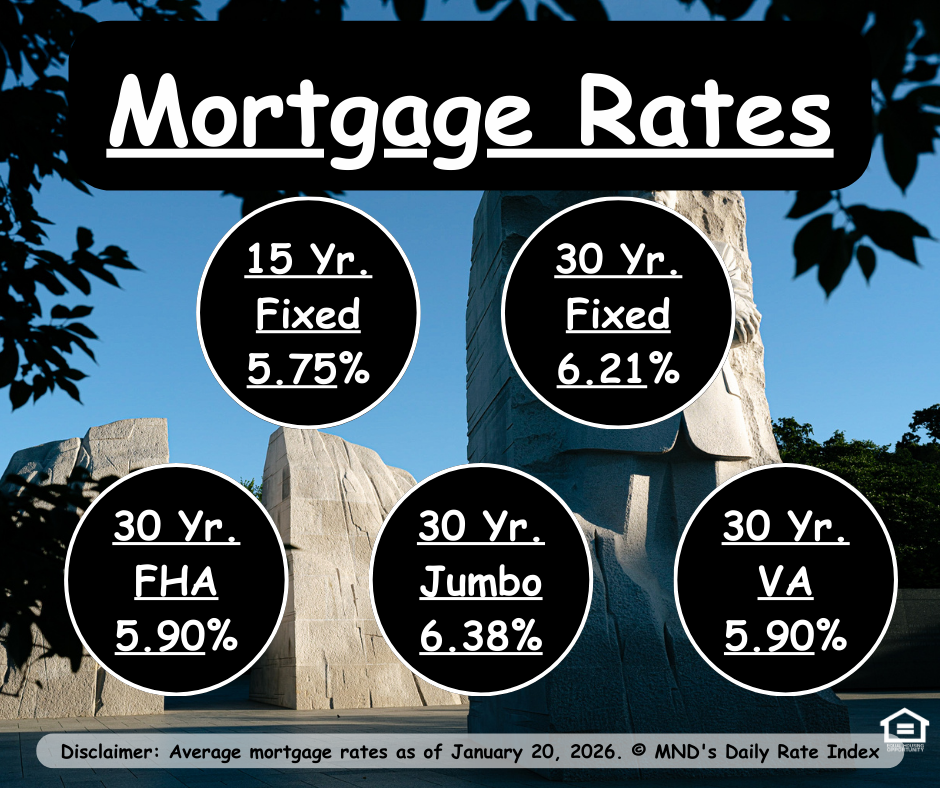

January 20, 2026

Mortgage rates jumped back to the low-6% range this week as global market pressure outweighed recent bond-buying optimism—proof that today’s rate environment is anything but boring.

