Your Essential Guide to 1031 Exchanges

A 1031 exchange allows an investor to sell one investment or business-use property and move the proceeds into another without triggering immediate capital gains taxes. It’s one of the strongest strategies available for long-term portfolio growth because it keeps your equity working instead of losing a chunk to the IRS.

Whether you’re upgrading into a higher-performing asset, diversifying your portfolio, or repositioning into a different market, a 1031 exchange opens the door to smart tax planning. Understanding the timelines, the professionals involved, and the more advanced structures—like reverse exchanges—helps make the process clear and manageable.

🧠 What a 1031 Exchange Really Is

A 1031 exchange (named after Section 1031 of the Internal Revenue Code) gives you the ability to sell an investment property and reinvest the profit into another like-kind investment while deferring capital gains taxes. The term “like-kind” is broader than many expect: rentals, multifamily, land, and even certain commercial assets can all be exchanged as long as they’re held for investment purposes.

Instead of paying taxes upfront, the investor gets to roll those dollars directly into the next asset. That means more cash flow potential, more appreciation opportunity, and more long-term compounding. It’s not a loophole—it’s an intentional tax strategy used by investors at every level.

⏳ Timelines: The Rules Everyone Must Respect

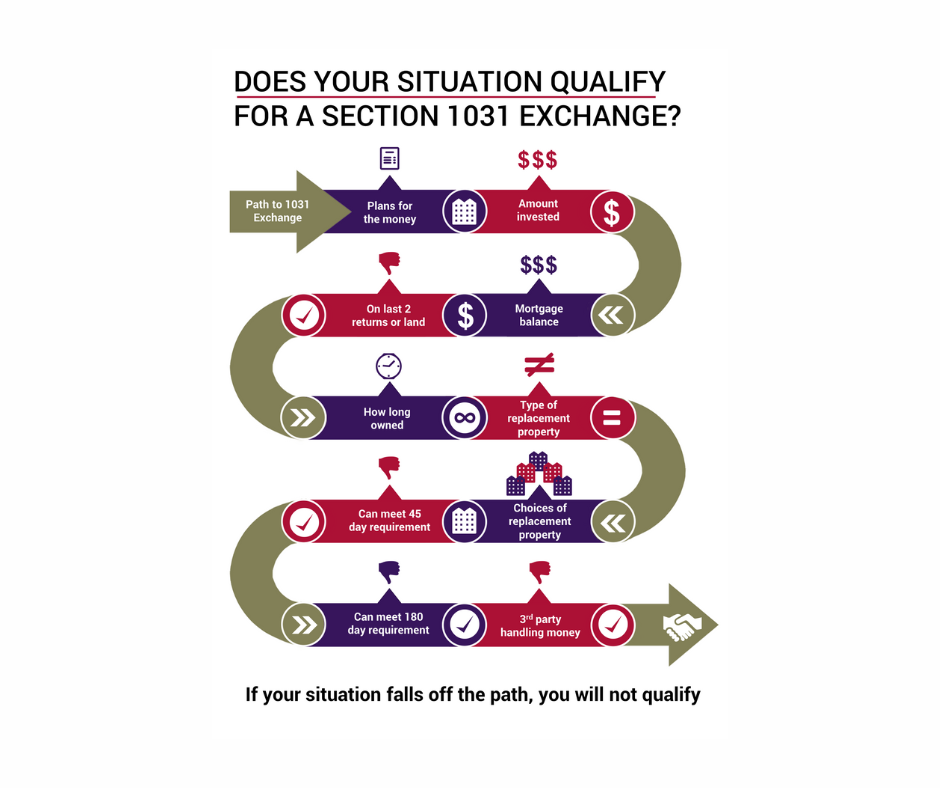

Once your investment property sells, the countdown begins. You have 45 days to identify your replacement property. This identification must be formally submitted to your Qualified Intermediary (QI) and cannot be changed after the deadline. The pressure is real—most investors feel this is the tightest part of the exchange.

From the date of sale, you also have 180 days total to complete the purchase of the replacement property. These 180 days include the 45-day identification period; they are not separate. The IRS takes these deadlines seriously, and there are no extensions for delays, lender hiccups, or unexpected repairs. When the clock runs out, it’s out.

🏘️ Determining What Qualifies for a 1031 Exchange

Not every property can be swapped in a 1031 exchange, and this is where investors sometimes get tripped up. The IRS has a clear framework for what does and does not qualify — and understanding these rules determines whether the exchange succeeds or fails.

At its core, a property must be held for investment or business use to qualify. That means rentals (short-term or long-term), multifamily properties, commercial buildings, raw land, storage facilities, and even certain leasehold interests can all be exchanged. The IRS uses the term “like-kind,” but it’s far more flexible than it sounds. You don’t have to trade a single-family rental for another single-family rental; you can sell vacant land and purchase a duplex, or sell a commercial unit and buy a short-term rental. As long as both properties are intended as investments, they generally qualify.

On the other hand, properties held primarily for personal use do not qualify. Primary residences and second homes can’t be used in a traditional 1031. Fix-and-flip properties are also excluded because they are considered inventory — not investments — unless the investor intends to hold them long-term as rentals.

What matters most is intent, and this is where documentation and consistency protect the investor. If the property is purchased, managed, and reported as an investment, it clearly meets the standard. When there’s ambiguity, your CPA, lender (hi, that’s me), and Navi Title’s QI team step in to review how the property was used and determine whether it meets IRS expectations.

With the right guidance, determining qualification becomes straightforward — and it sets the stage for a smooth, compliant exchange.

🤝 The Key Players and How They Keep Everything on Track

A 1031 exchange works best when every professional involved understands the choreography required to keep the process compliant. While most exchanges force investors to juggle multiple companies, our partners at Navi Title have built something unique: a true one-stop shop with an in-house Qualified Intermediary, an expert title/escrow team, and a hands-on marketing and education department that supports agents and investors from the very first conversation.

