January 13, 2026

📉 Market Rate Update: Rates Hover Near Recent Lows

Mortgage rates are flirting with their lowest levels in weeks—but they’re not quite ready to commit.

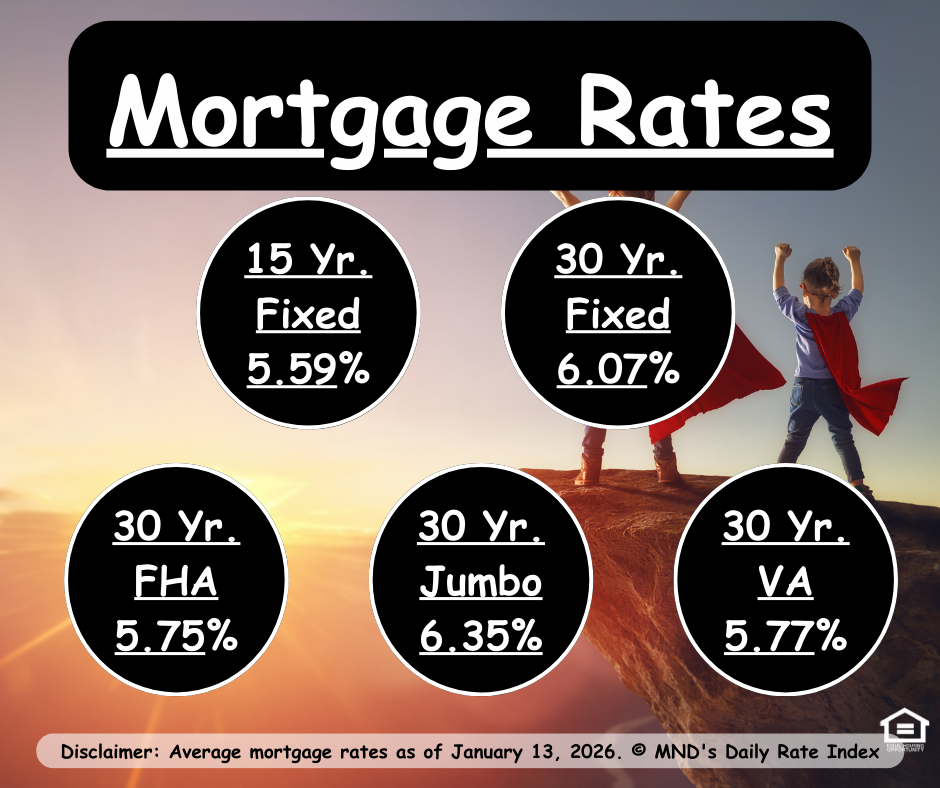

According to Mortgage News Daily’s rate index, the average 30-year fixed rate briefly dipped to 5.99% on Friday, before ending the day higher and settling just over 6% to start the week.

📊 What Happened With Rates?

While the chart currently shows a 6.01% low, that figure reflects the latest entry of the day—not the intraday low. Here’s how things actually played out:

Friday morning: Rates dipped as low as 5.99%

Friday afternoon: Several lenders repriced higher, pushing the index up to 6.06%

Today: Rates edged slightly higher again, closing around 6.07%

The good news? Most of the damage happened yesterday. Lenders who raised rates Friday afternoon were largely unchanged this morning—meaning today wasn’t a fresh sell-off, just a continuation.

MND Rate Change Index - Jan 13, 2025 to Jan 13, 2026 👇🏼

📈 CPI Inflation Data: A Soft Landing (For Now)

Rates could have moved higher today if not for a reasonably well-received CPI (Consumer Price Index) report.

Inflation for December came in slightly below expectations

That helped keep the bond market stable

Lower inflation is generally good for mortgage rates

That said, inflation isn’t falling fast enough to spark a major rally yet. Today’s data acted more like a safety net than a trampoline—preventing rates from rising further rather than pushing them meaningfully lower.

🧭 What This Means for Borrowers

Rates are still near recent lows

Volatility has cooled, but not disappeared

Small daily moves can still trigger lender reprices

If you’re floating a rate, this is the zone where strategy matters more than guessing. Timing, loan type, and risk tolerance all play a role.

🐼 Mama Bear Takeaway

This is a pause, not a pivot. Rates aren’t racing lower—but they’re also not spiraling up. That creates opportunity if you’re paying attention.

If you’re buying, refinancing, or just wondering whether to lock or float, let’s talk through the options and make a smart move—no panic, no guesswork.

📞 Questions about how today’s rate environment impacts your scenario? I’ve got you covered.