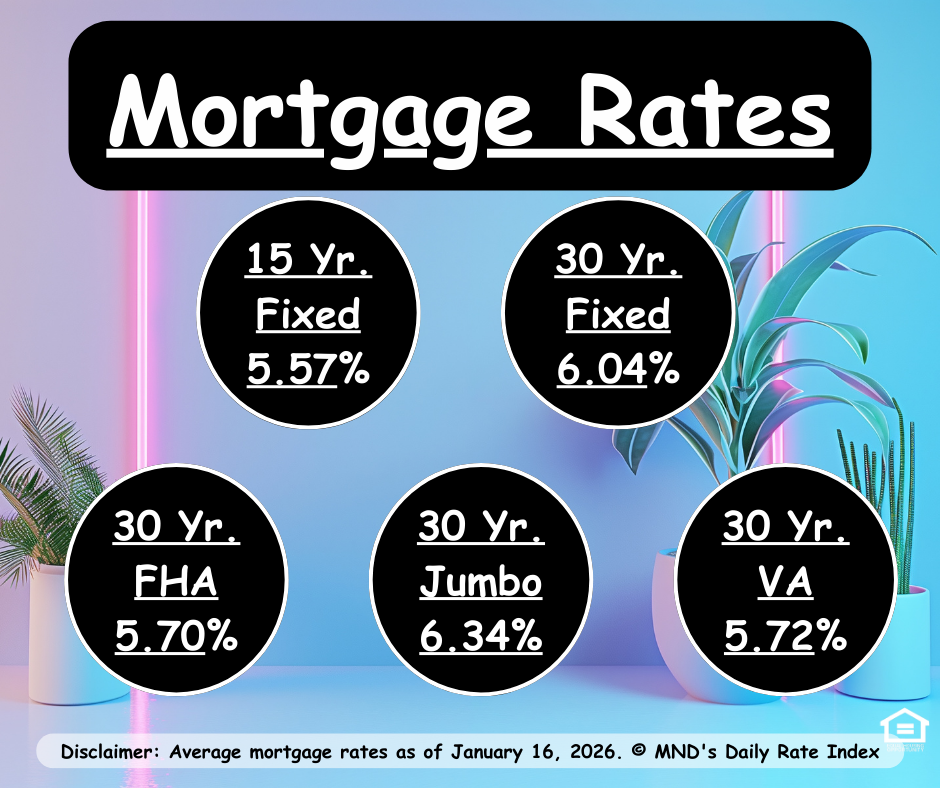

January 16, 2026

Mortgage rates saw mixed movement today depending on lender timing, but zooming out, pricing remains near 3-year lows.

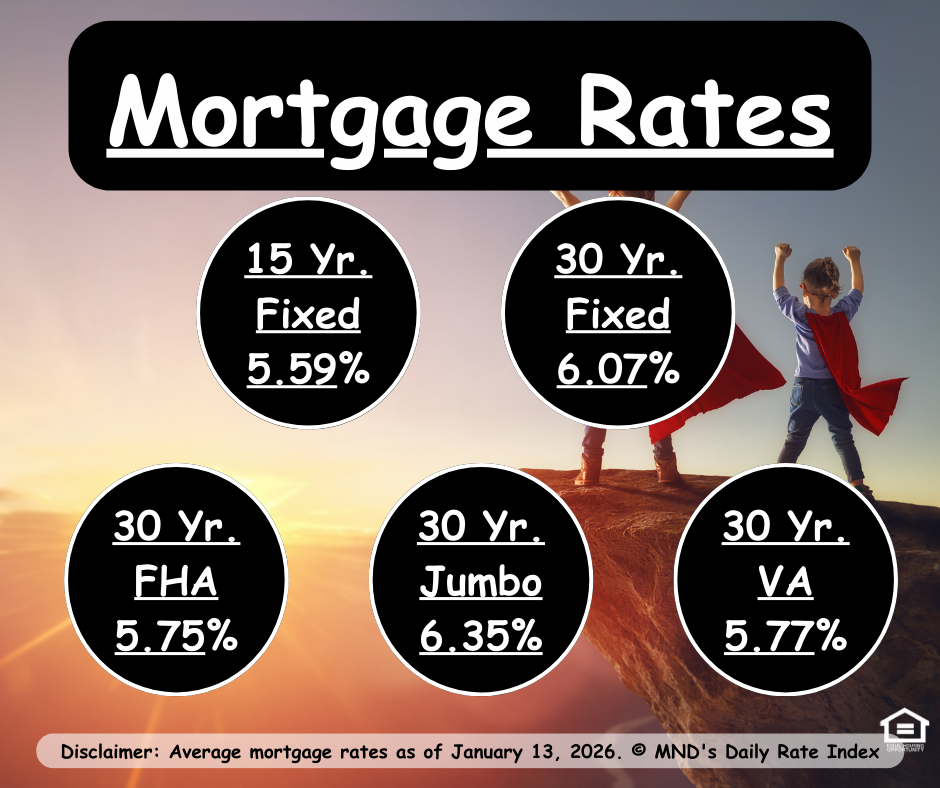

January 13, 2026

Mortgage rates hovered just above recent lows today, with a softer inflation report helping prevent further increase.