Navi Title’s internal QI handles the required documentation, tracks every deadline, safeguards proceeds so the investor never touches the funds, and answers the complex questions that inevitably come up along the way. Because the QI and escrow teams work together inside the same organization, communication stays clear, quick, and accurate.

Their title and escrow team, led by professionals like Liz Teixeira, ensures exchange language is inserted correctly into contracts and closing instructions, verifies vesting, coordinates with lenders, and keeps both sides of the transaction on track. With exchanges, even small errors can jeopardize eligibility — which is why I trust Liz with my clients’ most intricate deals.

Supporting all of this is Navi’s marketing and education team, led by Shannon Goldberg, who equips clients and real estate agents with worksheets, timelines, explainer tools, and step-by-step guidance. Shannon’s expertise helps investors understand each phase of the exchange so they feel confident from start to finish.

Beyond title, several other key players round out a successful exchange. The real estate agent helps locate eligible like-kind replacement properties, negotiate terms, and move quickly during the 45-day identification period. The CPA or tax advisor analyzes basis, depreciation recapture, boot, and tax implications to ensure the exchange truly benefits the investor. And then there’s the lender — me. I structure financing to align with the exchange timelines, coordinate closely with the QI and escrow team, and ensure vesting and documentation match IRS requirements.

When lending, tax strategy, title, and property search all work in sync — especially when major pieces live under one roof — the investor gets something rare with 1031 exchanges: clarity, efficiency, and peace of mind.

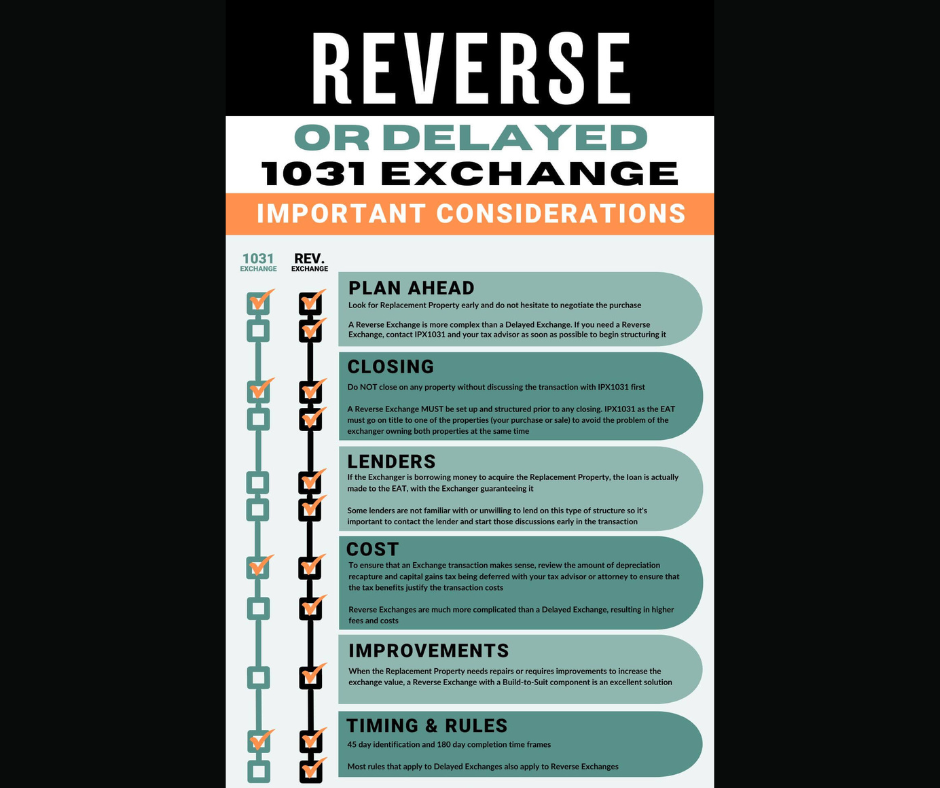

🔄 Reverse 1031 Exchanges: When You Need to Buy First

A reverse 1031 exchange flips the process: the investor buys the replacement property before selling the current one. This structure is especially useful in competitive markets or when a unique opportunity appears and timing becomes everything.

In a reverse exchange, an entity called an Exchange Accommodation Titleholder (EAT) temporarily holds the property because the investor cannot take direct ownership until the old property sells. The timelines are identical — 45 days to identify the property being sold and 180 days to complete the sale — but the execution is more complex. It requires precise coordination between the QI, lender, CPA, escrow officer, and agent.

Reverse exchanges give investors flexibility and security when the perfect replacement property appears before their current property is ready to list — but they absolutely require an experienced team.

🧰 Why Navi Title Is the Partner You Want on a 1031

A 1031 exchange is deadline-driven, documentation-heavy, and unforgiving of mistakes. Navi Title’s integrated 1031 exchange team brings clarity to the process, strong communication, and a level of expertise that protects the investor’s equity and timeline. Between their QI department, escrow experts like Liz, and educational support from Shannon, they deliver a level of coordination that is incredibly rare — and incredibly valuable.

📌 Quick Takeaway

1031 exchanges offer one of the strongest strategies for tax-deferred real estate growth. With defined timelines, coordinated professionals, and a trusted title partner like Navi Title, investors can use 1031 exchanges to strategically scale, reposition, or diversify their portfolios.

📣 I’m Here To Help!

Thinking about selling an investment property or exploring whether a 1031 exchange fits your long-term goals? Reach out to me. I’ll walk you through your options, connect you with the right partners, and help you structure a strategy that protects your equity and strengthens your portfolio. Let’s make your next move your smartest one yet.