Mortgage Rates Hit Multi-Week Lows

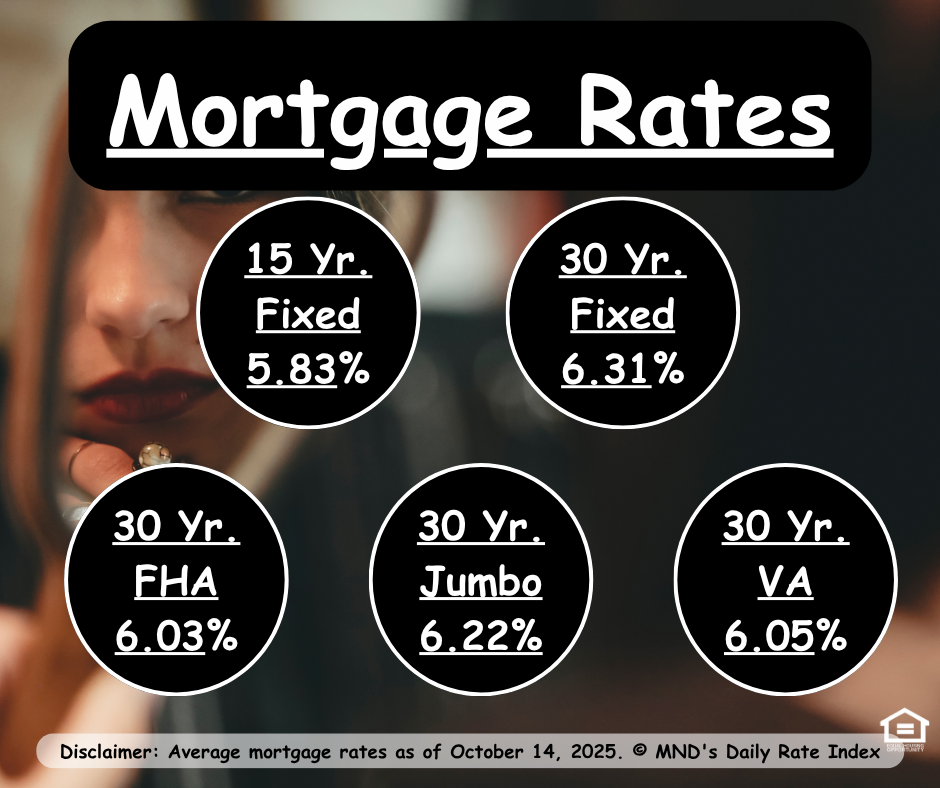

After weeks of hovering in a tight range, mortgage rates have finally dipped to their best levels since mid-September. Over the weekend, the bond market held steady, allowing lenders to offer slightly lower pricing on Monday. In fact, the average top-tier rate — for borrowers with excellent credit and strong down payments — is now sitting between 6.31% and 6.39%, according to 🔗Mortgage News Daily.

While that’s not a dramatic drop, it does mark a fresh multi-week low and could signal some calm before the next market storm. With the government shutdown quieting the usual flow of economic data, volatility has been muted. But once the shutdown ends, expect market movement to pick back up — especially with Fed Chair Powell’s comments still echoing in investors’ ears.

📅 What to Watch Next

Government shutdown resolution: expect data releases and market reactions to return

Fed commentary: Powell’s tone will guide rate expectations

Inflation data: the next CPI report could shift rate momentum

🐼 Mama Bear’s Take:

Right now, the rate market feels like a balloon being gently squeezed — not popping, but building pressure. A bit of patience could go a long way. If you’ve been waiting to lock, now’s a smart time to chat strategy with your lender before the next wave of data hits.