Market News

Stay Ahead with the Latest Mortgage Market News

The real estate and mortgage markets are constantly evolving, and staying informed is key to making confident financial decisions. Whether you're a homebuyer, homeowner, or real estate professional, I bring you the latest updates on interest rates, housing trends, loan programs, and economic shifts that impact your mortgage options.

Check back often for expert insights and timely news to help you navigate the ever-changing market with clarity and confidence.

Have questions about how the market affects your mortgage? Contact me today to discuss your options and make the most of current opportunities!

Home Flipping Profits Hit 17-Year Low

Home flipping profits just dropped to their lowest level since 2008, as high purchase prices continue to squeeze investors’ returns. 🏚️

🚨 MBA Pushes Back on Fannie & Freddie Merger Talk

The Mortgage Bankers Association is warning that merging Fannie Mae and Freddie Mac could create a monopoly in housing finance and hurt both lenders and borrowers.

🏗️ Builder Confidence: Stuck in Neutral, Waiting for a Spark

Builder confidence slipped again in August, weighed down by high mortgage rates, weak buyer traffic, and policy frustrations

🌵 What a Housing Emergency Could Mean for Arizona

Treasury Secretary Scott Bessent floated the idea of declaring a national housing emergency this fall—here’s what it could mean for buyers, builders, and Arizona’s red-hot market.

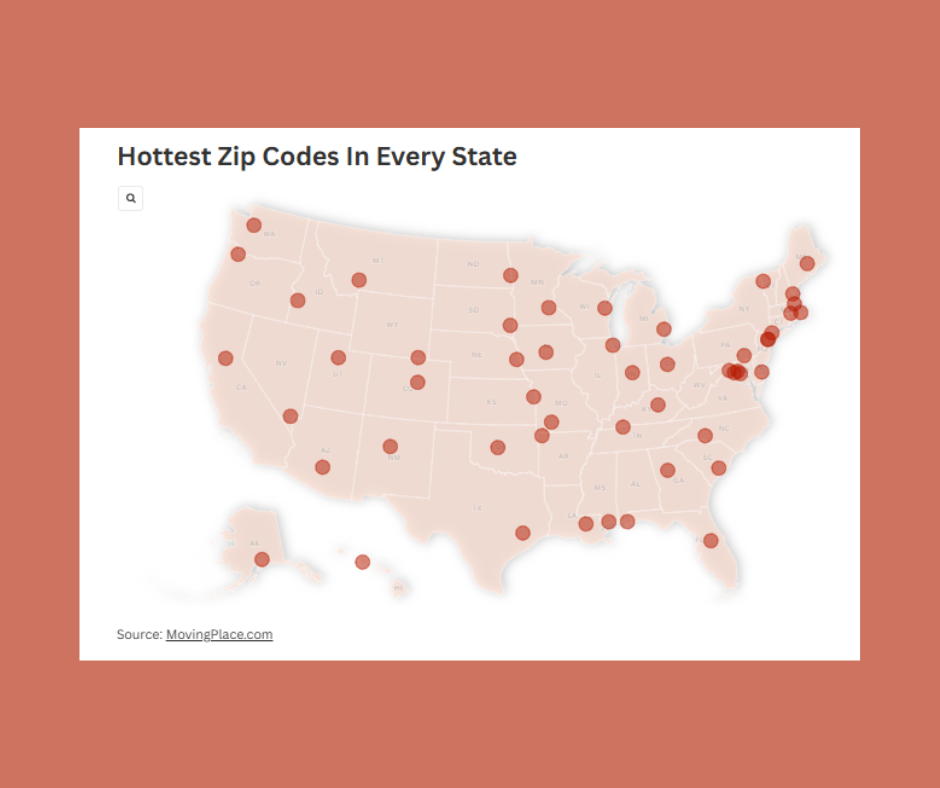

🧭 Market News: America’s Hottest ZIP Codes (and Arizona’s Standouts)

The hottest ZIP code in America is 01915 (Beverly, MA), while Arizona heat is showing up in migration magnets like 85142 (Queen Creek)

📢 Trigger Leads Get the Axe

President Trump signed the Homebuyers Privacy Protection Act, ending abusive “trigger leads” and ushering in a new era of borrower privacy

📰 Weak Jobs, Strong Signal: Mortgage Rates Could Dip

The August jobs report showed sluggish hiring and rising unemployment—bad news for the economy, but potentially good news for mortgage rates.

Mortgage Fraud at the Top? Why It Matters for All of Us

Mortgage fraud scandals—even at the highest levels—shake trust in the housing system, and that ripple can affect every homeowner 🏡.

Rocket + Mr. Cooper Merger Approved

The Rocket–Mr. Cooper merger just got the green light, creating a mortgage mega-giant—here’s what it means for the industry (and why brokers like me 🐼 are still the better choice).

📰 Deed Scams on the Rise in the U.S.

Deed scams are climbing across the U.S., especially targeting seniors and vacant-home owners—stay alert and use county fraud monitoring to protect your property

Rate Cuts on the Horizon—but Affordability Still Rules the Day

Even if Fed leadership changes, lower rates alone won’t fix today’s affordability crunch

AZ Suburbs Shine on National Stage

Four Phoenix-area suburbs ranked among the fastest-growing and most affordable in the U.S., underscoring Arizona’s rising influence on housing trends.

Social Security 2026:

A modest 2026 Social Security COLA is shaping up (~2.7% estimate), with final numbers due in mid-October—here’s how it could affect borrower income, DTI, and mortgage rates

📈 Wholesale Prices Have Exploded

Wholesale prices just saw their biggest jump in three years, thanks to tariffs—and that means higher costs for families, but a surprising dip in mortgage rates

🏡 Builder Confidence Is Still Low

Builder confidence is stuck in the low 30s, but with incentives rising and affordability challenges front and center, now’s the time to see what it means for buyers and sellers

🎓 Student Loan Shake-Up

President Trump’s One Big Beautiful Bill reshapes federal student loans starting in 2026 — and the ripple effects could even reach the housing market.

Inflation’s Plot Twist Keeps Rate Cuts in the Cards

Inflation is creeping up, but not enough to derail expectations for a September Fed rate cut—and possibly more before year’s end. With two to three cuts on the table, borrowing costs could ease heading into 2026

Trump IPOs Fannie & Freddie

Trump wants to put Fannie Mae and Freddie Mac on Wall Street’s main stage—think billions in taxpayer cash, a possible merger, and plenty of “will it or won’t it” drama

📈 Arizona Still a Top Moving Destination

Even Arizona’s triple-digit heat isn’t stopping the influx—256,000 people moved here in 2023, drawn by jobs, new housing, and a booming economy.

📵 Trigger Leads Get the Boot:

A rare bipartisan win aims to protect homebuyers from spammy lender offers. No more unsolicited calls after a credit pull.