Cromford Report

Weekly Market Insights for Agents & Clients!

Stay informed with the latest Cromford Report updates! Each month, we’ll share expert insights helping both agents and clients navigate Arizona’s ever-changing real estate market. Whether you’re buying, selling, or advising others, staying on top of market trends is key to making smart decisions.

Subscribe to our weekly newsletter to get additional insights and market analysis and even more information from the Cromford Report.

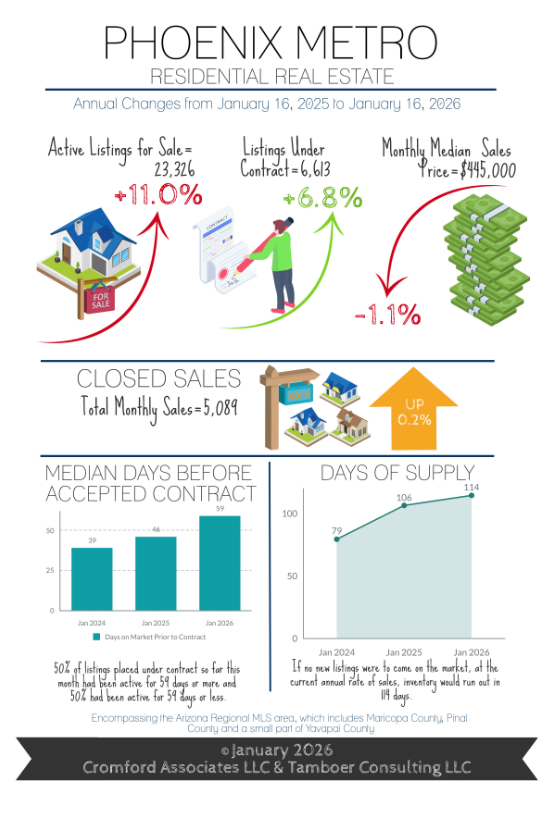

January 2026 - Infographic

-

These Cities Had the Most Sales Growth in 20

Affordability Strains Show Signs of Easing

-

Happy New Year! Buying season has begun in Greater Phoenix, and it’s kicking off with a wave of fresh new listings. In a typical year, January is the most popular month for luxury and retirement community listings to hit the market while March tends to be the peak month for the main stream. Within the first 3-4 weeks of the year, these new listings are met with buyer demand escalating dramatically in January, then tapering off before peaking in April or May.

New listings are coming in weaker than this time last year, but only down 2.5%. That’s still stronger than the 5 years from 2020-2024 which had the weakest counts in 25 years for January listings. Listings under $300K are seeing a significant increase in new supply, up 15% over last year and with nearly 3,800 active listings at this writing, comprising 18% of supply. This is the most affordable range in Greater Phoenix where sales prices are down 2-3% from last year and are continuing to decline. It comprises mostly condos and mobile homes in central cities such as Phoenix and Mesa, and mostly single family homes in the outskirts like Pinal County. All other new listing counts are in line with last year or weaker, which is contributing to a more balanced state between supply and demand as we begin 2026.

A $300K purchase with FHA is approximately $1,860/month before taxes and possible HOA. Mortgage payments on properties under $300K can compete with rent, but not necessarily when tenants are upgrading their living space. For instance, a tenant paying $2,100 in apartment rent in Scottsdale cannot afford to upgrade to a single family home in the same area for the same monthly payment. However, they may be able to purchase a similar unit in the same area, or they could purchase a single family home in an outer city like Maricopa and commute.

This is where the affordable housing debate can get messy. Listing counts are telling us that the supply of affordable homes under $300K is rising and sales of those units are also rising (up 7%), suggesting that affordability strains are easing. However, 2025 sales over $500K were also up 7% while sales within $300K-$500K were near identical. If there were truly a lack of affordable homes, then supply under $300K would be rapidly declining like it did from 2020 to 2022 where there were fewer than 500 for sale, and prices would be rising. But that’s not happening. Evidence suggests that it’s not a lack of affordable homes to purchase, but an aversion to moving out of a desirable area.

*Per RL Brown Reports, a local specialist on new home construction data.

Commentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report

©2026 Cromford Associates LLC and Tamboer Consulting LLC -

2025 ended with total annual sales up 3.5%, equivalent to 2,351 more sales through the MLS than in 2024. Local builder reports* show new home sales down nearly 6% for the year and 2025 permits for new construction were down a significant 21%. Nationally, builder optimism is low for future sales, reportedly due to labor and lot shortages. However, some cities with a lot of builder activity saw sales shoot up the most in 2025.

By number of sales per the Maricopa County Recorder’s Office, the following cities saw the biggest jumps in closed sales last year: 1) Goodyear with 414 more sales, up 16%, median price $486K; 2) Scottsdale with 335 more sales, up 5%, median price $900K; 3) Peoria with 245 more sales, up 7%, median price $515K.

By percentage growth of sales, the following mid-sized cities saw the biggest proportional increases: 1) Waddell up 36% with 178 more sales, median price $468K; 2) Sun Lakes up 32% with 122 more sales, median price $470K; 3) Anthem up 29% with 64 more sales, median price $574K.

The 2025 annual median sales price for Greater Phoenix is $451K, but it’s interesting to note that half of the cities with sales growth had considerably higher median prices. Considering that most of 2025 operated with mortgage rates in the high-6% or low-7% range, entering 2026 with rates ranging in the high-5% and low-6% means payments are at least 10-12% lower on the same priced homes from a year ago. This bodes well for first quarter sales in Greater Phoenix in 2026.

While sales are expected to increase, prices are not. Price is the last measure to move when a market shifts, and it can take up to 3-6 months to emerge. Price appreciation remains stagnant in the middle price ranges, rising in upper ranges, and declining under $400K. Greater Phoenix is pulling out of a buyer’s market and edging towards a balanced state, but a seller’s market isn’t on the horizon.

*Per RL Brown Reports, a local specialist on new home construction data.

Commentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report

©2026 Cromford Associates LLC and Tamboer Consulting LLC

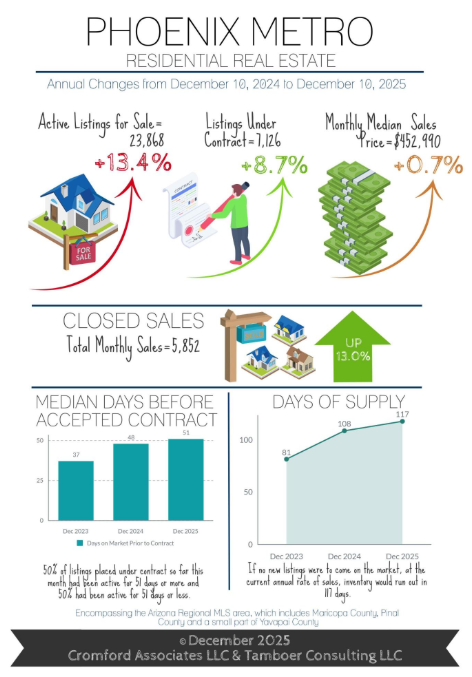

December 2025 - Infographic

-

Optimism Emerges for 2026 Home Sales

Incomes Up 33% in Maricopa County since 2020

-

Journalists reporting on housing affordability are frequently quoting sources that reference median household income. Household income can be broken down into two categories, family and non-family households. The US Census defines a family household as two or more people living in a home and related by blood or marriage. Non-family households are all others, including non-related people living as roommates or people living alone. Non-family household income is typically much lower than family income and is more suited for measuring the affordability of rental housing. Family household income is more suited for measuring the affordability of purchasing a home.

