The Truth About Condos (and Why Lenders Ask So Many Questions)

Buying into a community with shared walls, pools, or palm-tree-lined walkways? Great — but your loan underwriter wants to meet your neighbors (first … on paper 😉). Condos, townhouses, and planned unit developments (PUDs) each follow unique rules that shape how fast (and how pain-free) your loan gets approved.

This week’s Mortgage Minute breaks down the differences, the approval hurdles for FHA, VA, and conventional financing, how insurance really works, and what to do if your dream condo isn’t on the “approved” list.

🧩 What’s What

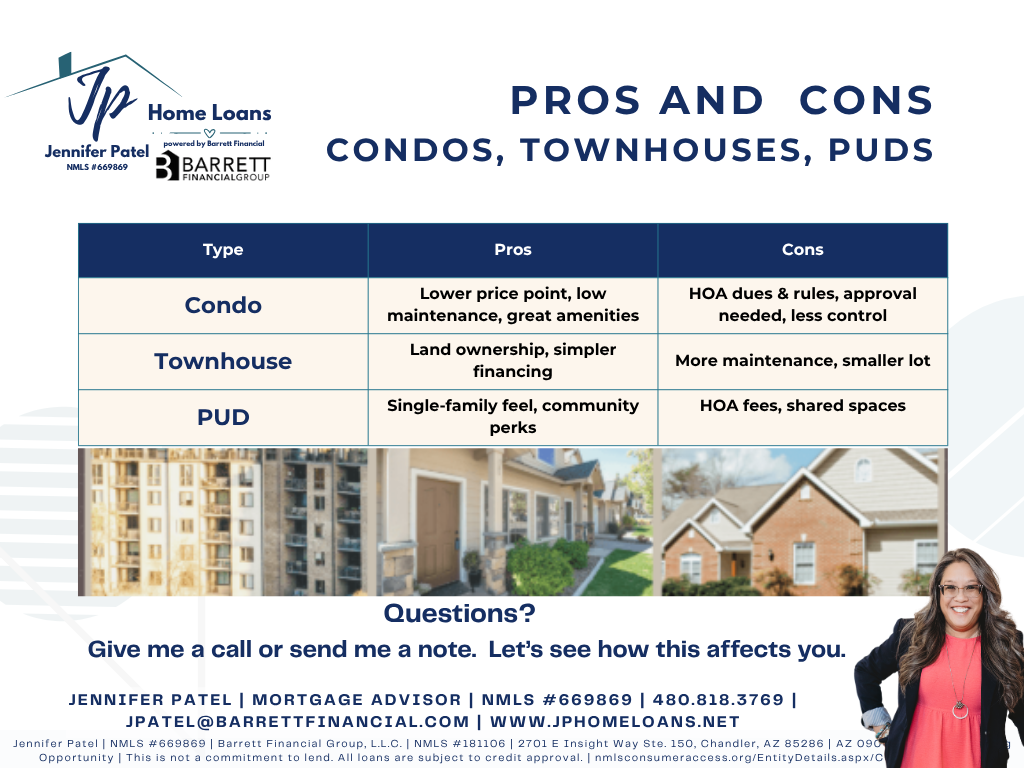

Condominium

You own the inside of your unit and share everything else — walls, roofs, hallways, amenities. The HOA controls budgets, reserves, and insurance, so lenders evaluate the entire project, not just your unit.

Townhouse

Often a multi-level unit where you own the structure and land beneath it. If that’s the case, it’s typically treated like a single-family residence (SFR). Easier underwriting, fewer “project” rules.

Planned Unit Development (PUD)

You own both home and lot but share community features (parks, roads, clubhouses). PUDs usually follow single-family lending standards but still require HOA review for financial soundness.

💡 Why It Matters

Condos = project review required 🕵️♀️

Townhouses/PUDs = simpler SFR-style review

Translation: more shared walls = more paperwork.

