December 23, 2025

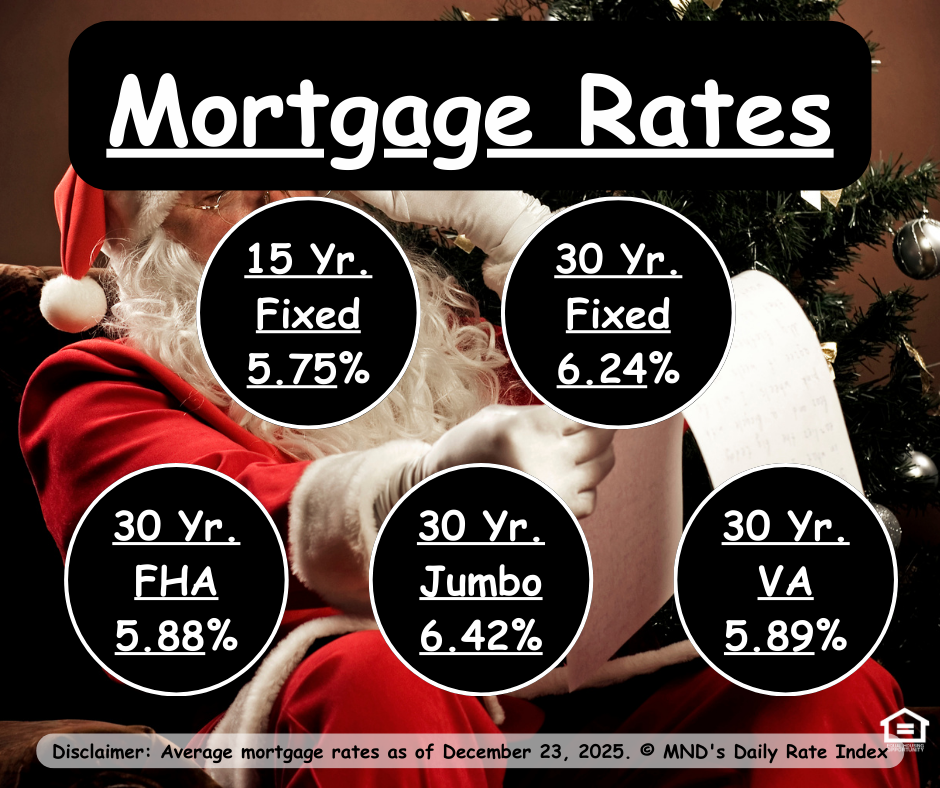

Mortgage rates were essentially unchanged today, tracking closely with bond market levels from late last week. That keeps the average lender near the lower end of the narrow range we’ve been stuck in for the past four months.

The good news? If rates manage to dip meaningfully from here, they’d be knocking on the door of the lowest levels we’ve seen in more than three years. 👀

The reality check: the next couple of weeks may feel a bit… sleepy. With multiple market holidays, partial trading days, and lighter overall volume, we could see small, random fluctuations—but not the kind of sustained momentum that leads to major rate moves.

For real direction, the market is likely waiting until January, with the January 9th jobs report shaping up to be the first big catalyst of 2026.

Quick takeaway: Rates are stable, flirting with long-term lows, but patience will be required until fresh economic data wakes the market up.

👉🏼Want to know what this rate range means for your buying or refinancing plans—reach out and let’s game out your next move.