January 20, 2026

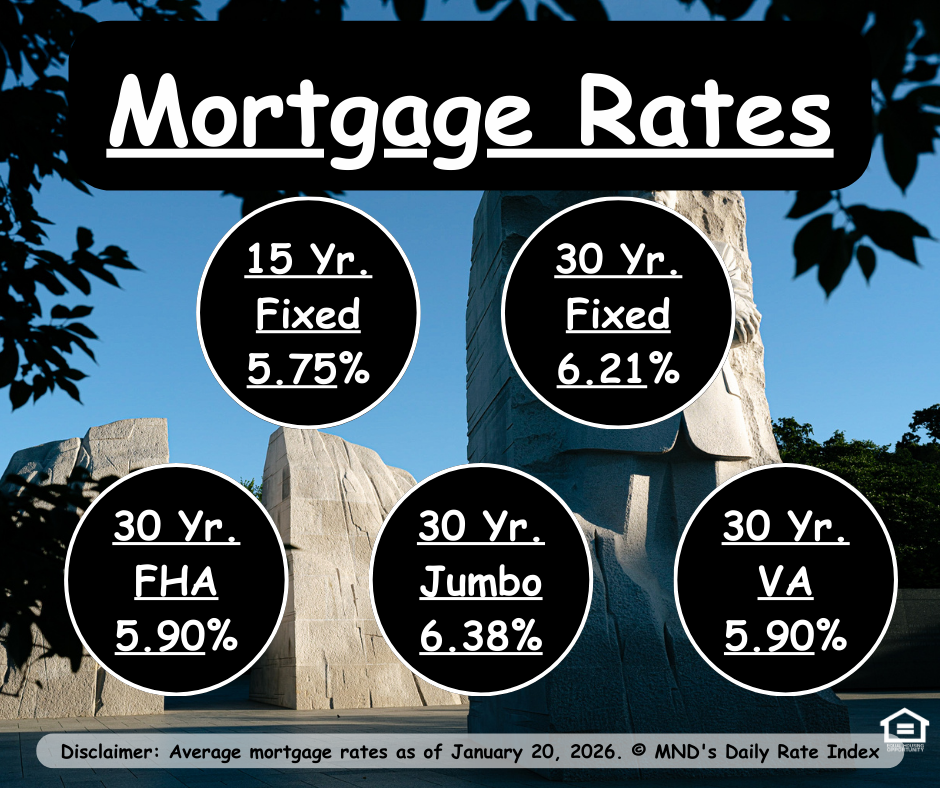

Mortgage rates moved sharply higher on Tuesday, reacting to a mix of geopolitical tension and weakness in overseas financial markets. After briefly touching 5.99% for a few hours on January 9 and spending most of last week in the low-6% range, the average top-tier 30-year fixed rate has climbed back to about 6.21%.

That puts rates right back where they were the day before the administration announced its $200 billion mortgage bond-buying plan. The last time rates were higher? December 23rd. So yes—this move got attention for a reason.

🤔 Wait… Didn’t Bond Buying Help Rates?

Great question—and you’re not wrong to ask it.

In short, the market already priced in that announcement. Because the bond-buying plan was relatively transparent and lacked a detailed schedule, investors reacted quickly and then… moved on.

This is very different from past Quantitative Easing (QE) programs, where the Fed laid out specific buying timelines and amounts in advance. Those programs made it easier for rates to move lower—and stay there—more quickly.

⚖️ What This Means in Real Time

Since this new bond-buying plan is unfolding gradually, the market will adjust day by day, not all at once. That leads to uneven results:

Some days, mortgage rates outperform U.S. Treasuries

Other days—like today—both move higher together

Volatility remains part of the landscape, even without major headlines

Translation: we’re in a market that reacts fast, digests news quickly, and refuses to move in a straight line.

🧭 The Big Picture

Rates are higher than they were a week ago—but still well below recent highs. Short-term moves are being driven more by global events and investor sentiment than by domestic housing fundamentals.

This is exactly why timing, strategy, and expectations matter right now. If you’re thinking about buying, refinancing, or just trying to make sense of the noise, let’s talk through it. Markets may zig and zag—but a good plan doesn’t have to.