From 2020-2024, the median annual household income in Maricopa County rose 33% from $68K to $91K. The non-family median household income rose from $44.5K to $59K. Family income rose from $80K to $108K; and married family income, a subset of family income, rose from $95K to $126K.

The lending industry considers 28% of gross income an affordable monthly payment for mortgage or rent. For a family household that’s roughly a $2,500-$3,000 payment. At a mortgage rate holding steady around 6.25%, that payment supports homes priced between $350,000 and $500,000 in Maricopa County. That budget will support roughly a 1,500-1,800 square foot single family home, which will trend in the mid-$300s in the West Valley, and the mid-$400s in the Southeast Valley.

Incomes are not stagnant in Maricopa County and have been rising at a significant pace since 2020. It’s home values that have been stagnant for 3 years waiting for family incomes to catch up and mortgage rates to decline. Inventory under $500K accounts for roughly 57% of all inventory for sale and is up 16% from last year. With rates holding steady in the low 6% range for the last 4 months, demand and optimism is up for the onset of 2026.

Commentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report

©2025 Cromford Associates LLC and Tamboer Consulting LLC -

November closings were another success for Q4 2025, up 3.3% from last November, except it was actually better than that. Last November had 19 closing days compared this November with 18 closing days, meaning this year November closed an extra 23 sales per day, putting the improvement at 9% instead of 3%. So far December is also outpacing last year with an extra 14 closings per day on average. If this is a peek into what 2026 may bring, then sellers should be optimistic for contract activity in January.

The big question is how many listings will line up to meet January’s expectation of increased demand. January is typically the top month for luxury, retirement and seasonal community listings to hit the market. However, new listings across all price points and areas often see a peak in March, providing ample selection for Spring buyers. This front-loading of inventory in the first part of the year often results in a rising number of price reductions as well, the level of which depends on whether we enter the year in a buyer’s market, balanced, or seller’s market.

Recent improvements in demand combined with declines in supply are pushing the Cromford Market Index back in the direction towards a balanced state. While Greater Phoenix is still in a buyer’s market overall, central and established cities are becoming the first to move back into seller’s markets. Most recently, Phoenix, Mesa and Tempe shifted back into seller’s markets within the last 30 days, putting nearly all cities in the Northeast and Southeast Valley in seller’s markets, with the exception of buyer’s markets Queen Creek and Sun Lakes. Developing cities on the edges of Metro Phoenix are typically the last ones to pull out of a buyer’s market. Pinal County cities, for example, are buyer’s markets except for Apache Junction, which is a seller’s market. The West Valley is a mix as El Mirage is a small seller’s market and Peoria recently shifted into a balanced market, joining Glendale, Avondale and Laveen. All other West Valley cities are buyer’s markets.

Don’t expect much upward pressure on price in the short term, even if your city has shifted back into a seller’s market. Prices can take up to 6 months to show a response to a shift, which means the seller’s market must be maintained, and many of these cities are still quite weak. What sellers can expect is more showing activity, shorter days on market, and less pressure to reduce their price once the Spring buying season begins.

Commentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report

©2025 Cromford Associates LLC and Tamboer Consulting LLC

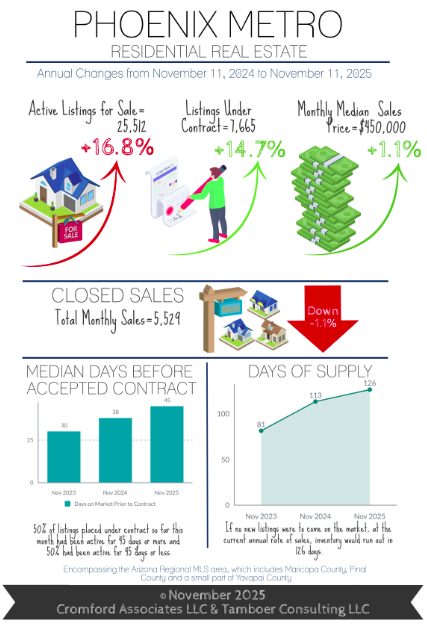

November 2025 - Infographic

-

Best Q4 for Contract Activity in 3 Years for Greater Phoenix

First-Time Homebuyer Payments are Down 13%-15%

-

It’s been an exciting month of November since President Trump floated the idea of a 50-year mortgage to help some buyers qualify to purchase a home. The initial reactions from the industry have spurred a healthy discussion on its potential impact on borrowers, affordability, demand. Since then, multiple ideas are circulating for new products that bring down payments without extending the term of the loan. It could get interesting!

For context, on a $400,000 loan at 6.25%, the PI payment on a 30-year is $2,463 and on a 50-year is $2,180, a difference of $283/month or 11.5%. But the cost of that savings is a much slower repayment of the loan. For example, after 3 years of payments a borrower would have paid down their loan by roughly $15,000 on a 30-year mortgage, but only $3,800 on a 50-year mortgage. It would take 9-10 years of payments to pay down the same 50-year mortgage by $15,000. This can create issues when it comes to pulling out an equity loan for expensive maintenance items like a new A/C unit or remodeling projects within 10 years of homeownership. That puts a lot of importance on annual appreciation to build equity.

The good news for first-time home-buyers looking under $400,000 is Greater Phoenix price measures have come down 10-14% from the peak of 2022, and 3-5% in just the last year alone. At 6.25%, mortgage rates are down from their peak of 7.25% at the beginning of 2025, and 0.5% lower than rates from last July, which has reduced the PI payment by 5-10%. Lower prices combined with mortgage rates down a full 1% puts payments down 13-15% over the course of the last year. This does not include the extra 20% off in the first year provided by temporary buydowns paid for by 60-70% of sellers in this price range. Supply of properties under $300K is up 39% over last year, prices are down 5%, October sales increased 21%, and new contracts are up 32% so far in November.

According to the Bureau of Labor Statistics, US wage growth has been outpacing the rate of inflation for 2 years now. Over the past 2 years, Greater Phoenix average hourly earnings have grown 12% while the concurrent CPI inflation rate for the area shows prices have only risen 3.3%. This growth combined with home prices coming down in the most affordable price ranges mean that a 50-year mortgage may not be needed to bring affordability measures into a manageable range. They may already be there for a growing number of buyers.

Commentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report

©2025 Cromford Associates LLC and Tamboer Consulting LLC -

It took a while for the buyers to mobilize, but better late than never. So far, this is the best 4th quarter Greater Phoenix has seen in 3 years for contract activity. Listings under contract are up 15% over last year with notable improvements in the market under $300K and the market over $1M. The government shutdown didn’t help closings for FHA and VA transactions, especially between $300K-$600K, but October saw a 3.3% increase in sales regardless, and closings delayed will add to the November sales counts.