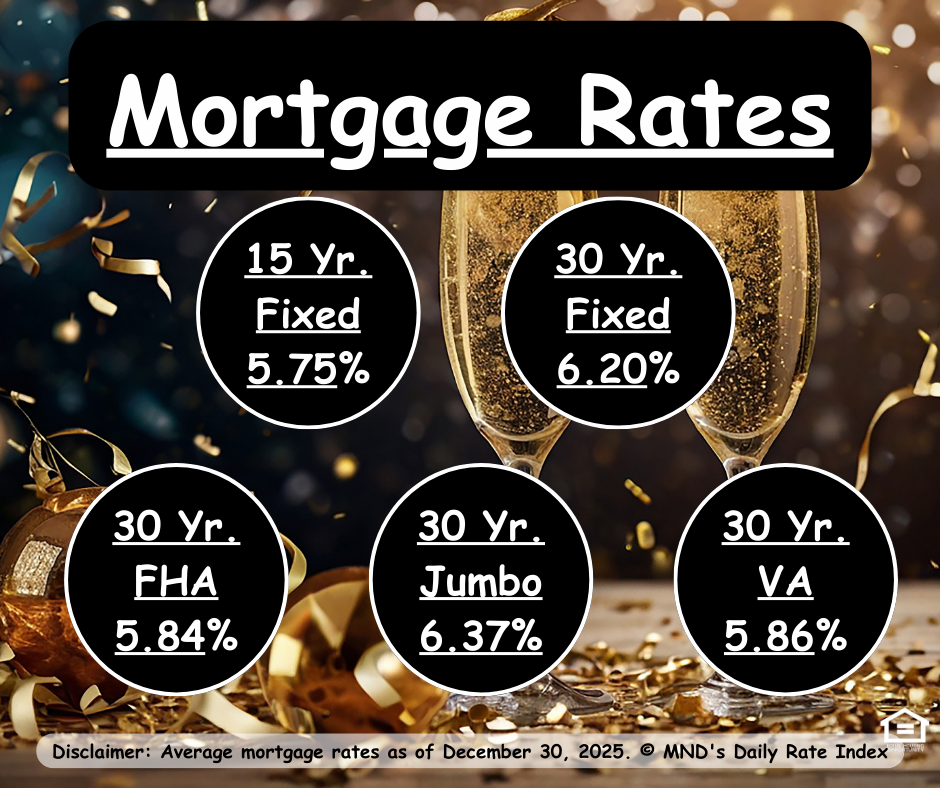

December 30, 2025

Mortgage rates wrapped up 2025 in a stable holding pattern, setting the stage for a more strategic — not rushed — approach to buying and refinancing in 2026.

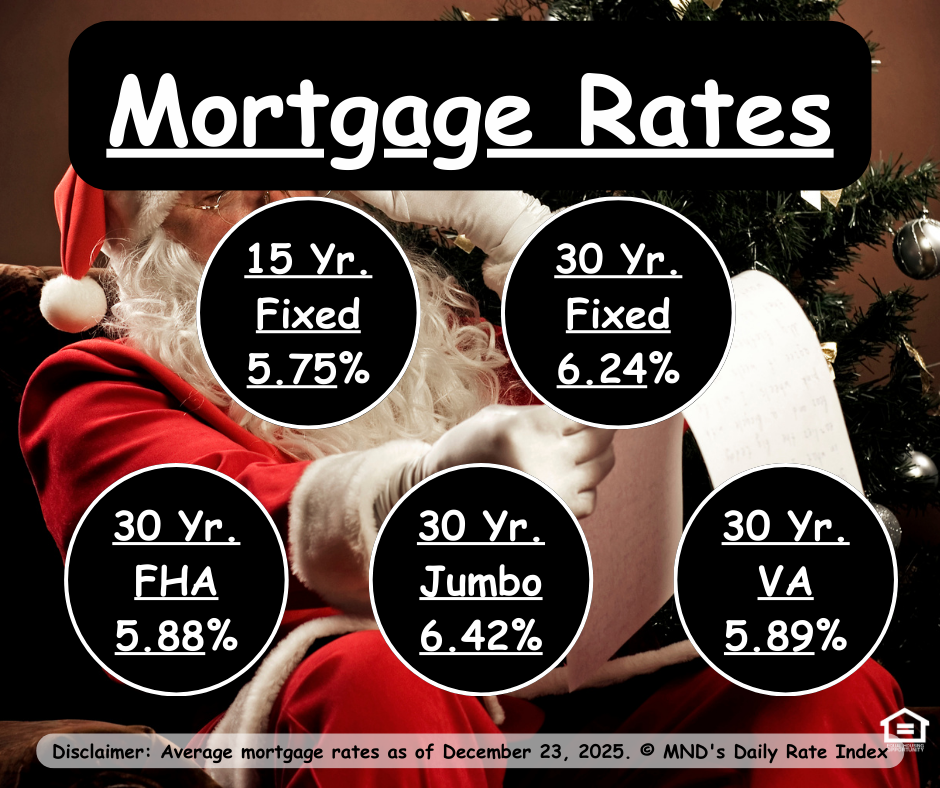

December 23, 2025

Mortgage rates are holding steady near the lower end of a four-month range, with the potential to challenge three-year lows.

