January 16, 2026

Mortgage rates edged modestly lower today for many lenders, though not all. The difference comes down to timing—and a bit of yesterday afternoon drama in the bond market.

⏰ Why Some Lenders Went Lower… and Others Didn’t

Yesterday afternoon, the mortgage bond market improved fairly quickly. Some lenders reacted late in the day by dropping rates before closing.

Fast forward to this morning: bond market conditions were weaker than they were late yesterday. That meant lenders who had already improved pricing had to give a little back today, nudging rates slightly higher.

Meanwhile, lenders who didn’t adjust yesterday afternoon were comparing today’s bond levels to yesterday morning’s weaker levels—and that allowed them to modestly lower rates today.

Same market. Different snapshots. Different outcomes.

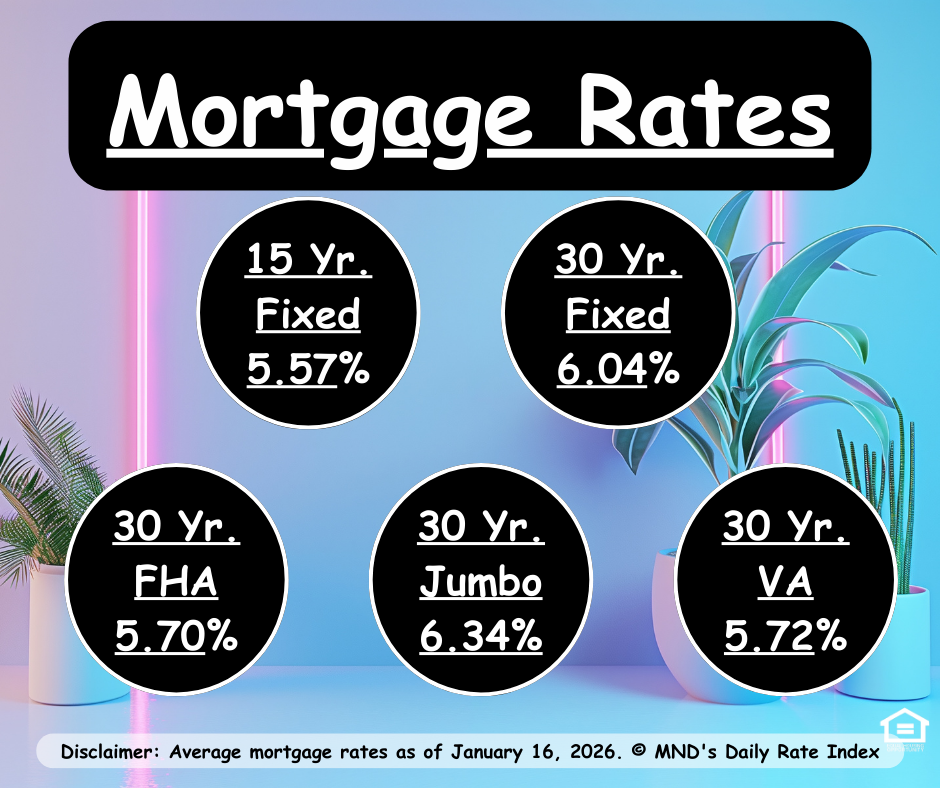

📊 Where Rates Really Stand

Zooming out, here’s the part that matters most: Despite the day-to-day shuffle, average mortgage rates remain very close to their 3-year lows.

That’s an important anchor point for buyers, sellers, and homeowners who may be feeling whiplash from daily headlines. Small fluctuations aside, the broader trend is still holding in a favorable range.

🐼 What This Means for You

Daily rate movements don’t always tell the full story—but context does. If you’re wondering how today’s pricing compares to your options or timeline, that’s where a real conversation matters more than a headline.

📞 Questions about how this impacts your next move? Call me. I’m happy to break it down without the bond-market jargon.