Manufactured Housing 101

Manufactured homes have evolved far beyond the “trailers” of decades past. Today’s models are energy-efficient, customizable, and a viable path to homeownership for families across Arizona. But when it comes to financing, they follow a few unique rules—and missing the fine print can delay your dream home.

Whether you’re eyeing a cozy manufactured home in a community park or building your own on private land, here’s what to know about financing options, specialty programs, and the real pros and cons of this growing housing trend.

🧱 What Defines a Manufactured Home

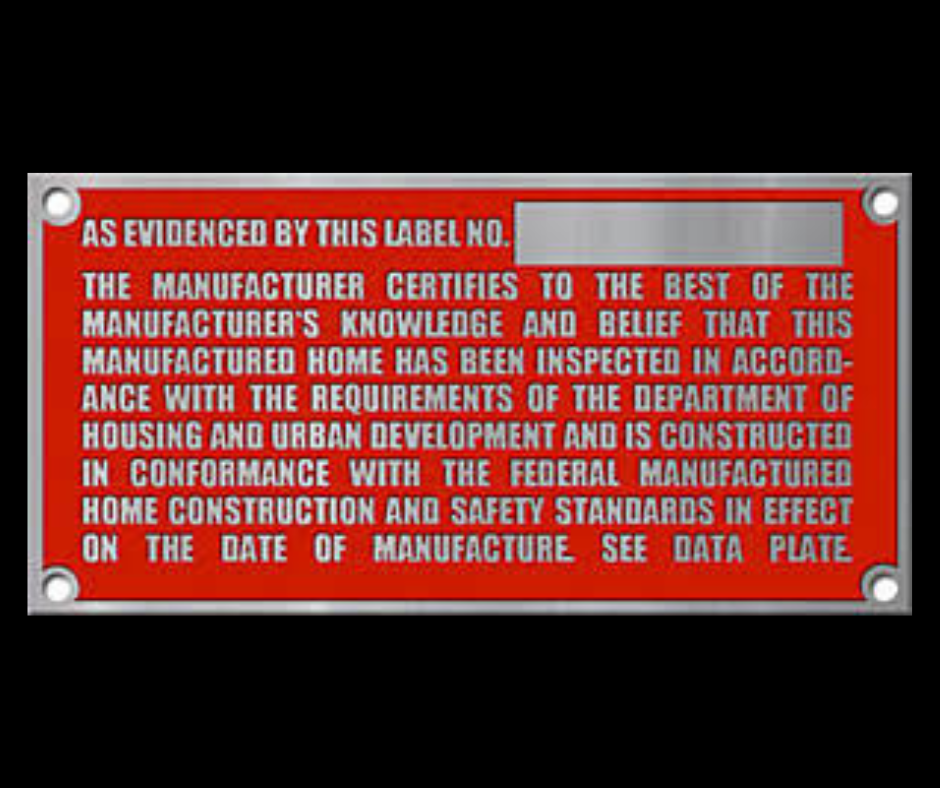

Manufactured homes are built entirely in a factory and transported in sections to their site. Each unit must meet strict HUD construction standards and display both a HUD data plate (inside the home) and a HUD certification label (metal tag on the exterior).

To qualify for mortgage financing, the home must:

Be built after June 15, 1976 (post-HUD code)

Be permanently affixed to land owned or leased long-term

Have axles, wheels, and hitches removed

Sit on a HUD-approved permanent foundation system

Be titled as real property rather than personal property

💰 Loan Options by Program

Manufactured homes can be financed through several mainstream mortgage programs—each with unique requirements:

FHA Loans – Minimum 3.5% down when the home and land are financed together. Must meet FHA’s foundation and property standards.

Conventional (Fannie Mae & Freddie Mac) – Require 5%–10% down and stricter appraisal guidelines. Look for MH Advantage (Fannie Mae) or CHOICEHome (Freddie Mac) programs for the best pricing and flexibility.

VA Loans – Available for veterans and active-duty service members purchasing or refinancing a permanently affixed manufactured home. The property must meet VA’s MPRs and be titled as real estate.

🏗️ Specialty Programs for Leased Land & Construction

Not every buyer owns the dirt beneath their home—and that’s okay!

At JP Home Loans, I offer specialty programs designed to make manufactured housing accessible in more situations:

✅ Manufactured homes on leased land: Perfect for long-term land leases or community parks. These programs consider the lease terms and location when qualifying.

✅ Construction-to-permanent loans: Ideal if you’re buying land and placing a new manufactured home, wrapping both land purchase and home setup into one convenient loan.

These niche programs make manufactured homes more attainable and flexible for today’s buyers.

⚖️ Pros and Cons of Buying a Manufactured Home

✨ Pros:

Affordability: Often 20–40% less expensive per square foot than site-built homes.

Energy Efficiency: Newer models are well-insulated and built to modern standards.

Speed: Factory construction means faster build times and fewer weather delays.

Customization: Buyers can choose layouts, finishes, and upgrades.

Flexibility: Financing available for owned or leased land—and even construction.

⚠️ Cons:

Depreciation: Values can decline if not titled as real property or located in strong markets.

Financing Hurdles: Fewer lenders and stricter guidelines.

Land Restrictions: Some areas don’t allow manufactured homes or have zoning limits.

Resale Complexity: Can be harder to sell or appraise compared to traditional homes.

Foundation Requirements: Missing or unapproved foundations can disqualify financing.

⚙️ What to Double-Check Before Appraisal

To avoid speed bumps later, verify these details early in the process:

The HUD tags and data plate are intact.

The foundation inspection meets HUD or engineer-certified standards.

The title has been retired (converted to real property).

The land status—owned or leased—is clearly documented.

A proactive checklist keeps underwriting clean and closing stress-free.

HUD Plate

🐼 Mama Bear Tip

Manufactured housing can be an incredible path to homeownership for families ready to plant roots without overextending budgets. With the right loan, land setup, and lender expertise (hi 👋), you can make one of these homes your foundation for the future.