🚪Multi-Family Homes

Build Wealth — One Door at a Time

Buying a multi-family property is one of the smartest ways to step into real estate investing. Whether you’re looking to create extra income, house extended family, or just stretch your mortgage dollars further, these homes can make it happen. They offer steady rental potential, long-term appreciation, and a level of flexibility that single-family homes just can’t match.

And I can tell you from experience — my husband and I have our own version of a multi-family setup. Our home includes a casita: a small attached unit with its own kitchen, bathroom, bedroom, and garage. Right now, my mother lives there, which is perfect for our family. But several of our neighbors have turned their casitas into income-generating rentals, and they’re absolutely making it work. That’s the beauty of multi-family living — it adapts to your needs, whether that’s family, finances, or flexibility.

🧱 What Exactly Is a Multi-Family Home?

A multi-family home is any residential property designed for more than one household — typically two to four separate living units under one roof. Think duplexes, triplexes, and fourplexes, or even setups like ours with a casita or accessory dwelling unit (ADU). Each has its own living space, and sometimes shared outdoor areas or hallways. Because these properties have four or fewer units, they still qualify for residential financing rather than commercial loans.

These homes appeal to buyers who want to “house hack” — living in one unit while renting out the others. They’re also great for families who want to keep loved ones nearby, like parents or adult children, while maintaining privacy and independence. Multi-family homes are an investment in both lifestyle and financial growth.

🏠 Single-Family vs. Multi-Family: What’s the Difference?

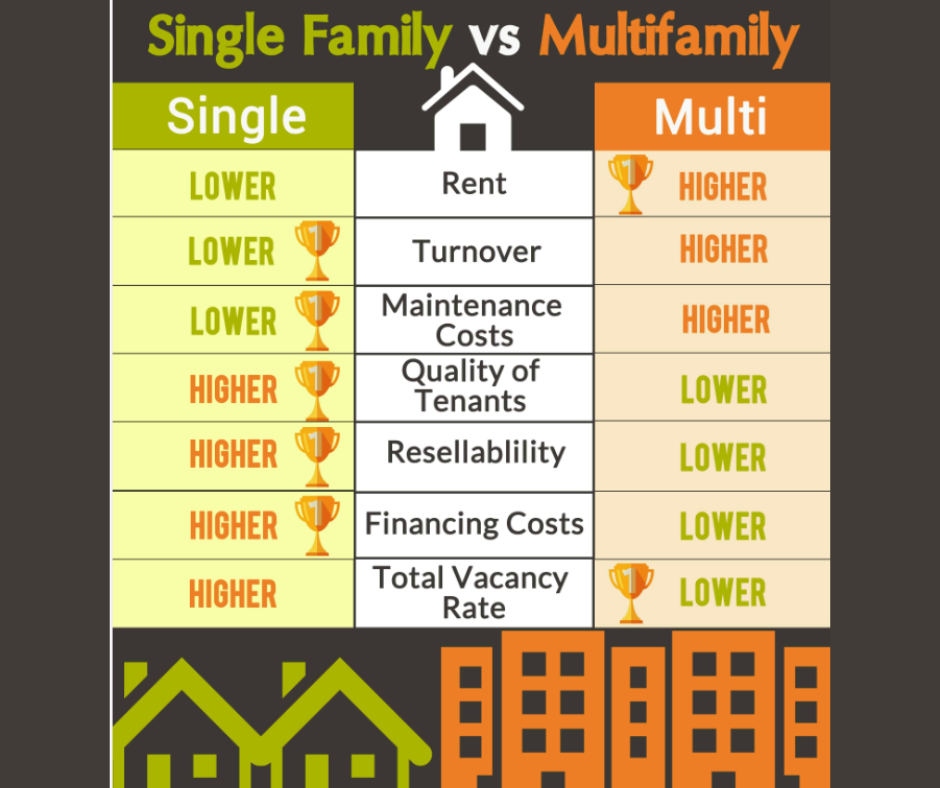

The main difference between single-family and multifamily properties is that single-family homes have only one dwelling unit and are unattached to other housing properties. They require less money to start and allow for easier exit strategies should you decide to sell.