December 16, 2025

Mortgage rates dipped slightly after a softer jobs report, but stayed within their recent range as markets now turn their attention to this week’s critical inflation data.

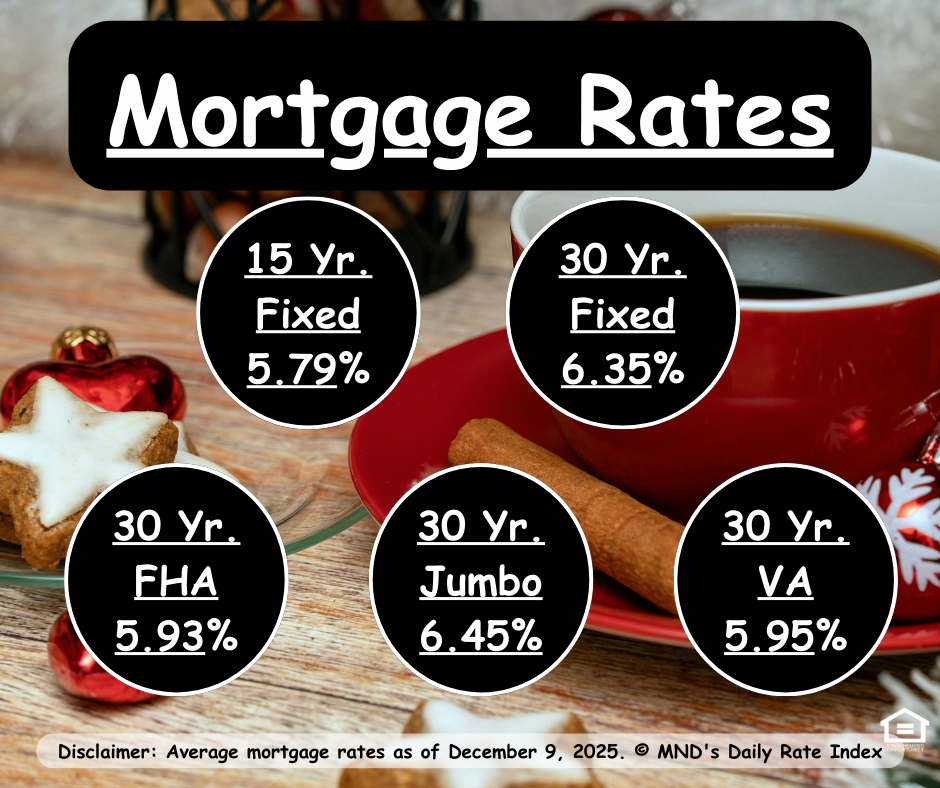

December 9, 2025

Today’s rates stayed steady, but we’re heading into one of the most volatile 24 hours of the month.

December 2, 2025

Rates dipped just slightly today 😊—but tomorrow’s economic data could shake things up.

November 25, 2025

Bond markets rallied overnight despite a messy morning of surprise economic report releases. Traders were already leaning toward buying the dip, and a softer ADP weekly jobs pulse supported the move

