Your Credit Score Isn’t Perfect—But You Can Still Buy a Home

🏡 Credit Scores & Mortgage Loans: What You Really Need to Know

Thinking about buying a home? One of the first questions you might hear is, “What’s your credit score?” It’s a big part of the mortgage puzzle—but not the whole picture. In this post, I’ll walk you through what credit scores really mean, how they impact your home loan options, and what steps you can take today to get on the right track.

🔎 Why Credit Scores Matter in the Mortgage Process

Your credit score helps lenders gauge risk—basically, how likely you are to pay back the loan on time. The better your score, the better your loan options and interest rates.

But here’s the thing:

You don’t need perfect credit to qualify for a mortgage.

You just need to know where you stand, what’s possible, and have someone on your side to help you navigate the process (hi, that’s me 🙋♀️).

📉 Mortgage Credit Scores vs. What You See Online

Not all credit scores are created equal. Apps like Credit Karma show you consumer scores (VantageScore), but mortgage lenders use older FICO models that can score you differently.

When you apply for a mortgage, lenders typically pull three FICO scores:

FICO 2 (Experian)

FICO 5 (Equifax)

FICO 4 (TransUnion)

These models weigh things differently than what you see on apps, so your mortgage scores are often 20–40 points lower (sometimes more!). That’s why getting pre-qualified early is so important—it gives you the real numbers we’re working with.

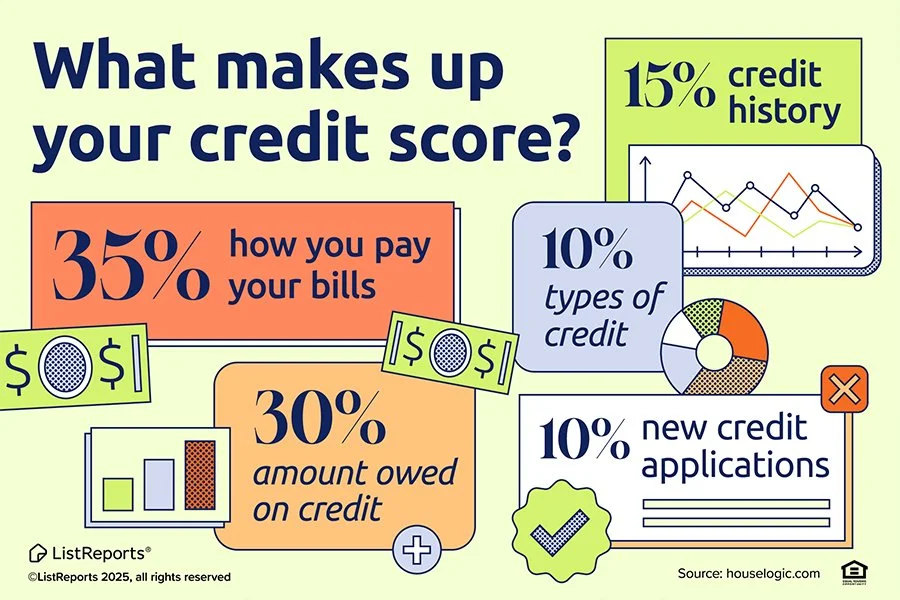

📊 What Makes Up a Credit Score?

Understanding what goes into your score can help you take control. Here’s the breakdown:

35% – Payment History: Do you pay on time? This is the biggest factor.

30% – Amounts Owed (Utilization): How much of your available credit are you using?

15% – Length of Credit History: Older accounts boost your score.

10% – Credit Mix: A variety of account types (credit cards, loans, etc.) helps.

10% – New Credit: Too many new accounts or hard inquiries can lower your score temporarily.

🎓 Student Loan Delinquencies Are Back—Check Your Reports

As of early 2025, many borrowers are discovering that student loans previously in COVID forbearance or deferment are now reporting as delinquent.

This can cause your credit score to drop—sometimes without warning. That’s why it’s essential to:

Review your credit report carefully

Make sure your student loans are either in repayment or on an income-based plan

Contact your servicer if anything looks off

I explain this shift in detail in this blog post about the 2025 student loan updates and how to protect your credit.

💻 Tools to Monitor & Simulate Your Credit

You don’t have to guess what’s helping (or hurting) your score. Use these tools to stay on top of your credit:

Credit Karma (Free): Great for tracking balances, alerts, and utilization trends.

MyFICO (Paid): Shows your real FICO mortgage scores and lets you run simulations—like how much your score could increase if you paid off debt or removed a collection.

These are great tools for self-monitoring. But if your credit needs more serious repair or personalized guidance, let me know.

👉 I can connect you with a trusted credit specialist who can create a custom plan and help get you back on track.

You’re not in this alone—I’ve got resources ready for you.

🚀 7 Ways to Boost Your Score

❄️ Try the Debt Snowball Method

Feeling stuck in debt and not sure where to start? The Debt Snowball method—popularized by Dave Ramsey—is a powerful tool for tackling multiple balances.

Start by paying off your smallest debt first (while making minimum payments on the rest). Once that’s paid off, roll that payment into the next-smallest debt. This creates momentum and quick wins, helping you stay motivated.

It’s a simple but effective system—and I walk you through exactly how to do it in this blog post.

📌 Minimum Credit Scores by Loan Type

These are just the entry points—your full credit profile, income, and debt situation all come into play.

⏳ Had a Bump in the Road? Here’s What You Need to Know About Seasoning

If you’ve had a bankruptcy, foreclosure, or late payments in the past, you’re not alone—and it doesn’t mean you can’t buy a home.

Lenders just want to see that time has passed. Here are some common seasoning periods:

Late payments: Ideally 12 months of clean history

Chapter 7 Bankruptcy:

FHA: 2 years

Conventional: 4 years

Foreclosure:

FHA: 3 years

Conventional: 7 years

Short sale/deed-in-lieu:

FHA: 3 years

Conventional: 4 years

✅ I’ve helped clients qualify again after these events—don’t count yourself out.

📞 Trigger Leads Are a Thing—Here’s How to Stop Them

Once your credit is pulled for a mortgage, you might start getting flooded with spam calls and texts from other lenders. These are called trigger leads—and yes, they’re legal (unfortunately).

But the good news? You can opt out.

👉 I walk you through exactly how in this blog post about what trigger leads are and how to protect your info before you apply.

💬 Final Thoughts: Your Credit Doesn’t Have to Be Perfect

You can buy a home without perfect credit.

You just need someone who understands the guidelines, knows how to work through the gray areas, and can build a strategy around your goals.

Let’s figure out what’s possible—together. When you're ready, I'm here.