Rent Checks Build Wealth… But Not Yours

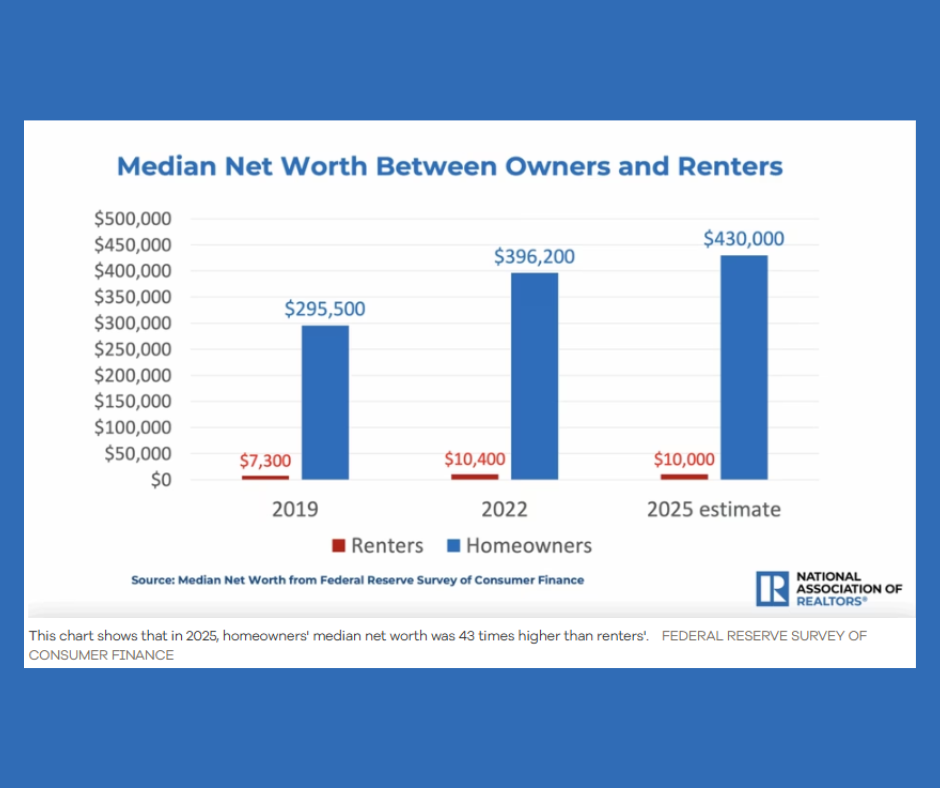

Homeownership has always been one of the most reliable wealth builders in America, and even in today’s uncertain economy, the numbers prove it. According to the latest 🔗Federal Reserve Survey of Consumer Finance, the typical U.S. homeowner now has a net worth of $430,000, compared to just $10,000 for the typical renter. To put it simply: the average homeowner is 43 times wealthier than the average renter.

Meanwhile, the 🔗National Association of Realtors® reports that property owners have seen their wealth grow by an estimated 45% since 2019. Renters, on the other hand, have barely gained ground—many have even lost wealth as rising costs outpace savings. The American Dream of homeownership isn’t dead—it’s still the key driver of generational wealth. The real question is: how do you position yourself to get there?

📊 Why the Wealth Gap Keeps Widening

Experts agree: homeowners have been able to ride the wave of price appreciation, building equity and leveraging it to “move up” into bigger or more desirable homes.🔗 Hannah Jones, senior economic research analyst at Realtor.com®, explained, “Rapid price appreciation gave existing homeowners the opportunity to cash in on home equity…while renters were not able to take advantage of recent housing market dynamics in the same way.”

Even during times of high mortgage rates, homeownership offers advantages renters can’t access. Fixed monthly mortgage payments act as a hedge against inflation, while rents tend to rise year after year. Homeowners also benefit from appreciation, tax deductions, and equity-building with every payment. Renters? Their money vanishes into their landlord’s pocket each month.

📰 Don’t Let Misinformation Keep You on the Sidelines

Too often, people listen to headlines or family members and decide that buying a home just isn’t possible. Maybe it’s the news saying interest rates are “too high,” or Uncle Frank insisting you need 20% down. The problem is, that information is usually outdated—or just plain wrong.

That kind of advice keeps renters stuck on the sidelines when they could be preparing to buy. The truth is, there are low down payment programs, down payment assistance options, and strategies that make homeownership possible for far more people than the media would have you believe. The key is talking to a professional who understands the current market and your unique financial picture, not relying on one-size-fits-all soundbites.

🔗Get more details on our previous blog post.

🔨 The Three-Legged Stool of Approval

So, how do you move from renting to owning? Mortgage approval rests on three sturdy legs: income and employment, credit, and funds for closing. If one is weak, the stool wobbles. Lenders want to see stable income, a history of responsible credit use, and properly seasoned funds for your down payment and closing costs.

When all three are strong, your approval—and your path to ownership—stands firm. For a deeper dive into what each of these legs really means, check out our previous blog post on what every homeowner needs to know before getting ready to buy a home.

💵 Cash Needed: What It Really Takes

The biggest question renters ask me is, “How much money do I need to buy a home?” Here’s a simple formula: plan for 3–3.5% of the purchase price for your down payment, plus another $10,000–$15,000 for closing costs like title fees, appraisal, and escrow.

For example, if you’re buying a $400,000 home, your down payment at 3.5% would be about $14,000. Add in closing costs, and you’ll need about $25,000–$30,000 in total. Some of this can be offset with down payment assistance programs or seller concessions (where the seller covers part of your closing costs). Each program comes with pros and cons, which is why it’s critical to find the right fit for your financial situation.

🔮 What the Future Holds for Renters

Research shows most people rent out of necessity, not preference. 🔗The Federal Reserve Bank of New York recently reported that 70% of renters would prefer to own a home, while fewer than 15% say they prefer renting. The desire is there—it’s the affordability that’s the challenge.

Until buyers are ready to make the leap, renters can still boost their wealth by contributing to retirement accounts, investing in stocks, or building savings. But the reality remains: nothing builds wealth for everyday Americans quite like owning a home.

✨ The Bottom Line

Homeownership isn’t just about having a place to live—it’s about building a foundation for long-term financial security. Even with high prices and interest rates, the wealth gap between renters and homeowners keeps growing. Don’t let headlines or family advice keep you out of the game. The sooner you start preparing, the sooner you can get on the side of the equation where equity, appreciation, and stability are working in your favor.

If you’re tired of building your landlord’s wealth, let’s talk. I’ll help you put together a plan—reviewing your income, credit, and cash-to-close—to get you on the path to homeownership. Don’t wait for the gap to widen even further.