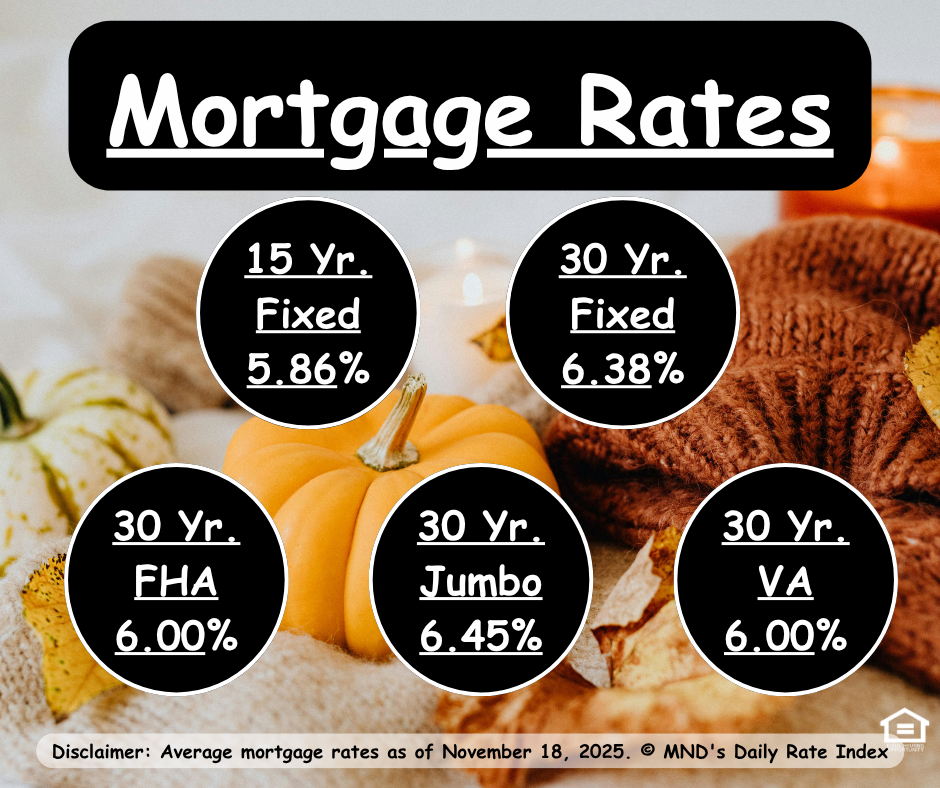

November 18, 2025

A messy batch of surprise economic releases created some early confusion, but the big takeaway was clear: softer labor data and an overnight bond rally helped nudge rates in a friendlier direction.

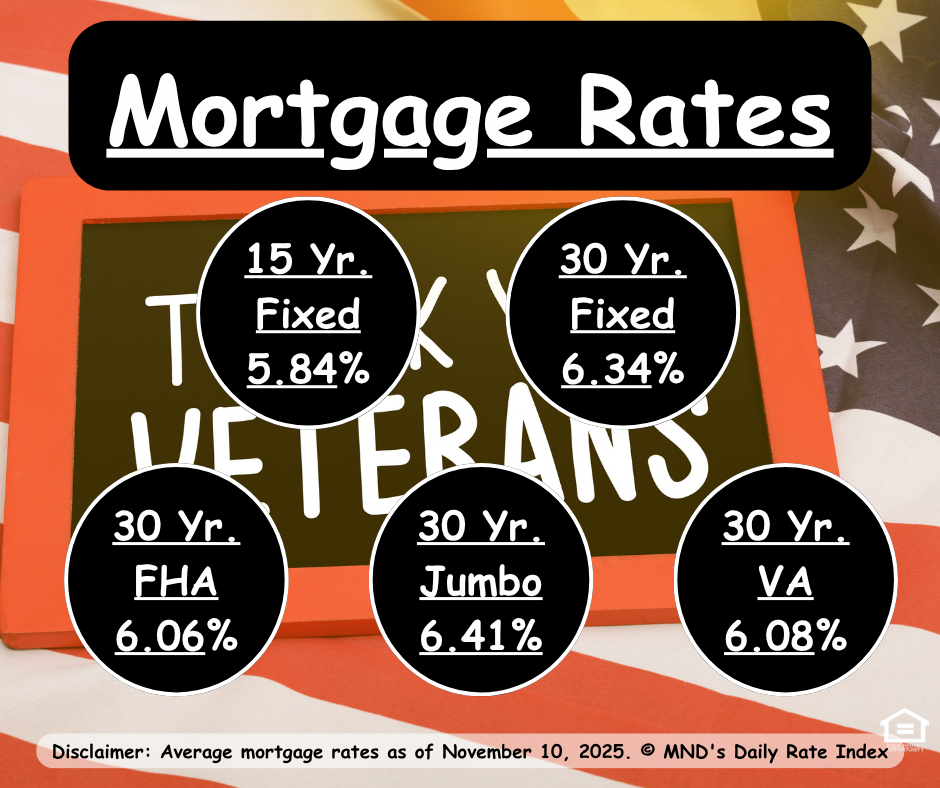

November 11, 2025

Mortgage rates held relatively steady heading into the holiday, but volatility may return mid-week once Congress takes action on the government shutdown.