The Federal Reserve met on October 29th and announced a 0.25% decrease in the Federal Funds Rate and the end of the reduction of their securities holdings as of December 1st. This is one more step towards easing up on quantitative tightening and should be stabilizing for future mortgage rates. That is good news for sellers.

In the meantime, stock market performance, corporate profits, and cryptocurrency have performed well enough to boost the luxury market in Q4. Contracts in escrow between $1M-$2M are up 25% over the past 5 weeks, and up 16% over last year. Contracts in escrow over $2M have risen 25% over the past 9 weeks putting them up 7% over last year. It hasn’t been enough to boost contracts in retirement communities much, but Sun City, Sun City West, and Sun Lakes are not doing worse than last year.

Contract activity typically drops after the Thanksgiving holiday until the new year begins. This sparks a wave of price reductions just before Thanksgiving followed by just a trickle of reductions in December. January is the most popular month for new listings to hit the market, so properties that don’t sell between now and December should expect another wave of price reductions in the first few weeks of January.

Overall, while demand is slowly improving, supply is still on the rise and keeping most cities in a balanced or buyer’s market. Prices are still under pressure and buyers are looking for the best value for their budget. Competition and negotiations can get fierce in December, especially in those areas competing with new home subdivisions.

Commentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report

©2025 Cromford Associates LLC and Tamboer Consulting LLC

October 2025 - Infographic

-

Sales Up 19% in this Price Range

Prices are Down 15% in these Segments

-

Mortgage rates dropped over 2 months from July 15th (6.85%) to September 16th (6.1%), dropping payments by 7.5% across the board and reaching the lowest rate in over a year. Real estate professionals swung open the gates and awaited a stampede of buyers to arrive. But, while there was a wave of refinances, purchase applications were stubborn. This is a common phenomenon. While rates are actively dropping, it’s human nature to wait and see where they stabilize before taking action, hoping to save even just a few extra dollars off a payment. Rates ultimately bounced and settled around 6.3%, and after 3 weeks of stability buyer activity finally ticked up to a level better than the past three years for October.

Mortgage rates weren’t the only measure dropping over the past 5 months, so were list prices. Listings under $1M saw asking prices drop an average of 2.5% from May to August, then stabilize in September and October. These properties do not yet have contracts on them, but when they do they will likely be closing in November and December, and possibly at the lowest closing price recorded all year.

The biggest price declines have been seen in the first-time homebuyer price ranges. Since July, sales prices for condos between $250K-$300K in Maricopa County (around 1,000sqft) have dropped 4.3% and are 15% below the peak prices of 2022. Single family homes in Pinal County between $300K-$400K (around 1,700sqft) are down 6.7% from last April, and are also 15% down from the peak of 2022. Single family homes in Maricopa County between $300K-$400K (around 1,500sqft) are down 2.9% from last year and down 13% from the peak of 2022. All of this is happening while the overall median price measure is showing just a mild increase year-over-year for the metro area, and just 4.5% below the peak of 2022. This is a prime example of how broad price measures spanning a large area are not always reflective of specific segments and can be skewed by better performing areas and price ranges.

Seller-paid concessions hit another high for September with 56% of MLS closings involving some form of closing cost assistance at a median cost of $10,000, which often includes a temporary rate buydown. This has been a unique hallmark of this housing cycle since rates skyrocketed in 2022. A tool typically used by builders to incentivize buyers has been adopted by everyday sellers and lenders in the resale market in order to compete. As appreciation has been stunted for the past 3-4 years and values declined this year, the number of sellers who can shoulder the cost of these incentives may diminish going forward.

If lower prices, lower mortgage rates, and a high share of seller incentives isn’t enough, seasonally the 4th quarter is the best time to be a buyer in Greater Phoenix. Supply tends to rise right before the holidays, but the rush of buyers doesn’t follow until after the 1st of the year. As a result, there’s a last hurrah of price reductions before Thanksgiving followed by heavier price negotiations and builder incentives as sellers aim to get under contract or close before the end of the year.

It’s common for buyers to get caught up waiting for evidence that it’s the “perfect time” to act, and delaying an affordable purchase in order to land some unicorn price and mortgage rate. Real estate is typically a long-term investment, however. The longer one holds a property, the more equity is built, appreciation accumulated, and risk of loss mitigated.

Commentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report ©2025 Cromford Associates LLC and Tamboer Consulting LLC

-

This year has been a slog for sellers (and their agents) to say the least with stock market fluctuations at the beginning of the year stalling luxury sales, and volatility in mortgage rates. But there are signs things have gotten better. Lower mortgage rates and lower prices have stimulated demand in unexpected places. While homebuyer demand between $300K-$500K has been anemic, homes between $500K-$1.5M saw a boost of sales in September, up 19% year-over-year, which increased the market share from 36% to 38% of sales, and increased both the median price and average price per square foot measures for the Valley. The reason could be linked to jumbo mortgage rates dropping below 30-year conventional rates for the first time in 2 years, but also the popularity among high-wage buyers of adjustable-rate mortgages, which are currently averaging 5.8%.

While Greater Phoenix remains in a buyer’s market overall, the Northeast Valley including Fountain Hills, Paradise Valley, and Scottsdale are top seller’s markets, reflecting a drop in supply and sustained demand in these cities. Also seller’s markets: Anthem, El Mirage, Avondale, Chandler, Gilbert, Apache Junction, and Sun Lakes. Balanced markets include Phoenix, Glendale, Sun City West, Tolleson, Mesa, and Tempe. Buyer’s markets are mostly on the edges and outskirts where there is more new home development. They include Peoria (barely), Sun City, Surprise, Goodyear, Litchfield Park, Laveen, Buckeye, Gold Canyon, San Tan Valley, Queen Creek, Maricopa, Arizona City, and Casa Grande.

The 4th quarter is not the best time to be a seller, but going in with the right mindset, patience, and price strategy will go a long way towards obtaining a contract before the end of the year. For those who wish to wait, the 1st quarter comes with both a wave of new competing listings from January through March, and increased contract activity that lasts through May.

Commentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report ©2025 Cromford Associates LLC and Tamboer Consulting LLC

September 2025 - Infographic

-

Payments Drop 12%, Monthly Sales Up 9.4%

As the Market Turns: Could a Recession be Good for Housing?

-

Be aware, the market is turning. Reading the Cromford® Market Index (CMI) for Greater Phoenix, a measure under 90 is a buyer’s market and 90-110 is a balanced market. Our index has been indicating a buyer’s market since November 2024 and hit bottom at a measure of 72 before turning mid-July. Two months later, as of September 11th, the CMI is up 9 points to 81. At this rate, it could surpass 90 and enter a balanced state by November, potentially ending a year-long buyer’s market and stabilizing prices.

Buyers may not have as much time as they think to purchase under the favorable negotiating conditions of a buyer’s market. Asking prices for homes have been declining for 4 months, but appear to have stalled over the past week. Mortgage rates in January were 7.26% per Mortgage News Daily, and on September 11th they averaged 6.27%, nearly a full percent change. Meanwhile, active mid-range listings between $300K-$600K have dropped nearly 2% in asking prices. What does this mean?

