💳What Counts as Debt?

Now with BNPL (Buy Now - Pay Later) in the Mix

When lenders assess your application, they calculate your Debt-to-Income (DTI) ratio — comparing what you owe monthly against your gross income to ensure you're not stretched too thin.

✅ Debts That Count Toward Your DTI:

Credit cards (minimum monthly payments)

Auto loans & leases

Student loans (actual payment or IDR-calculated amount)

Personal loans and store financing

Other mortgages/HELOCs

Court‑ordered child support & alimony

Installment plans (e.g., furniture or medical financing)

🔗Buy Now, Pay Later plans — increasingly treated like installment debt and potentially included if evidenced by payments or statements

🚫 Debts That Don’t (Typically) Count:

Utilities, cell phones, streaming services

Insurance not escrowed

Groceries, gas, memberships (unless financed)

💰BNPL: How It's Changing the Mortgage Game

What it is:

Buy Now, Pay Later lets you split a purchase into smaller, interest-free (or low-interest) payments over a set period. Think Klarna, Afterpay, Affirm, and PayPal Pay in 4. It feels harmless — but it’s still debt, even if it’s short-term.

Why it matters now:

Credit Reporting Changes – FICO will start factoring BNPL into its new 10 and 10T credit scoring models later in 2025. If you’re a responsible user, it could help; if you’re juggling multiple BNPL accounts or missing payments, it could hurt your score. 🔗 Washington Post

Potential FHA Rule Updates – HUD issued a Request for Information in June 2025 on BNPL’s impact on FHA borrowers, hinting future guidelines could require factoring these payments into DTI. 🔗 Federal Register

Regulatory Concerns – The CFPB warns BNPL can create “phantom debt” — obligations not visible on a credit report but real enough to affect affordability.

Not Always Reported… Yet – Some BNPL providers still choose not to report activity to bureaus, but that’s changing fast.

💡 Bottom line: Even if BNPL doesn’t appear on your credit report today, lenders may still ask about it — and soon, it could directly affect whether you qualify.

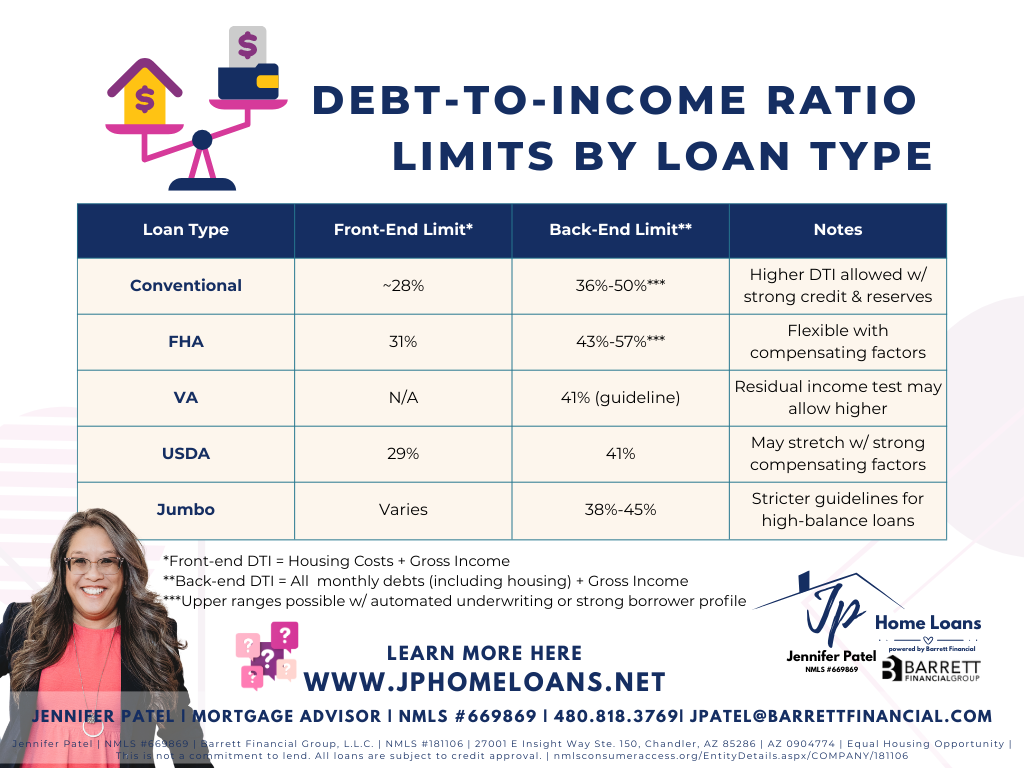

📊 Debt-to-Income Ratio Limits by Loan Type

💡Takeaway Tip

Yes, BNPL may feel like a harmless swipe—but soon, your lender might be keeping score on that "Slice It Now, Pay Later" too. Just like house hunting, transparency is your best mortgage strategy. Track your BNPL commitments, consider minimizing them when applying, and keep an eye on how they're being reported—or not.

💬 Thinking about buying a home? Let’s run your numbers — DTI, BNPL, and everything in between — so you know exactly where you stand before you start house hunting.

📩 DM me today and let’s build your game plan.