November 11, 2025

🏛️ Shutdown Drama & Market Reaction

This week’s rate movement is more about politics than policy. If enough members of the House return to D.C., the government shutdown could finally end — possibly within days. While some traders linked early bond market weakness to optimism about reopening, later recovery showed hesitation. The takeaway: markets want confirmation, not speculation.

Should the shutdown end soon, bonds could weaken (which tends to push rates up) since a prolonged closure is viewed as economically harmful. But until there’s an official resolution, the reaction remains limited.

💸 Rate Snapshot

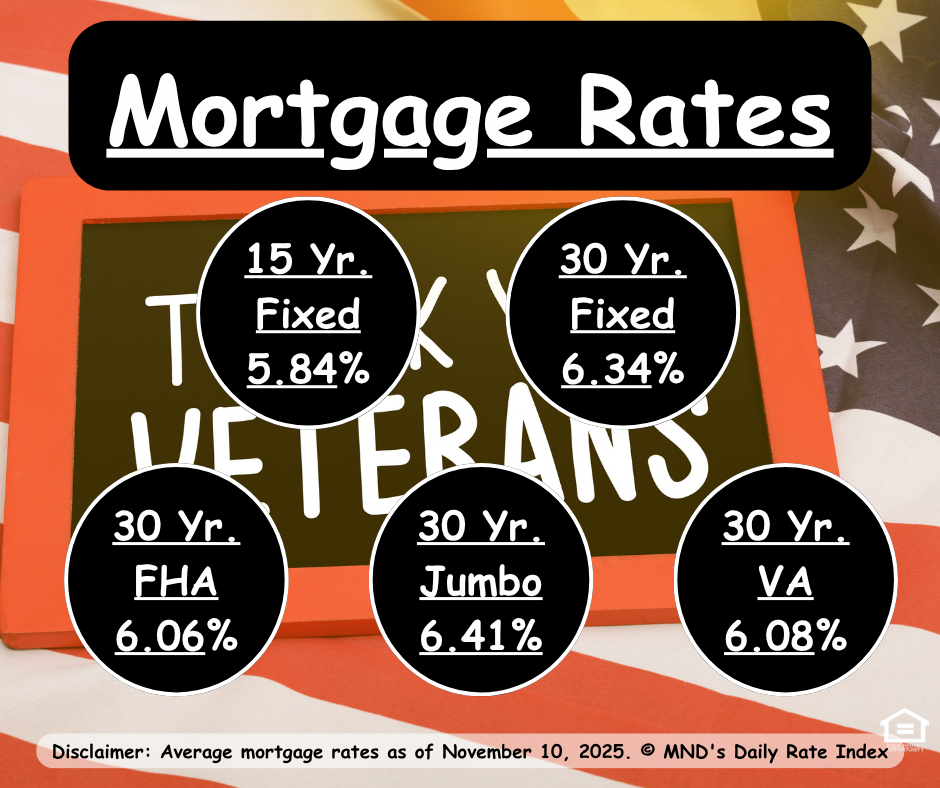

Mortgage rates entered the weekend on a slight cushion thanks to bond improvement Friday afternoon — just after most lenders had already priced for the day. That means rates could have been a hair lower if the bond gains had held through Monday. Unfortunately, overnight losses erased that advantage, nudging the average 30-year fixed rate up a modest 0.02%.

Despite the fluctuation, rates remain comfortably within a narrow 0.10% range that’s been steady since late October.

📅 What’s Next

With bond markets closed for Veterans Day, attention turns to midweek developments. A potential House vote on a shutdown deal Wednesday (or later this week) could spark rate movement depending on how markets interpret the outcome. If today’s trading offers any hint, a government “reopening” might apply upward pressure to rates — though some of that expectation may already be baked in.

💬 Next Steps

Thinking about locking your rate before potential volatility hits? Let’s chat and map out your best strategy.

📅 Schedule time on my calendar here.

Source: 🔗 MND