Let’s do the math. With every 1% drop in mortgage rate, all principle and interest payment measures across all loan amounts drop by 10%. So if a buyer was quoted a $2,400 monthly payment in January on a $350,000 loan at 7.26%, that PI payment would be $2,160 at 6.26%, saving $240/month. Combine that with a 2% drop in the asking price of the home, that saves another 2% off the payment, bringing the total savings to $288 and a payment of $2,112, a 12% discount compared to January.

That’s not all. In this buyer’s market, more than 60% of sales between $225K-$600K have sellers paying for the buyer’s closing costs, which often include a 2/1 rate buydown. This drops the buyer’s payment by another 20% in the first year, and 10% in the second, bringing the first-year payment down to $1,690 and second-year payment to $1,900 before taxes and insurance.

Over the next few months, sales prices will begin to show the decline active list prices have already endured. However, if mortgage rates stay low and the Cromford® Market Index continues to climb out of a buyer’s market, buyers may see their negotiating advantage dwindle. For now, all properties are officially “on sale”.

Commentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report ©2025 Cromford Associates LLC and Tamboer Consulting LLC

-

Headlines on the economy are pretty scary these days with recession predictions reaching as high as a 93% probability from UBS last week. These are based on a continuous stream of weak jobs reports and an increase in the unemployment rate to 4.3% reported on September 5th. Ironically, history tells us that as the labor market weakens and recession looms, mortgage rates improve and homebuyer demand increases. In fact, in Greater Phoenix home sales actually increased over the 2001, 2008, and 2020 recessions despite high unemployment. How can this be?

As fears of a recession rise with unemployment, demand for bonds increases as people move their funds to safety. This pushes the 10-year treasury rate down, which in turn pushes the 30-year mortgage rate down. Even with higher unemployment, the vast majority of people are still working. Those who are stable in their employment see an increase in their ability to qualify when mortgage rates decline and are motivated to explore their options, thus increasing demand.

Buyers are not the only ones that get excited over lower mortgage rates, sellers do too. This means that while demand is increasing, more listings than expected could hit the market initially and create a speed bump for the Cromford Market Index on its way to a balanced state. This is something to watch for over the coming months. Additionally, the 4th quarter is rarely the best time to be a seller seasonally. While lower mortgage rates are improving demand compared to last year, buyer demand drops significantly over the holidays in November and December.

Finally, while recessions can activate the mainstream housing market, they will stall the luxury and retirement communities. These segments do not rely on mortgage rates (often paying with cash) and are influenced more by the performance of their investment portfolios, which tend to suffer in a recession.

Commentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report ©2025 Cromford Associates LLC and Tamboer Consulting LLC

August 2025 - Infographic

-

New Contract Activity Bounces after July 4th

Active Supply has Been Reduced 14% since April

Commentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report ©2025 Cromford Associates LLC and Tamboer Consulting LLC

-

Since April, active supply levels have now declined 13.6% due to a large increase in cancelled and expired listings from May through July and too few new listings to replace them. July cancellations were up 64% over last year and expired listings increased 69%. Demand for homes has also begun to recover, helped by a drop in mortgage rates from 6.75% to 6.55% and a 14% increase in weekly accepted contracts since the 4th of July.

Despite the median sales price showing a flat trend over last year, asking prices are steadily declining when analyzed by price per square foot. Sellers contributing to their buyer’s closing costs and rate buydowns hit 56% of sales, and so far August concessions are hitting a record high of 58% of sales. The largest decline in asking prices have been seen in condominium/townhomes under $500K, which are down 5.9% under last year compared to single family homes under $500K, down just 1.3%. Within the same price range, buyers negotiated down an extra 2.5% off of the last list price on condo/townhomes and another 1.3% on single family homes in July.

While things are looking very good for buyers right now, the Greater Phoenix market is no longer falling farther into a buyer’s market. Over the past 30 days, the Cromford Market Index started to reverse course as a direct result of lower supply and stabilizing demand. This could mean the days of this buyer’s market could be numbered if it continues at its current pace. Buyers who would like the benefit of seller incentives and zero competing offers for homes should probably get in the game. As affordability improves with reduced mortgage rates and lower home prices, more buyers will enter the market and sellers will be under less pressure to concede to every buyer demand

Commentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report ©2025 Cromford Associates LLC and Tamboer Consulting LLC

-

While metrics are improving for the Greater Phoenix housing market, it’s still in a full blown buyer’s market so sellers should remain patient when it comes to days on market. July and August so far are seeing a median marketing time of 48 days prior to an accepted contract, the highest for July in at least 11 years, and the count typically doesn’t get any lower between now and the end of the year. Marketing times are especially brutal in the condo market with a median of 69 days prior to contract, the highest recorded for any month in at least 11 years. Even condos under $250K are seeing a median of 79 days.

Even as the buyer’s market is easing up in the metrics, price will not see a bottom until 3-6 months after the Cromford Market Index re-enters a balanced state. If that were to happen in October or November, for example, then the bottom of price will emerge around February or March give or take. If sellers decide to wait, the good news would be more activity, their home may sell a little faster, and fewer will have to pay for the buyer’s closing costs. The bad news for sellers would be that they’ll most likely be getting a lower price for their home than if they sold today, so the money they save in closing costs could be a wash. Prices will not show much appreciation until the market re-enters a seller’s market, and that isn’t on the horizon at this time.

But there is hope, ironically. National economists are beginning to release higher expectations of a potential recession coming, with large banks such as Chase, Goldman Sachs, and Deutsche giving a range of 30-43% chance in the near future. This puts more pressure on the Federal Reserve to lower the Federal Funds Rate and stop reducing their securities holdings at their September meeting. The big number to watch is unemployment. If that begins to rise too sharply, then the Feds will ease up on their monetary policies, money will flow into bonds for safety, and mortgage rates will fall again. With home prices already down, that would lead to more contract activity in the fourth quarter and hopefully some relief for tired sellers. No one likes an economic recession, but it may need to happen to turn the housing market around faster.

Commentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report ©2025 Cromford Associates LLC and Tamboer Consulting LLC

July 2025 - Infographic

-

Guess Which City Bounced into a Seller’s Market this Month

Where Have Home Prices Dropped the Most? -

Welcome to July in Phoenix where it’s so hot we saw a bird pull a worm out of the ground with an oven mitt. The peak buying season is officially over, and while both supply and demand kicked off with a bang in the first quarter, the second quarter was a dud due to increased mortgage rates and market volatility.

By the end of May, many sellers threw in the towel and decided to cancel their listings or allow them to expire. Cancelled listings were up 46% in June compared to last year, and expired listings were up 79%. At the same time, the number of new listings added weekly to the MLS dropped 24% from week 22 (Memorial Day) to week 27 (Independence Day). All factors combined, the result was an 8% drop in overall supply over the last 5 weeks.