Alternatively, multifamily properties require more capital and leave you with fewer options when reselling. Single-family homes also have a larger buyer pool because you can sell to either real estate investors or homebuyers.

💰 Financing Your Multi-Family

Here’s the good news: duplexes, triplexes, and fourplexes can still be financed with traditional residential loans. FHA loans allow as little as 3.5% down if you’ll live in one of the units, VA loans let eligible buyers go in with 0% down, and conventional loans typically require 15–25% depending on occupancy and credit.

Even better — lenders often count part of the anticipated rental income from the other units toward your qualifying income. That means your buying power can stretch further than you might think. An appraiser will estimate fair market rents for each unit, and usually 75% of that projected income can be used to offset your mortgage payment.

If you’re considering a setup like ours with a casita or ADU, your financing options may vary depending on how it’s titled and permitted — but it’s worth the conversation. In many Arizona neighborhoods, these secondary dwellings are growing in popularity and adding major value. 🔗Here is a previous article on the website about what AZ legislators are proposing in regards to allowing more ADUs.

🔍 What to Look For When Buying

When shopping for a multi-family home, think both like a homeowner and an investor. You want a property in a desirable location — close to schools, jobs, and amenities — where rental demand stays high. Check the condition of major systems like the roof, HVAC, and plumbing, since repairs multiply quickly when you’re maintaining multiple units.

Older buildings can offer great character but may also come with hidden costs. Get a professional inspection, and budget for both immediate fixes and long-term maintenance. If the property’s utilities aren’t separately metered, factor that into your monthly costs — you may be covering some tenant utilities yourself.

A thorough home inspection is one of the smartest steps you can take to protect your investment — and in the Valley, Checklist Inspections is one of the most trusted names around. Founded over 20 years ago by John and Kathy Tyer, this family-owned business has built a reputation for treating every home like their own. Their team uses decades of experience and top-notch tools to provide honest, transparent inspections from the roof to the foundation.

Whether you’re buying a multi-family home, a single-family property, or something in between, Checklist Inspections helps safeguard your investment so you can focus on what really matters — making your house a home. Because at the end of the day, family protecting family is what it’s all about. ❤️

🔗 Learn more about Checklist Inspections

🧰 Managing and Maintaining Your Investment

Before you hand over keys or sign leases, make sure your finances are ready for the unexpected. Most lenders require cash reserves for multi-unit properties — typically two to six months of mortgage payments — to ensure you can weather vacancies, repairs, or other surprises. Even if it’s not required, keeping a cushion set aside is one of the smartest ways to protect your investment (and your peace of mind).

If you’re managing tenants yourself, be ready to handle the occasional maintenance call, rent collection, or late-night “the water heater’s out” text. It can be rewarding, but also time-consuming. That’s why many Arizona investors turn to 🔗 Real Property Management Copper State, owned by Cia Kersten, a proud Arizona native who knows the Valley inside and out.

Cia’s team specializes in protecting your investment by providing comprehensive, professional property management services — minimizing your costs while maximizing your income. From tenant screening and lease compliance to maintenance coordination and financial reporting, they handle the details so you don’t have to.

Whether you manage things yourself or bring in the pros, the key is creating a system that safeguards your time, money, and sanity — because being a property owner should build wealth, not stress.

🌟 Pros and Cons to Consider

The biggest advantage of owning a multi-family home is the built-in income potential. Rent from one or more units can offset your mortgage, lower your living expenses, and help you build equity faster. Add in tax benefits — like deductions for mortgage interest, repairs, and depreciation — and the numbers start to look very appealing.

On the flip side, multi-family ownership does mean more moving parts. You’ll need to manage tenants, plan for maintenance, and keep an eye on your finances. But for many buyers — especially those like us who use a casita for family now and income later — the benefits far outweigh the challenges.

🏁 The Takeaway

A multi-family home can be the perfect blend of financial growth and personal flexibility. Whether you use your extra space to house loved ones, host guests, or create rental income, you’re setting yourself up for long-term success.

Multi-family living isn’t just about making money — it’s about making your home work for you. And when done right, it can help you build wealth, community, and a legacy… all under one roof.

🎯Let’s explore your financing options and see how a multi-family home (or casita setup) could work for you.