🌽 USDA Loans

Affordable Homes Without the Down Payment

Buying a home with no money down might sound too good to be true, but there are programs out there that make it possible. In fact, I covered a few of them in a previous blog—🔗 check it out here if you’d like to compare other 0% down payment options. Today, let’s shine the spotlight on one of the best-kept secrets in lending: the USDA loan.

🕰️ A Little History

The USDA loan program was created in 1991 by the U.S. Department of Agriculture as part of its Rural Development initiative. Its purpose was simple but powerful: help families strengthen rural and suburban communities by making homeownership more accessible. More than 30 years later, it’s still one of the only true zero down payment programs available.

💡 Why USDA Loans Matter

At its core, the USDA loan is about opportunity. It gives families in qualifying areas the chance to buy a home without the heavy burden of a down payment. Interest rates are competitive, and the monthly mortgage insurance is lower than FHA’s, which keeps overall payments more affordable. For first-time buyers—or anyone who thought they needed years of saving before they could buy—this program can be a real game-changer.

📋 USDA Loan Guidelines

Location: Home must be in a USDA-eligible rural or suburban area.

Income: Household income ≤ 115% of the area’s median income.

Credit: 640+ preferred, though exceptions exist with extra documentation.

Occupancy: Primary residences only—no vacation or investment homes.

💰 What About the Costs?

While you won’t need a down payment, USDA loans do include a couple of built-in fees. The upfront guarantee fee is 1% of the loan amount, but you can roll it right into the loan so it doesn’t hit your wallet at closing. There’s also a small annual fee of 0.35%, which is added into your monthly payment. Outside of that, you’ll see the usual closing costs—things like appraisal, title, and lender fees. The good news? Sellers can sometimes cover part of those costs, making the deal even sweeter.

⚖️ Pros, Cons, and the Mama Bear Truth 🐼

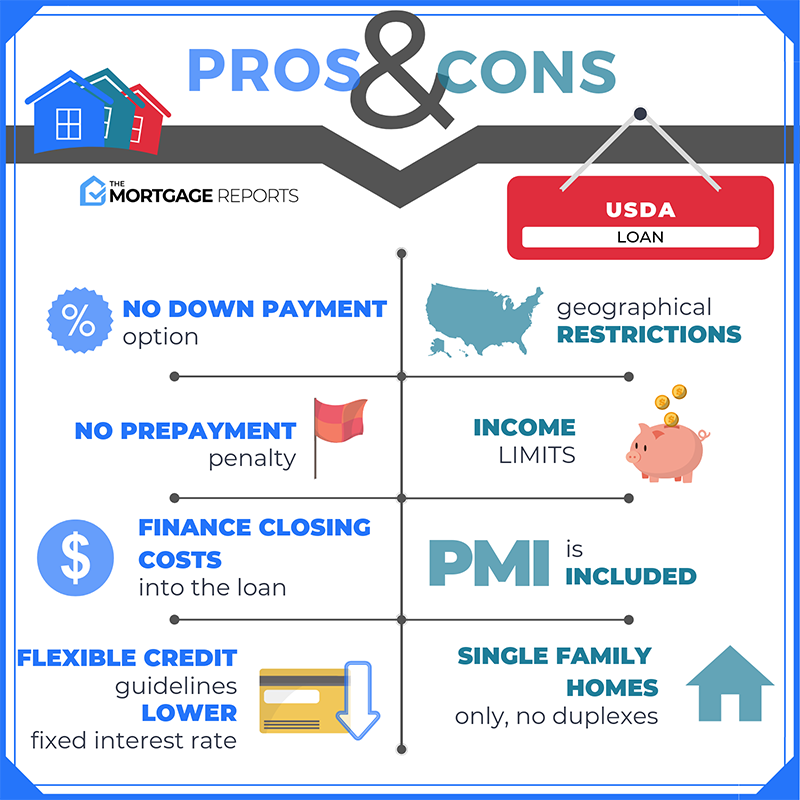

The biggest pro is obvious: no down payment required. That alone makes USDA loans one of the most powerful tools in home financing. Add in lower mortgage insurance and competitive rates, and the benefits are clear.

The downsides? You’ll need to fall in love with a home that’s in a USDA-approved area, and income caps could keep some households from qualifying. The guarantee fees do add to the cost, but even then, they’re lower than what FHA buyers typically face.

At the end of the day, USDA loans are about creating opportunity. If you’re open to rural or suburban living, this program can help you plant roots and own a home without draining your savings.

📌Ready for the Next Step?

Curious if a USDA loan could work for you? Let’s check your eligibility, run the numbers, and see if this program can unlock the door to your next home. DM me today—I’d love to guide you through it. 🏡