While all price ranges are seeing impact, the largest percentage inventory drop was recorded over $800K with a 14% decline compared with under $800K at a just a 5% drop. The increase in cancelled and expired listings on the high end is expected seasonally as June is typically the peak month for luxury sellers to pull out, but not to this degree. For example, Paradise Valley dropped 39% in active supply over the past 6 weeks, but contracts in escrow only dropped 5%. Ironically, this pushed Paradise Valley out of a balanced market and into the 3rd strongest seller’s market this month, the opposite of what most would expect during the heat of a Phoenix summer.

As for the lower end of the market, single family homes between $250K-$300K are up 38% in June sales, with a nice bounce in new contracts over the week of 4th of July. Single family homes between $300K-$400K are up 10% in sales. Both of these price ranges have seen prices drop an average of 3.5% since last year. Condos in the same range have dropped 5.5% in price and are down 11% in sales compared to last June. Mid-range homes in the $500K-$800K range are seeing unremarkable changes in both price and June sales volume.

As prices continue to drift down in this buyer’s market, contract activity is expected to improve compared to last summer.

Commentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report ©2025 Cromford Associates LLC and Tamboer Consulting LLC

-

It’s business as usual for sellers as 55% of sales closed last month with sellers contributing a median of $10,000 to the buyers’ closing costs, and negotiations averaging 97.1% of list price. Sales volume is about even with last year, but supply is still up 41% despite recent declines over the past few weeks, keeping sellers at a disadvantage in most areas. This means that many prices are coming down.

The median time on market prior to an accepted contract is 44 days, unless you’re selling a condo or townhome, then it’s 59 days. While buyers are negotiating to 97.1% of the last list price, it’s not consistent across all price ranges and property types. Lower price ranges will often see less of a negotiation on price and more on closing cost assistance, repairs, and upgrade requests. Upper price ranges negotiate more off of the price.

For example, single family homes between $300K-$400K are negotiating within 99.1% of list, but closings of condo/townhomes in the same price range are within 97.7% of list. That can be a difference of $4,000-$6,000 in price negotiations because there are fewer large negotiating items in a condo compared to a single family home. Single family homes in the higher price ranges over $1M are seeing negotiations within 95%-96% of list.

Large negotiation gaps don’t necessarily mean sales prices are declining and small gaps don’t mean prices are rising. Sellers always list high to get the most out of the sale; sometimes the market obliges them and sometimes it denies them. The gap between the original list price and the final sale price, which can involve both price reductions and negotiations, is simply the difference between a seller’s expectation of price and what the market is willing to bear. Buyer’s markets are less obliged to grant sellers their price wishes.

June sales prices for properties under $400K were down an average of 4.5% from last year. The $400K-$600K range was down 2.4%. Mid-range prices from $600K-$1.5M were flat within 0.1%-0.8% over last year, and higher-range prices over $1.5M where buyers negotiate harder on price are up 4.4% on average in appreciation.

Commentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report ©2025 Cromford Associates LLC and Tamboer Consulting LLC

June 2025 - Infographic

-

Active Supply Declines in May, Luxury Bounces

Housing Affordability is Getting Better -

There are three main measures that affect housing affordability: mortgage rates, home values, and income. In the past when home values rose too fast for incomes to catch up, it was mortgage rates that adjusted and brought payments back into range, but in this cycle rates have proven to be an unreliable, volatile ally.

The housing industry has been waiting three years for mortgage rates to decline and save the day, and as more time goes by without relief, the more pressure there is on home prices and incomes to adjust in order to increase demand. It is finally happening.

Recent reports from the Federal Reserve of Atlanta state that wage growth grew nationally at a rate of 4.3%, higher than the current 2.4% rate of inflation. Meanwhile in Phoenix, the Business Journals reported a whopping 9.3% wage increase from 2024 to 2025. Combine that with the local Phoenix rate of inflation at 0.3% and that means workers get to keep the majority of their wage increases.

Meanwhile, Phoenix is entering its 8th month as a buyer’s market. Overall price appreciation is flat, within 1% of last year and lower than the 2.4% rate of inflation, with expectations that it may start gliding slowly down over the next few months. Affordable properties under $500K (which made up 58% of sales last month) have already seen prices drift down 2.2% year-over-year.

The combination of increased wages, low inflation, and declining price measures in the most popular ranges means affordability is improving without a massive decline in mortgage rates. It is also creating an environment where buyer contract activity could increase sharply if mortgage rates were to adjust downward over the summer.

Commentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report

©2025 Cromford Associates LLC and Tamboer Consulting LLC -

Sales were down in May compared to last year, but consider it a temporary hangover from April. The announcement of surprise tariffs at the beginning of April led to volatility in both the stock market and mortgage rates, which led to lower contract activity for the following 3 weeks before buyers snapped out of it and got back into the game. Fewer accepted contracts in April led to fewer sales in May.

Consumer sentiment was dismal in April, but improved significantly in May citing a more upbeat outlook on business conditions, jobs, and incomes. This outlook was also reflected in the purchase mortgage applications index, which rose sharply to 18% over last year’s index measure and higher than it’s been in 2 years. This is a positive indicator for summer contract activity and sales.

The luxury market received some good news in May as crypto and stock portfolios bounced back from March and April lows, corporate profits for Q1 were strong, and exchange rates returned to normal for international buyers. The result was an unseasonal bounce in weekly accepted contracts over $1M, up 30% over 4 weeks. This is unusual since high end contract activity typically declines in May as temperatures pop over 100 degrees.

Meanwhile, more sellers have decided market conditions are too unfavorable for them and are taking a pause. While supply is still up 45% from last year, the last 7 weeks have seen a 3.4% decline. New listings added to the MLS every week has dropped 39% over the last 2 months, and are now at the second lowest level historically (2023 was the lowest year for new listings). Weekly listing cancellations are up 38% over last year, and expired listings in the last week of May were up 84%. In the past, cancelled and expired listings were re-listed right away and didn’t affect the total count, but this time sellers are taking a longer break and sometimes opting to rent their homes instead.

While cancellations are up across all price points and property types, for those in the luxury market June is the peak month for cancellations and sometimes (ironically) there can be a bigger drop in active listings than in buyer activity over the summer. More luxury listings typically hit the market again in October once temperatures drop below 100 degrees, but buyer activity doesn’t always rise with them over the holidays. For this reason, it’s not a bad idea to list a luxury property after June, even if it’s just to test the market for a few months and get valuable buyer feedback.

Commentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report

©2025 Cromford Associates LLC and Tamboer Consulting LLC

May 2025 - Infographic

Make it stand out

Whatever it is, the way you tell your story online can make all the difference.

-

Description text goes hereAre Homes Overvalued in Greater Phoenix?

Only 6 Cities Left in Seller’s Markets -

In April, there was a crisis of “crisis” headlines, spurred by unexpected tariffs and market volatility. The end result was mortgage rates rising from 6.6% to 7.1%, which frankly is nothing new for the housing industry. In fact, mortgage rates were higher at 7.2% just last January and even higher last May at 7.3% without any headlines screaming “crisis". Unfortunately, this time active buyers froze with indecisiveness and shock, resulting in an 18% drop in weekly accepted contracts for 3 weeks after the tariff announcement. Fortunately, the first few weeks of May saw a small recovery as some buyers woke up and got back to business.

