Make Homeownership More Affordable with a Temporary Buydown Strategy

With mortgage rates hovering in the high 6s to low 7s, affordability remains a top concern for homebuyers—and a top challenge for sellers trying to stand out. While we wait for the Fed to lower rates, now is the perfect time to explore creative financing strategies that benefit both buyers and sellers.

One of the most effective tools I recommend? The Temporary Buydown.

What Is a Temporary Buydown—and How Is It Different?

Before we dive into the benefits, let’s clear up some common confusion.

The Buydown is not the same as a permanent buydown or an adjustable-rate mortgage (ARM).

Not a Permanent Buydown: A temporary buydown only reduces your rate for the first one or two years of the loan, instead of permanently. That means less upfront cost and short-term savings that help you ease into homeownership.

Not an ARM: Adjustable-rate mortgages fluctuate over time based on market changes. With a temporary buydown, your rate is locked—it’s just reduced at the beginning before stepping up to the full fixed rate. No surprises.

How Does a 2/1 or 1/0 Buydown Work?

With a 2/1 Buydown, your interest rate is reduced by:

2% in the first year

1% in the second year

Then it adjusts to your locked-in fixed rate in year three and remains there.

We also offer 1/0 Buydowns, which reduce your rate by 1% for the first year only before adjusting to the permanent rate.

Both options are designed to create affordability up front while providing long-term stability.

Benefits for Homebuyers

If you’re a buyer, a Temporary Buydown can make it easier to step into your new home—especially in today’s rate environment:

Lower Initial Monthly Payments: Start with manageable payments while you settle in and get comfortable financially.

Extra Cash Flow: Free up your budget during the early years for moving costs, furniture, or emergency savings.

Built-In Flexibility: Planning to earn more in the near future or refinance when rates drop? A buydown gives you a softer runway.

Keep the Value If You Refinance or Sell: If you refinance or sell your home before the buydown period ends, any unused funds set aside for the reduced payments are applied directly to your principal balance. You don’t lose them—they help pay down your loan.

Benefits for Home Sellers

Sellers can use a buydown as a strong negotiation tool to attract more interest and help offers convert to contracts faster:

Appeal to Budget-Conscious Buyers: Lower payments can widen your buyer pool, making your listing more attractive.

Stand Out in a Competitive Market: Offering a buydown credit as an incentive can help your property shine without lowering the sales price.

Retain Home Value: Instead of dropping your list price, you can offer a buydown incentive that feels like a win-win for everyone.

What About Seller-Paid Buydowns and Concessions?

