🚂Assumption Junction – Hop On That Low-Rate Train!

📅 What is a Loan Assumption?

Loan assumptions allow a homebuyer to take over the seller's existing mortgage — including the interest rate, balance, and term. Rather than getting a new loan at today’s rates, the buyer assumes the remaining balance of the seller’s loan and continues payments under the same conditions.

According to HUD guidelines, loan assumptions are a viable option for FHA loans originated after December 15, 1989 (HUD Handbook 4155.1).

🤔 Why It Matters

Loan assumptions can be a hidden gem in a high-rate market. Benefits include:

Locking in a lower historical interest rate

Reduced closing costs (fewer fees, often no appraisal required)

Faster closing timeline

But it’s not magic. The buyer must cover the gap between the purchase price and the remaining mortgage balance.

Example: If the home is selling for $350,000 and the assumable loan balance is $250,000, the buyer must bring in the $100,000 difference—either through cash or a secondary loan.

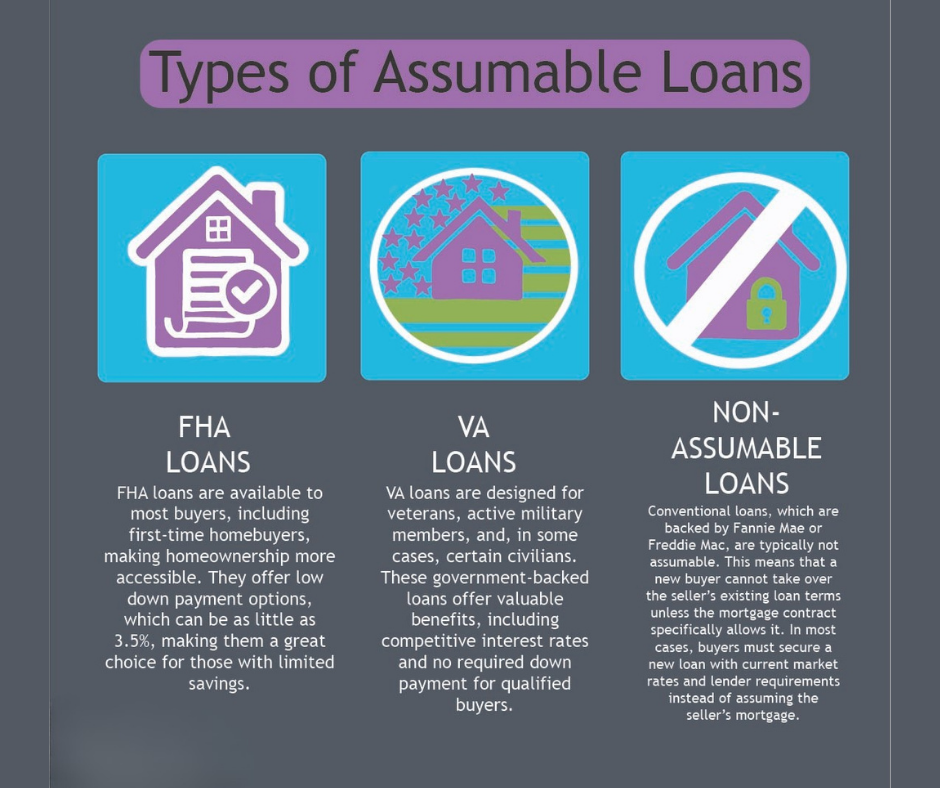

📄 Which Loans Are Assumable?

Government‑backed loans usually say yes:

FHA: All FHA loans are assumable with lender OK. Processing fee now capped at $1,800, according to HUD Mortgagee Letter 2024‑02.

VA: Assumable by vets or civilians; a 0.5 % funding fee applies. Non‑vet buyers may tie up the seller’s entitlement (VA Lender Handbook Pamphlet 26‑7).

USDA: Allowed if the buyer will occupy the property and meets income rules; USDA must approve the assumption. Full rules are in USDA HB‑1‑3555 Chapter 6.

Conventional loans? Rare—thanks to “due‑on‑sale” clauses. One common exception: divorce or legal separation, where one spouse assumes the loan to remove the other from liability.

📊 How It Works

Find a listing with an assumable mortgage.

Confirm loan type/date and lender’s assumption policy.

Apply with the servicer (credit + income check).

Bridge the equity between sales price and loan balance.

Close and secure the seller’s release of liability.

⚠️ Watch Out For...

Equity shock if the seller’s balance is low.

VA entitlement freeze when a civilian assumes.

Servicer slow‑downs—not all lenders love processing assumptions.

🏡 Final Takeaway

Assumptions aren’t common, but they can be incredibly effective in the right situation—especially when rates are rising. If you’re thinking about buying or selling and want to explore this option...

📞 Reach out to me and let’s set a time to chat about how a loan assumption might work for you. 🐼