Mortgage Minute

Welcome to our Resources page—your go-to destination for the latest product news, mortgage insights, and industry updates. Whether you're a first-time homebuyer, refinancing your loan, or exploring market trends, we’ve got you covered with expert advice and up-to-date information. Stay informed and make confident financial decisions with our trusted mortgage resources.

🧧Gift Funds — The Best Gift You’ll Ever Get as an Adult

Gift funds can help buyers overcome one of the biggest barriers to homeownership—saving for the down payment.

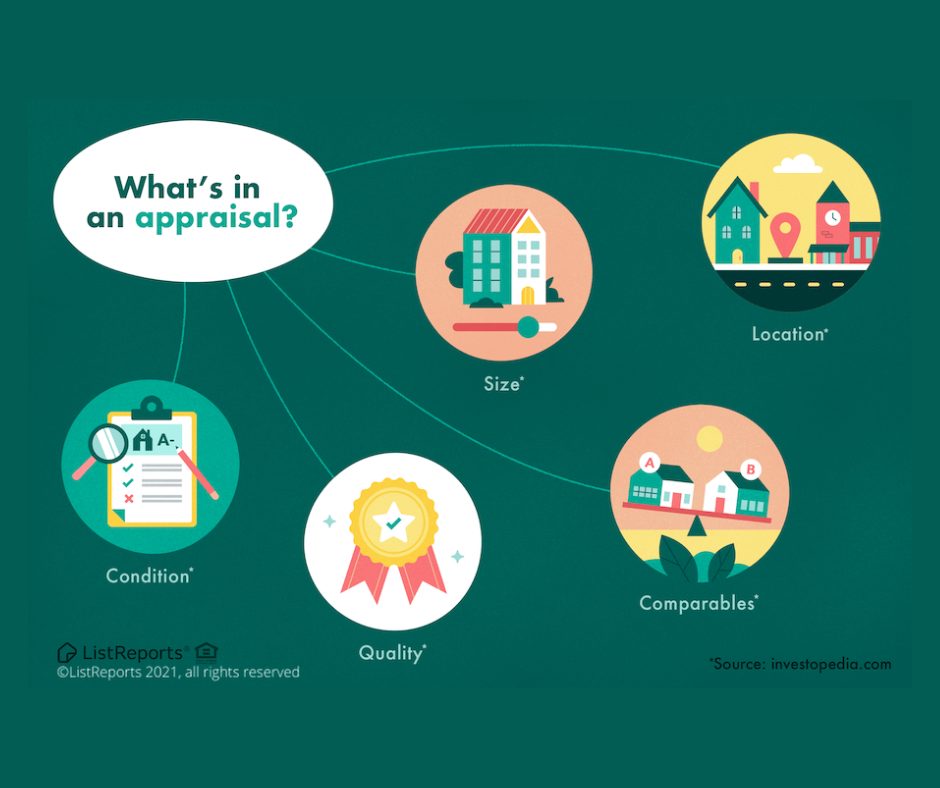

What Is an Appraisal Contingency?

A low appraisal doesn’t have to sink a deal—here’s how appraisal contingencies, Reviews of Value, and VA Tidewater protections work together to keep things moving

Cromford Report

The Cromford Report is a Detailed Analysis of the Phoenix Metro Housing Market. While Many of Our Partners & Clients are in different areas, Phoenix often starts housing trends and thus we think the information is valuable regardless of your market. **Subscribe to our weekly newsletter to get exclusive insight and information.

Arizona Property Tax Exemptions —

Arizona property tax exemptions can lower your taxable home value and reduce your annual tax bill — but only if you apply.

Construction Loans 101

Can’t find a home that checks all the boxes? 🏡 Construction loans—including a powerful VA one-time close option—can help you build the home you’ve been searching for.

How Much Cash Do You Really Need to Buy a Home?

Buying a home requires more than just a down payment—most buyers need to plan for cash to close, which includes the down payment, closing costs, and earnest money.

The Best Gift You Can Give Yourself? The Right Homebuying Team 🎁

Behind every smooth home purchase is a lender and realtor working in sync—and that teamwork can make or break your buying experience 🐼.

💰Should You Buy Down Your Mortgage Rate?

Mortgage discount points can lower your interest rate and monthly payment, but whether they’re worth it depends on how long you plan to keep a loan and how you want to use your cash.

⏰Why Waiting to Buy Can Cost More Than You Think

A lot of buyers today feel torn—rates bounce around, headlines change daily, and “waiting just a little longer” feels safe. ⏳ But when you zoom out, the long-term math tells a clearer story: waiting has a cost too.

🎯7 Questions Every Buyer Should Ask Before Picking a Lender

Choosing the right lender isn’t about rates — it’s about guidance, communication, and finding a partner who puts your goals first. 💡

Your Essential Guide to 1031 Exchanges

A 1031 exchange lets investors sell an investment property, reinvest the proceeds, and defer capital gains taxes. It’s one of the most powerful tools for long-term wealth building — especially when you have the right team behind you.

🚦The Escrow Speed Trap

Escrow can move fast — unless a few common roadblocks slow everything to a crawl. Here’s how to avoid the delays

🏁What “Clear to Close” Really Means

You’ve made it through underwriting and your lender just said the magic words—“Clear to Close!” Find out what that means, what happens next, and how to keep your closing on track.

Proudly ServingThose Who've Served

This Veterans Day, whether you or someone you know has served, it’s the perfect time to learn about one of the most powerful benefits available to our nation’s heroes — the VA Home Loan.

🌞 Why Solar Makes Sense in the Valley of the Sun

In the Valley of the Sun, solar panels aren’t just eco-friendly—they’re wallet-friendly. Whether you’re adding solar or buying a home that already has it, here’s what you need to know.

The Truth About Condos (and Why Lenders Ask So Many Questions)

Not all shared-wall homes are created equal — here’s how condos, townhouses, and PUDs differ and why that matters for your mortgage approval.

Manufactured Housing 101

Manufactured homes are making a comeback—here’s what you need to know before you buy one. 🏠

🚪Multi-Family Homes

Multi-family homes can help you live smarter, earn more, and maybe even keep family close — here’s how.

🏡 Seller Concessions: A Win-Win for Buyers, Sellers & Agents

Seller concessions are back in 2025 — showing up in nearly half of Phoenix contracts — and they’re helping both buyers and sellers close deals faster

💸 Escrow, Prepaids & Closing Costs: What’s the Real Difference?

Escrow and prepaids are often bundled with your closing costs, but they’re not fees—they’re the upfront costs of homeownership.