From the mess of chaos erupted a wave of opportunistic negative predictions about the housing market across social media platforms. Even Newsweek ran an article suggesting that homes in Greater Phoenix could drop by 20%. While buyers would certainly swarm the housing market if property values suddenly dropped by 20%, the chance of that happening is slim. While Greater Phoenix is slipping farther into a buyer’s market, it’s not extreme enough for a collapse of that magnitude. Buyer’s markets over the past 25 years, excluding the 2008 sub-prime mortgage collapse, saw prices drop between 5% and 11% year-over-year, and those price declines were enough to pull the market back into a seller’s market each time.

Questions persist about the degree to which Greater Phoenix homes are overvalued. To answer this, a basis must be established prior to the 2005-2008 bubble/crash and a “typical home” defined. The median home sold in Maricopa County was 1,600sqft in 2000 and 1,900sqft in 2025, so a single family home of 1,500-2,000sqft is typical for this region. The annual appreciation rates from Q1 2001 thru Q1 2004 ranged from 3.6% to 5.3% with a median of 4.65%. The median rate across 25 years from Q1 2000 to Q1 2025 is 5.3% (high of 32.9% and low of –41.4%). Extrapolating the 4.65% appreciation rate over 25 years supports a price correction of 3% by next year. However, one could argue that prices are currently in line with where they would’ve been with a 5% annual appreciation rate over 25 years, below the 5.3% long term median and are already undervalued. Either way, the current buyer’s market supports declining prices over the next 3 months; 20% is extreme, but 3% is more reasonable. If mortgage rates move closer to 6.5% or lower, all projections will change again.Commentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report

©2025 Cromford Associates LLC and Tamboer Consulting LLC -

Brace yourselves, some buyers have become drunk with power. Negotiations have evolved from repairs and closing costs to remodeling requests in some cases; asking to replace things that are functioning properly, but are simply not new or upgraded. Only 6 cities are left in seller’s markets, and they’re not very strong. They are El Mirage, Apache Junction, Tolleson, Chandler, Avondale, and Fountain Hills. Interior cities Glendale, Phoenix, Paradise Valley, Scottsdale, and Gilbert all dropped from seller’s markets to balanced markets over the past 30 days, joining Mesa, Tempe, Cave Creek, Anthem, and Laveen. The remaining 13 cities are still in buyer’s markets.

After having the best year ever for sales over $1M, volatility in the stock market in March and April caused lower luxury sales in April. At the same time, lower mortgage rates in March led to a higher number of closings under $500K in April. Thus sales under $500K went from 56.7% market share in March to 60.1% in April, pulling down both the average and median price measures, and showing a 3.5% drop month-over-month and 1.1% drop year-over-year. Both months averaged 315 closings per day. April saw a drop in contract activity, so May will be weaker for sales but hope remains for June.Commentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report

©2025 Cromford Associates LLC and Tamboer Consulting LLC

April 2025 - Infographic

Make it stand out

Whatever it is, the way you tell your story online can make all the difference.

-

Markets are a mess, but it’s business as usual for housing.

New Contracts Spike between $250l and %500l.

-

It’s not easy to do predictions these days, even for just a month or two out. Home values typically don’t turn on a dime, so in order for a shift in supply or demand to have a lasting affect on home values it needs last for more than a few months. When a prediction is made regarding the housing market, it’s based on a level of expectation that current scenarios will continue. However, volatile trends in both the stock and bond markets have been changing by the hour due to abrupt and dramatic global trade negotiations, sending mortgage rates low and then high over the course of just a week. It’s like doing hard turns back and forth on the rudder of a large cargo ship, it’s a bumpy ride but there’s very little actual turning until the rudder commits to a position.

Fortunately, or unfortunately, volatility in the housing market is nothing new over the last 5 years. From extremely low mortgage rates, high demand, and astronomical appreciation from 2020-2021, to extremely high mortgage rates, falling demand, and depreciation in 2022, to moderately high mortgage rates, low-but-stable demand, andflat appreciation from 2023-2025. Real estate professionals have guided their clients through it all.

Emotions remain high in the news media headlines and consumer sentiment polls, but buyers continue to buy homes based on their personal needs, lifestyle, and financial situation. As of this writing, overall buyer demand in Greater Phoenix is holding steady, just about even with this time last year, with one unexpected spike in new contracts between $250K-$500K in late March. This coincided with a national 6% spike in FHA mortgage applications as qualified buyers took advantage of down-payment assistance and grant funds before regulations change regarding who may utilize them.

Supply continues to rise, putting buyers in good position during negotiations, and prices remain stable with the median up only 1.7% from last year. Negotiations are averaging 97.7% of the last list price, down from 97.8% April last year, but it varies by price range. Negotiations are still 99% of list on a $300K-$400K single family home, and 98.6% for $400K-$500K. On a home listed for $450,000, that’s a $6,300 negotiation to $443,700 on top of another $10,000 in median costs towards seller-paid closing costs.

**Commentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report ©2025 Cromford Associates LLC and Tamboer Consulting LLC

-

One segment of housing demand that does not care for the volatility in the markets is luxury buyers. Listings under contract over $1M has been drifting down for 6 weeks now as buyers take a pause to wait for some form of certainty to move forward. Despite this recent trend, contract activity still remains the 3rd best Greater Phoenix has ever seen, behind 2022 and 2024. Supply in this price range is also at record levels, which offsets the added demand and is keeping prices modest.

• 11 cities in Greater Phoenix are in very weak seller’s markets: Paradise Valley, Scottsdale, Fountain Hills, Phoenix, Anthem, El Mirage, Glendale, Avondale, Apache Junction, Chandler, Gilbert

• 4 cities are in balanced markets: Cave Creek, Tolleson, Tempe, Mesa

• 14 cities are in buyer’s markets: Peoria, Goodyear, Surprise, Buckeye, Laveen, Sun City, Sun City West, Litchfield Park, Queen Creek, Sun Lakes, Maricopa, Gold Canyon, Arizona City, Casa Grande

A weak seller’s market will not look too different from a balanced market, it only means that price appreciation will be slightly higher than the rate of inflation, which is just 2.4% per the most recent CPI measure. Sellers are always testing the top boundaries of price for a give, but in a buyer’s market they are routinely denied. This is reflected in the number of price reductions up 68% compared to last year at this time and at levels not seen since 2022. This is true even in seller’s markets of the Northeast Valley, with price reduction counts not seen since 2017. As a result, very few sellers are “greedy” in their asking prices as they are often lower or even with last year’s asking price per square foot. As with any buyer’s market, condition is a top priority for sellers along with pricing. In some cases that may be as simple as neutralizing kid’s room paint or accent walls, or as complicated as a new roof or major repairs prior to list.

Commentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report ©2025 Cromford Associates LLC and Tamboer Consulting LLC

March 2025 - Infographic

Make it stand out

Whatever it is, the way you tell your story online can make all the difference.

-

It’s a Buyer’s Market. Why aren’t prices crashing?

Could Economic Uncertainty Help the Housing Market?

