October 7, 2025

📉 Mortgage Rates Stay Calm Amid Data Drought

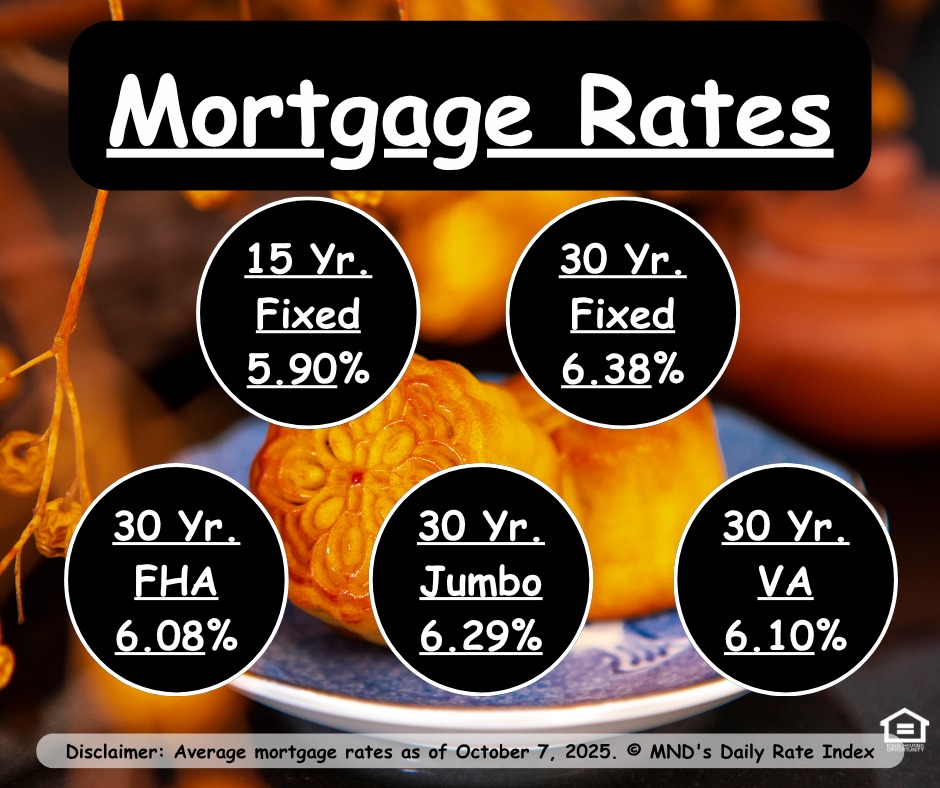

Mortgage rates have been cruising in a narrow lane for almost three weeks now—no major turns since September 17–18, when the Fed cut rates. The ironic twist? Mortgage rates actually went up right after the Fed lowered the Fed Funds Rate.

That’s because the Fed doesn’t pull the strings on mortgage rates as much as many think. The real influence comes from big-ticket economic data—especially the jobs report. In fact, the dip in early September (after a softer jobs report) was much stronger than the post-Fed bounce. That bounce, by the way, came from surprisingly upbeat data the following morning.

Now, with the government in shutdown mode, those juicy economic reports are on pause. That quiet stretch is keeping rates pinned in their narrow range. The only notable update came from the New York Fed, showing that consumers feel less confident about the job market—helping keep rates steady today instead of nudging higher.

💡 Takeaway: Rates are holding steady, but this calm may not last. Once major data returns, expect some movement—potentially fast.