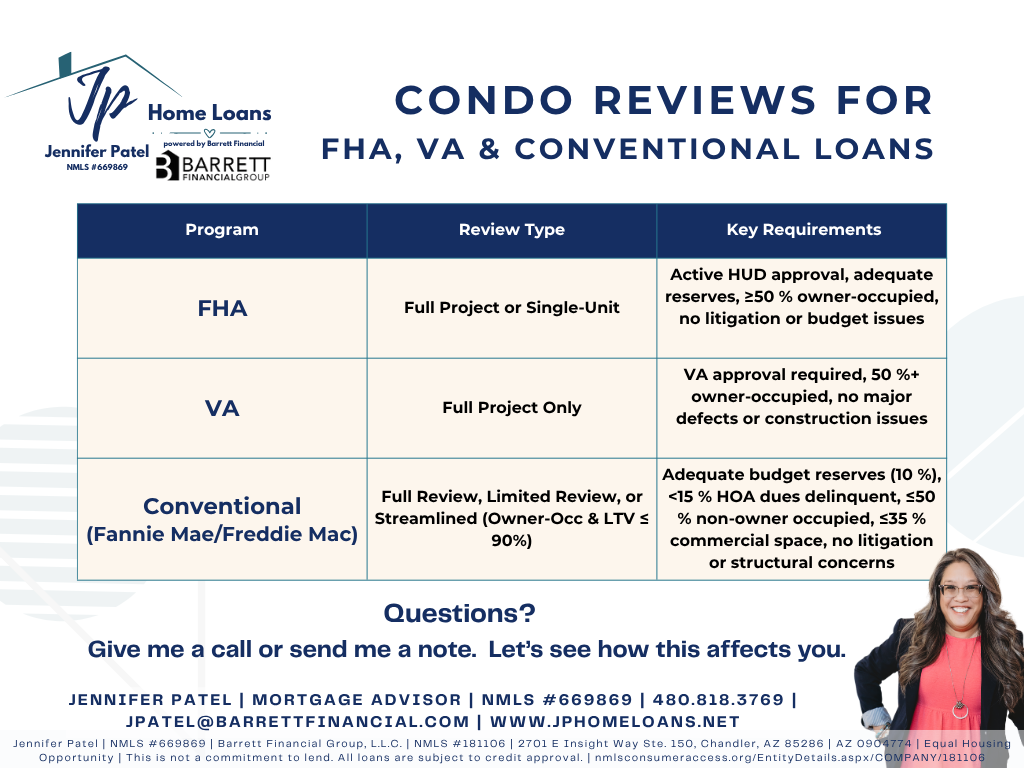

🏛️ FHA and VA Condo Approvals

FHA Projects

Allows full-project or single-unit (“spot”) approval.

Requires adequate reserves, >50 % owner-occupancy, no major litigation, and proper master insurance.

VA Projects

Must be VA-approved (project-level only). No spot approvals.

Key factors: 50 %+ owner-occupied, <10 % owned by one entity, no litigation or excessive commercial use.

Check these lists early — approvals can make or break your timeline.

📋 Condo Reviews for FHA, VA & Conventional Loans

🏦 Conventional Guidelines in Plain English

Limited Review: Primary residences up to 90 % LTV and second homes up to 75 % LTV may skip the full project paperwork if basic criteria are met.

Full Review: Required for investment condos or high-LTV purchases. Lenders scrutinize HOA budgets, insurance, and occupancy ratios.

New Construction Projects: Need developer documentation and completion standards before approval.

👉 If your project misses the marks (too much commercial space, not enough owner occupancy, weak reserves), it becomes non-warrantable — see below.

🚫 Non-Warrantable Condos & Non-QM Options

Non-warrantable = does not meet Fannie/Freddie/FHA/VA rules.

Common red flags:

One entity owns >20 % of units

HOA delinquency >15 %

Insufficient reserves (<10 %)

Active litigation or construction issues

Too much commercial space (>35 %)

Non-QM solutions:

20–30 % down payment

Bank-statement or asset-based qualification

Flexible credit standards

Expanded ratios and program types

Not a fallback — just a different path for unique properties.

⚖️ Quick Pros & Cons

🛡️ Homeowners Insurance 101

Condos: The HOA carries a master policy covering the building and common areas. You’ll need an HO-6 policy for interior walls, fixtures, and personal belongings.

Townhouses / PUDs: You own the structure and lot, so you typically carry an HO-3 homeowner policy covering the entire building. The HOA’s policy is limited to shared amenities.

Flood zones: Confirm who is responsible for coverage — sometimes both HOA and unit owner must have policies.

🧠 Pro Tip: If you’re unsure what coverage you need, reach out to 🔗 John Bene with Jelms Insurance — he’ll make sure your policy meets lender and HOA requirements.

🐼 Final Take

Different property types mean different rules — and your lender needs to speak each dialect fluently. Before you fall for that perfect balcony view or courtyard pool, let’s confirm how the home is classified and which loan program fits best.

💬 Reach out and I’ll help you find the right financing path — and loop in John Bene for the insurance piece so everything is buttoned up from day one.