For Buyers

Phoenix has been in a buyer’s market for 3 out of the last 4 months, and it’s continuing into March as of this writing. Some buyers may be surprised to see price measures aren’t showing a decline yet, in fact the median is up 4.3% over last year. Price measures take at least 3-6 months to crack after a shift in the market, and that shift needs to be in effect for at least a season before it starts to hit the price line.

Why does it take so long? For a number of reasons, but one is the length of the sale. When selling a home, first the seller needs to list it on the open market and possibly wait 30 days before accepting a contract. Then after another 30-45 days in escrow, the price finally records. Then in order to establish a trend, two more months need to be established to show a measurable decline in price. Stocks, in contrast, can be sold and recorded at the push of a button, so volatility and price responses are instantaneous, and crashes are common.

This is only the 4th buyer’s market for Greater Phoenix over the past 25 years, and the one from 2006 -2008 was a doozy that ignites PTSD for those who suffered through it. Because the housing crash coincided with the Great Recession of 2008, there are some who believe home values are set to crash if another recession should occur in the near future. Historically, this theory is not supported. Typically home values go flat and boring during recessions, or barely rise. Ironically, buyer demand for homes increases during recessions because mortgage rates typically decline. Measures today suggest prices could decline in the coming months if supply continues to rise, but more like a coast or glide, not a crash.

Most price ranges are currently averaging somewhere around 1-2% appreciation year-over-year, which is less than the rate of inflation. However, condominiums and townhomes under $400K are seeing the most notable declines in value, down -4.2% so far this month, while those between $1M-$1.5M are experiencing the strongest growth at +5.5%. Under these circumstances, any drop in mortgage rates will have significant impacts on a buyer’s purchasing power.

For Sellers

Today’s buyer’s market is not due to falling buyer demand. The Cromford® Demand Index is actually rising at the moment. It’s rising supply that’s causing sellers added stress. So far in this year, the Arizona Regional MLS has seen more new listings added to supply than it has in the last 4 years, and the highest total count of active listings since 2015. While buyer demand is improving, it’s not enough to absorb this many added listings. The byproduct is a spike in price reductions over the past 4 weeks (up 58% over last year) and stronger buyer negotiations, even for homes in perfect condition.

The average list price per square foot tells us that sellers are not pushing the market on price as much as they used to, with measures by price range mostly within 1% of last year, give or take. But added pressure from increased competition is causing some sellers to go the extra mile just to get an offer. That could mean staging their vacant home, or neutralizing paint, upgrading appliances, or more.

Once they get the offer, price negotiations are shaving off a tad more than they did last year as well. The average price negotiation for listings under $1M is running at 98.3% of the last list price, down from 98.6% last year. On a $500,000 purchase, that’s a negotiation of $8,500 off the sales price vs. $7,000 last year. Negotiations over $1M are averaging 95.4% compared to 96.4% last year. On a $1M home, that’s a downward negotiation of $46,000 vs. $36,000.

There’s one ray of good news for sellers. Mortgage rates have been trending down since January’s peak of 7.26% and are averaging 6.78% as of this writing per Mortgage News Daily. In the face of perceived chaos and uncertainty over the economy, potential tariffs, and federal government downsizing, the stock market declined as investors moved their money over to more stable investments, including bonds. This pushed down rates on the 10-year treasury, which is closely tied to 30-year mortgage rates. If mortgage rates continue to decline past 6.5%, the market will improve for sellers.

Commentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report

©2025 Cromford Associates LLC and Tamboer Consulting LLCon text goes here

February 2025 - Infographic

-

Fact Check February - Don’t Fall In Love With These 7 Narratives on Housing

There is no online shortage of armchair quarterbacks when it comes to prognostications on the future of home values and affordability. However, there are narratives that some people, and journalists, stubbornly hold to that are simply outdated or incorrect. Many of them were true a few years ago but are no longer true today. Here are just a few:

Myth #1 - Buyer demand is declining.

This was true in 2022 and 2023, but is no longer true today. While mortgage rates have knocked many buyers out of the game, buyer demand is now stable and following last year’s trend with little reaction to rate fluctuations.Myth #2 - There is very little to buy under $300K.

This was definitely true a few years ago, but not today. In February 2022, there were only 90 single family listings active for sale under $300,000 in Maricopa and Pinal County. Today there are 534, mostly in Pinal County. Condo and townhome inventory is even more abundant by comparison. In March 2022, there were only 156 active condo/th listings while today there are more than 1,200, all of which are in Maricopa County.Myth #3 - My income is too high to qualify for any homebuyer assistance programs.

Some grant and downpayment assistance programs correlate to an area, not income. Many have income limits as high as $150,000/year and some don’t have income limits at all. Putting in the research and finding a qualified loan officer to explain these programs could save thousands of dollars.Myth #4 - I need to be a first-time homebuyer or renter to qualify for homebuyer assistance programs.

In most cases, this is not true. They may say first-time home buyer, but if you haven’t owned a home in 3 years or more, you’re a first-time home buyer once again according to HUD’s definition. Also, if you’ve only ever owned a home with a spouse, have a child, and are now divorced, you are also a first-time home buyer. Or, if you’ve only ever owned a mobile home. These are just 3 of the 5 HUD definitions for first-time homebuyer.Myth #5 - Mortgage rates are too high, there’s nothing to be done about it.

57% of January sales between $200,000-$600,000 involved seller-paid incentives, most went towards a temporary buydown of the mortgage rate, and many home builders are providing permanent rate buydowns. Other sellers have FHA or VA loans that are assumable with rates below 5%. In fact, about 10% of all active listings fit this criteria. Some buyer assistance programs even allow grant money to buy down mortgage rates. Again, a little research goes a long way in hacking the affordability issues caused by mortgage rates.Myth #6 - Housing is in a bubble and home prices are on the precipice of a crash.

One could argue that Greater Phoenix already had a bubble and price crash in 2022 when prices rose to their peak by May and declined a whopping 12.3% from May to December that year, with short-term flip investors taking the brunt of the pain. Since then, prices bounced and stabilized with most price ranges seeing less than 2% appreciation year over year today. That is less than the current rate of inflation, and what is expected after nearly a year in a buyer-leaning market. While Greater Phoenix is officially in a buyer’s market, it’s very mild. Under these conditions, sale price measures are showing most non-luxury buyer negotiations at approximately 1.9% below the last list price. That’s a huge improvement over 2022 where sales prices were averaging 2.4% OVER list price. Prices are declining in some areas, but not all, and not by leaps and bounds. Current supply and demand indexes do not support massive declines in sales prices, but shaving 1-2% off lower list prices during negotiations is not out of the question. Sellers are not pushing the market with outrageous list prices. In fact, most are in line or even below last year in some price ranges.Myth #7 - I’ll sell my home “as-is” and price it aggressively with buyer incentives.

