🏢 DSCR Loans 101

When the Property Qualifies, Not You

📌What is a DSCR Loan?

A Debt-Service Coverage Ratio (DSCR) loan is a type of mortgage specifically designed for real estate investors. Unlike traditional investment property loans that heavily rely on the borrower’s personal income and employment history, DSCR loans focus on the cash flow of the property itself. Essentially, lenders evaluate whether the rental income generated by the property is sufficient to cover the loan payments.

I’ve had the privilege of helping many clients take advantage of the DSCR loan program, and it’s quickly becoming one of my favorite options for real estate investors. As a broker, I have the option of placing this loan program with more than 50+ lenders in this market.

Its simplicity and flexibility make it an excellent fit for clients looking to grow their investment portfolios without the hurdles of traditional lending requirements. Best of all, we can offer DSCR loans in every state across the nation—except New York—giving clients nationwide opportunities to succeed.

If you or someone you know have been searching for a streamlined solution to help achieve their real estate goals, this program is worth exploring.

💡How is a DSCR Loan Different?

Income Qualification: Traditional loans typically require proof of personal income through tax returns or W-2s, while DSCR loans assess the property’s rental income.

Flexibility: DSCR loans are ideal for self-employed individuals or investors with multiple properties who may not qualify under conventional guidelines.

Streamlined Process: With less emphasis on personal financials, DSCR loans often involve fewer documentation requirements, making them quicker to close. In many cases, they can close faster than traditional loans.

📚General Guidelines - FYI!

Eligibility: DSCR loans are available for both purchasing and refinancing investment properties.

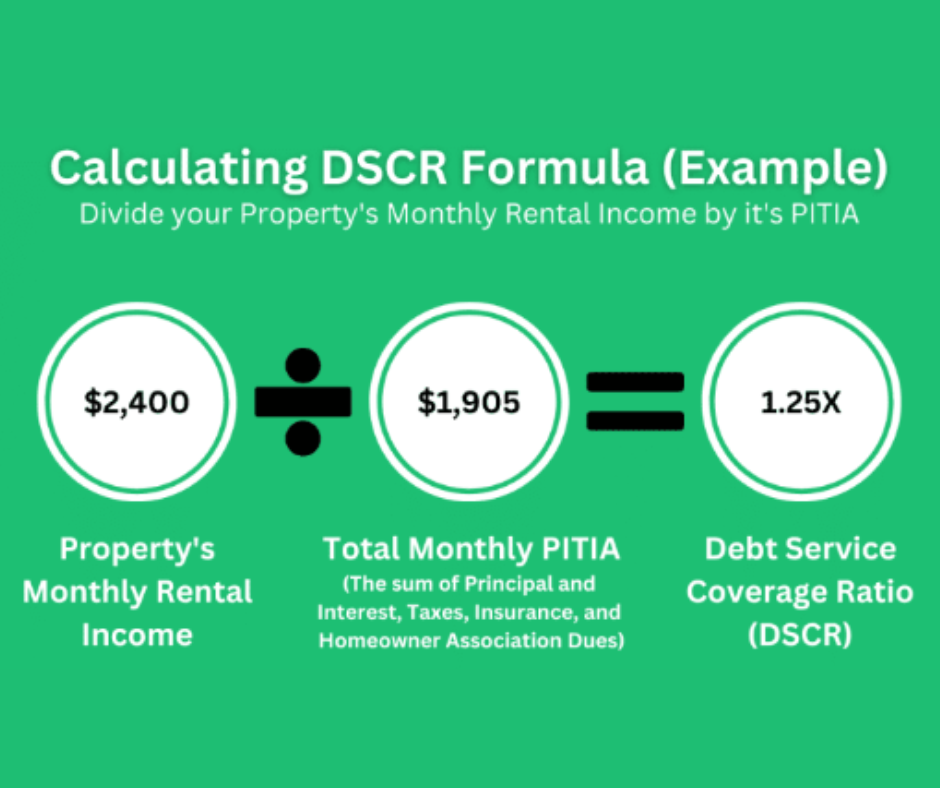

Cash Flow Focus: Our lenders typically look for a DSCR ratio of 1.0 or higher, meaning the property generates enough income to cover its debt obligations. However, I do have some options that can accept lower ratios depending on other factors.

Loan Terms: These loans usually offer competitive rates and terms, including fixed and adjustable-rate options.

Down Payment: Clients should be prepared for a down payment of 20-30%, depending on the lender and property type.

Reserve Requirements: Many of the lenders i can use will require borrowers to have reserves, which are additional funds set aside to cover mortgage payments in case of unexpected vacancies or expenses. Typically, 6-12 months of reserves may be required, depending on the loan and property type.

No Limit on Properties: DSCR loans have no limit on the number of properties an investor can own, making them ideal for growing portfolios.

Title Vesting Options: Properties can vest title in an LLC, S or C Corporation, or revocable trusts, offering flexibility for investors.

Eligibility for Various Residents: These loans can be done for both permanent and non-permanent residents, broadening accessibility.

No Personal Income Requirements: Clients with non-traditional income sources or complex financial situations may find DSCR loans particularly beneficial.

💰Real Estate - The BEST Investment!

Consistent Returns: Over the past 25 years, real estate has consistently outperformed many other asset classes, providing both cash flow and long-term appreciation.

Hedge Against Inflation: Real estate tends to appreciate over time, helping investors preserve and grow their wealth.

Tax Benefits: Rental property owners can take advantage of deductions, including mortgage interest, property taxes, and depreciation.

Demand Growth: As rental demand continues to rise, owning investment properties offers a steady income stream and potential for equity growth.

Great Resource: For a comprehensive guide on building your real estate portfolio, check out the book🔗 HOLD: How to Find, Buy, and Rent Houses for Wealth. It’s an excellent resource for new and seasoned investors alike. 📖

I'm Here to Help! 💖

Unlock the potential of investment strategies with DSCR loans! 🔓

Whether purchasing a new property or refinancing an existing one, this program can simplify the process and open doors to greater opportunities for your clients. This is also a fantastic program for you as an agent to consider for your own investment goals.

Reach out to us today for program details, pre-qualification assistance, or marketing resources to share with your network. Let’s help your clients—or you—take the next step toward financial growth through real estate investing! 🏢