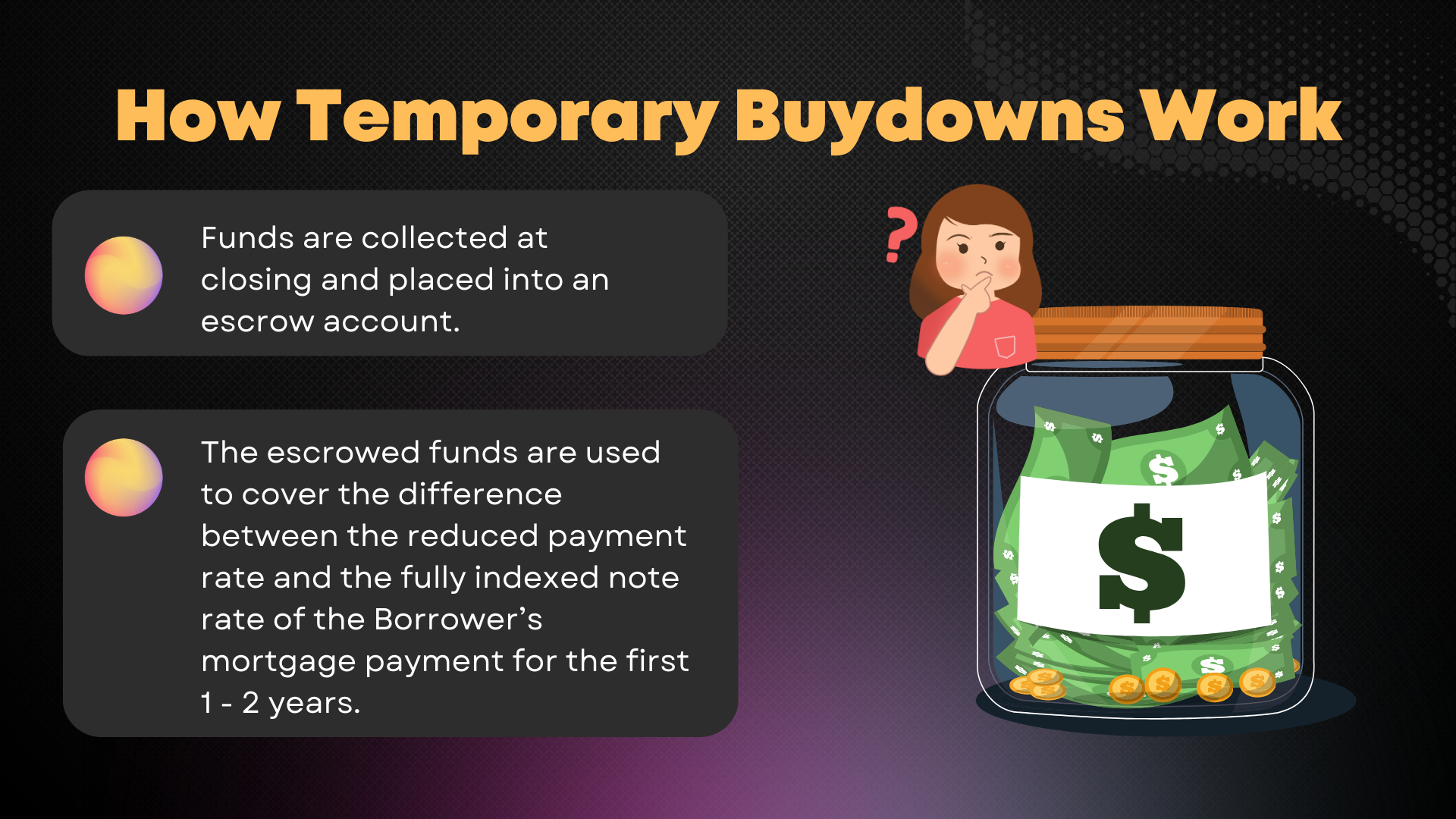

Buydowns are often funded through seller concessions—also known as Interested Party Contributions. These are funds from the seller (or sometimes the builder or lender) that help cover buyer closing costs, including buydown expenses.

There are limits to how much sellers can contribute, depending on the loan type and the buyer’s down payment.

I’ll help ensure we structure the offer to stay within these limits while maximizing the value of your buydown strategy.

How I Can Help You Use a Temporary Buydown Effectively

Whether you're a buyer or a seller, I'm here to make the process seamless:

Break It Down Simply: I’ll explain how 2/1 and 1/0 buydowns work, and when they make sense for your goals.

Custom Solutions: We’ll look at your budget, plans, and timeline to build a strategy that works for you.

Coordinate Seller Contributions: I’ll work with your agent to negotiate seller-paid credits where allowed—so you get the most value with the least stress.

Plan Ahead: We’ll build a game plan for what happens when your rate adjusts, including refinancing options or longer-term financial planning.

Ready to Explore a Smarter Path to Homeownership?

Temporary buydowns are a powerful way to reduce your payment stress today—without sacrificing long-term financial health. Whether you're buying or selling, let’s talk about how this strategy can help you win in today’s market.

📞 Contact me today to run the numbers and see if a 2/1 or 1/0 buydown could be the right fit for your home journey.