This worked in the mild seller’s market of 2023 and first part of 2024, but not now. In a buyer’s market, it’s okay to sell your home “as-is” so long as it “is” in excellent condition. The hierarchy of importance isn’t price first, then buyer incentives, then condition. It’s condition AND price, the importance of additional incentives depends on your area and price range. When everyone is offering low prices and buyer incentives, properties in good condition rise to the top.Commentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report

©2025 Cromford Associates LLC and Tamboer Consulting LLC

January 2025 - Infographic

Make it stand out

Whatever it is, the way you tell your story online can make all the difference.

-

Description text goes hereHome Prices Rose 4.7% ... Or Did They?

What was Hot in December, and What Was Not...

For Buyers:

Buyer’s season has begun and new listings for January are the strongest Greater Phoenix has seen since 2020. New listings waned in November and December, so this rebound is a refreshing start for buyers in 2025 as supply is rising and sellers continue to be open to incentives and negotiations.

Hovering around 7.25%, mortgage rates continue to limit the general buyer pool. Currently, just over 5,600 listings are under contract in the MLS, but normally we expect to see at least 7,000-8,000 at this time of year. On the other hand, supply is around 21,000, the highest entry point for January since 2016-2017, fostering an environment favorable towards qualified buyers.

These conditions suggest home price projections should remain flat, either at or slightly lower than the rate of inflation annually. However, December price measures were significantly higher than the rate of inflation with a +4.7% growth in the median sales price and +6.7% for price per square foot. How can this be? Well, blame it on the luxury market.

Mortgage rates suppress buyers on the low end of the price scale, but don’t affect those on the high end. As crypto and stock investments spiked after the 2024 election, luxury sales over $1M over surged +37% over last December compared to just +11% for homes under $1M. This caused December’s data set to be more top heavy in luxury and skewed price appreciation measures high.

When December sales over $1M are eliminated, the annual appreciation rate per square foot falls from 6.7% to just 2.5%, in line with the rate of inflation. This is expected in a market that bounced between a buyer’s market and balance for most of the year. While mortgage rates are not ideal, they are temporary. Prices are stable, incentives abound, and sellers are negotiable. There’s no harm in getting qualified and taking a look.

For Sellers:

January is starting off pretty frigid overall, but not for everyone. When taking a broad look at Greater Phoenix, the gap between supply and demand can seem insurmountable. However, specific target price ranges and areas are lighting up the map with heated activity.

For example, the West Valley lights up in the first-time home-buyer price ranges between $250K-$400K, specifically Surprise, Waddell, Avondale, Tolleson, and Southwest Phoenix as high builder incentives combat affordability issues. Also lighting up with frenzy activity in this range is Mesa (85204), North Gilbert, and Chandler (85226).

The Southeast Valley heats up in the $400K-$500K range, as does Tolleson and North Glendale.

Luxury condo sales over $1.5M are insanely popular in Scottsdale 85251, 85255 and Paradise Valley. However, the condo market in general is under the most stress with many areas seeing zero contract activity and a 67% increase in competing supply under $400K. Condos between $300K-$500K and $600K-$800K rose in value from January-April last year, but those gains disappeared from April-December*. They are now starting 2025 dead even with January 2024 at 0% appreciation.

Homeowners insurance is going to be a major topic this year, especially for the condo market as many HOAs can no longer shoulder the extra costs without raising dues. More landlords facing increased insurance costs, HOA fees, and lower rents on apartment-style condos are experiencing lower returns and looking for an exit strategy.

As the housing market enters its high season, things will look up for sellers from now through May. How much contract activity lights up depends mostly on mortgage rates, however. Until then, sellers must continue to offer high incentives to buy down rates, keep their properties in top condition to compete, and resist the urge to press the market on price.

*using a 3-month moving average, sales price per square foot

Commentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report

©2025 Cromford Associates LLC and Tamboer Consulting LLC

December 2024 - Infographic

Make it stand out

Whatever it is, the way you tell your story online can make all the difference.

-

Predictions for 2025, What to Expect in Q1

It’s a Buyer’s Market, Will Prices Drop?

For Buyers:

The buyer’s market in Greater Phoenix is still young at just over 5 weeks old but isn’t getting worse thanks to supply stabilizing over the past two weeks. For some, this scenario brings anticipation of a decline in sales prices, however there’s more to this buyer’s market than meets the eye. There have only been 3 other buyer’s markets in Greater Phoenix over the last 25 years, and they are all unique in their circumstances and thus give us little to compare with our current market.

What can we expect in terms of price trends today with our new baby buyer’s market? That depends on how long the market stays friendly towards buyers. Sales price is the last measure to respond to a shift from a seller advantage to a buyers advantage. The first measure to crack is the seller’s asking price. When that doesn’t improve buyer interest, then buyer incentives increase. If that doesn’t improve sales, then negotiations begin to shave more off of the seller’s asking price. The whole process for sales prices to respond can take 3-6 months; so if the buyer’s market is brief there may be little effect on sales price trends.

Currently, price measures are flat and buyer incentives are high at 53% of November MLS closings with a median cost to sellers of $10,000. The last 6 months have the highest percentage of concessions ever recorded in Greater Phoenix and double the long term normal concession range of $4,000-$5,000.

The moral of this story is don’t rely on price measures to reflect the best time to buy. By the time prices hit a bottom the party is already over. Additionally, measures don’t reflect the plethora of “shadow” benefits that happen outside of price during buyer’s markets; like rate buy-downs, loan assumptions, seller acceptance of contingent sales, and major property improvements performed prior to close.

Will prices drop? Currently, December sales price measures are trending up over November, not down. If we attempt to correlate to the last buyer’s market of 2022 that lasted 4 weeks between November and December, price measures dropped just 2.7% during that time before immediately bouncing up again in January and February when mortgage rates declined to 6%. Buyers who bought at that time have the most appreciation accumulated within the last 3 years.

For Sellers:

It continues to be a frigid market for most zip codes in Greater Phoenix with the lowest contract ratio* we’ve seen since January 2015, 10 years ago. Mortgage rates have improved slightly from 7.1% in November to 6.8% as of December 12th, and most national lending experts believe they’ll stagnate for the rest of December. In order to see a notable improvement in demand, these same experts agree that mortgage rates need to drop below 6.5%. Sellers struggling the most are those who have owned for less than 3 years, and especially those who purchased in mid-2022 at the height of market price. Those sellers may need to hold on for another year or so to see enough appreciation to recoup their selling costs and down payment. However, those who have owned for 3.5 years or more still have significant equity to manage the expenses of selling in today’s market.

Sellers who purchased in 2021 have a possible advantage over those who purchased after them, and that’s a much lower mortgage rate which may be assumable by a buyer. Both VA and FHA mortgages are automatically assumable for a qualified buyer and this option could save the seller thousands of dollars in costly buyer incentives in addition to saving the buyer hundreds per month in their payment.

After 2.5 years of a challenging housing market, there is one thing sellers can look forward to right now; the Spring buying season that kicks off in mid-January and continues through May every year. The Spring of 2024 saw contracts increase 83% from January through May, and the bounce was 85% in Spring 2023. Pre-Covid 2019, the Spring bounce was 105%. If mortgage rates decline as expected in 2025, this Spring could see similar improvements for sellers.

*listings under contract divided by active listingsCommentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report

©2024 Cromford Associates LLC and Tamboer Consulting LLC