⏰Why Waiting to Buy Can Cost More Than You Think

A lot of buyers today feel torn—rates bounce around, headlines change daily, and “waiting just a little longer” feels safe. ⏳ But when you zoom out, the long-term math tells a clearer story: waiting has a cost too.

📈 Why So Many Buyers Feel Stuck Right Now

Between shifting rates and dramatic headlines, plenty of buyers feel emotionally pulled in two directions:

“Should I buy now… or wait and hope things feel better later?”

Honestly? That feeling is valid. Nobody wants to make a major financial decision without confidence.

But here’s the piece that often gets overlooked:

👉🏼Waiting has a cost too. Not in every situation and not for every buyer, but it’s rarely part of the conversation because so much attention goes to one question—

“Is now the perfect rate?”

Spoiler: Perfect rarely shows up on schedule.

💡 The Wealth First Approach: Clarity > Noise

Instead of banking everything on today's rate, Wealth First shifts you to a wider, calmer perspective:

Timing matters.

Equity builds quietly in the background.

Affordability is shaped by price and rate—not rate alone.

Long-term outcomes beat short-term stress.

When you see how these pieces connect, the decision becomes less emotional and a whole lot clearer. You’re no longer guessing. You’re choosing.

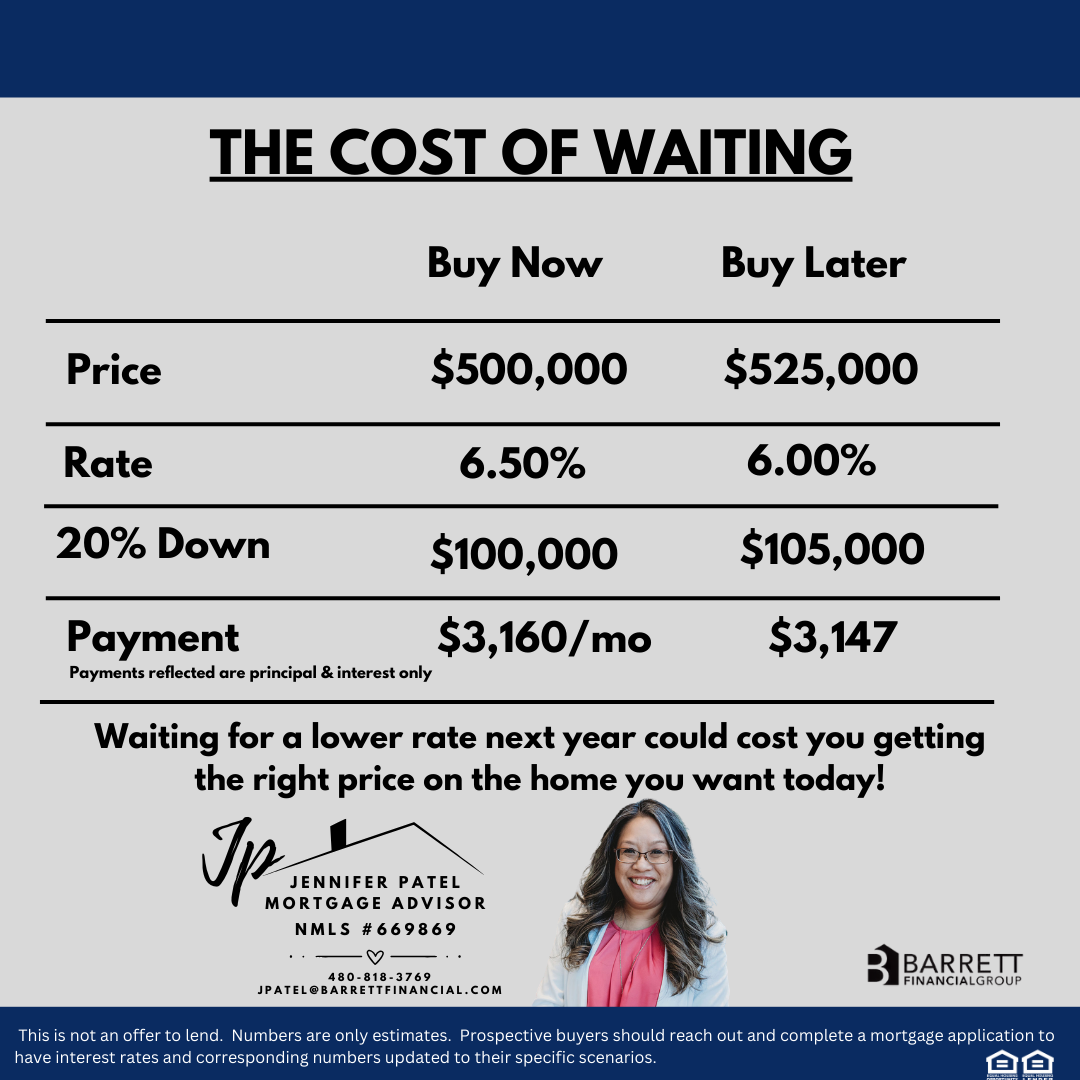

📊 A Simple Example of “The Cost of Waiting”

Let’s use a clean, hypothetical example—no predictions, no pressure, no magic 8-ball answers.

Assume a home priced at $500,000, using a historical 5% appreciation trend.

If someone buys now:

Purchase price: $500,000

If the home followed a typical 5% trend, in one year it could be worth ~$525,000

Each payment includes a slice of principal—slow, steady equity building month after month

If they wait one year:

The same home, following the same historical trend, might now cost ~$525,000

Monthly payments could be a tiny bit lower from interest-rate changes, but is the savings worth the additional funds?

You’ve missed one year of equity growth

Again—this doesn’t mean everyone should run out and buy today.

👉🏼Some people should wait. Some need time. Some have other goals.

The point of Wealth First is not to rush you.

⏰It’s to help you see the math clearly so you can make a confident, intentional decision.

🧭 Understanding Time, Price & Equity Changes Everything

When you realize how these three elements work together:

Time creates opportunity

Price movement shapes affordability

Equity quietly builds wealth

… the anxiety starts to fade.

Suddenly you’re not reacting to headlines—you’re responding to your own strategy.

Clarity replaces fear.

✅Confidence replaces hesitation.

✅You’re in control, not the news cycle.

🧠 Final Thoughts: Choose Strategy, Not Stress

The real question isn’t, “Is this the perfect moment?”

It’s, “What’s the best decision for my long-term financial picture?”

If you want to see this comparison using your numbers—your budget, your price range, your timeline—I can put together a simple side-by-side breakdown.

🎯No pressure. No commitment.

🎯Just clarity.

🔗Click Here to view my calendar. Let’s set up a time to chat about your goals. Your future self will be thankful.