October 29, 2025

Bonds are treading water ahead of today’s Fed meeting, with a rate cut already priced in and traders watching for Powell’s tone and any tweaks to quantitative tightening.

October 21, 2025

Mortgage rates ticked slightly lower today — proof that even small moves in the bond market can make a difference when momentum is on our side.

Mortgage Rates Hit Multi-Week Lows

Mortgage rates just slipped to their lowest levels in nearly a month — a small but welcome win for borrowers!

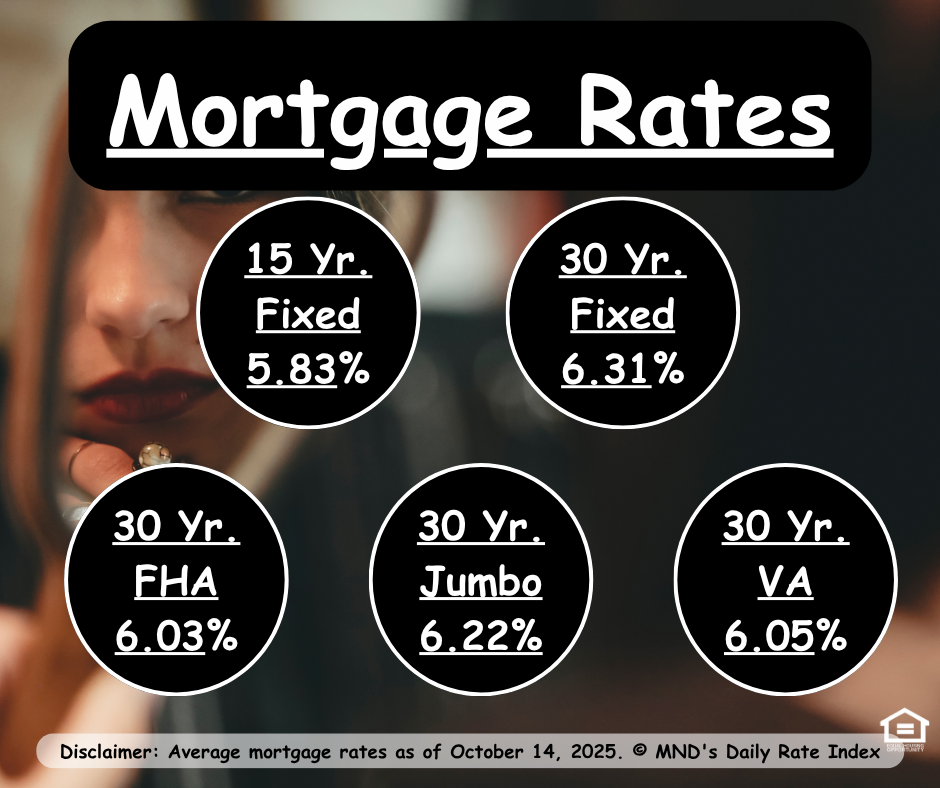

October 7, 2025

Mortgage rates have been coasting in a narrow range for nearly three weeks, holding steady since the Fed’s mid-September rate cut.

September 30, 2025

Mortgage rates are holding steady…ish. This morning brought a tiny dip compared to yesterday’s levels, but for most borrowers, it still feels like déjà vu. Rates haven’t really budged much over the last seven business days. Some lenders even reversed course mid-day, nudging rates slightly higher after bond market weakness crept in.

September 16, 2025

Mortgage rates dropped sharply today, hitting their lowest levels since late 2022, but tomorrow’s Fed outlook could shake things up. 📊

September 9, 2025

Mortgage rates finally ticked higher today—but the move is mild, and the bigger story is still inflation later this week. 📊