Buy a 4plex with Just 5% Down? Yes, Really.

There’s a little-known opportunity that could completely change how you think about homeownership: Fannie Mae allows 5% down payments on 2–4 unit owner-occupied properties. Yep, you can buy a duplex, triplex, or fourplex—live in one unit and rent out the rest—while putting way less down than traditional investment loans

This isn’t some gimmick. It’s conventional financing, with comparable interest rates to FHA, cancelable mortgage insurance, and the ability to use projected rental income to help you qualify. For buyers looking to house hack, support multigenerational families, or invest smartly, this often-overlooked loan program is worth a serious look.

💡 Why It Matters

Historically, conventional loans for multi-unit properties required 15–25% down—out of reach for many first-time buyers. But with this Fannie Mae guideline, you can now bring just 5% to the table while still tapping into the benefits of conventional financing.

And get this: You can use market rent estimates from the appraisal to help you qualify, even if you've never been a landlord before. Conventional also means no upfront mortgage insurance, and your monthly PMI can go away once you’ve built 20% equity.

💡Real‑Life Examples

Erica the Nurse (Mesa, AZ):

She bought a triplex for $475K. With 5% down ($23,750), she lives in one unit and rents the others for $1,600 and $1,550. Her total mortgage is around $3,700/month—but rent from tenants covers most of it. Erica’s now paying about $550/month to live in her own property, while building equity every single month.

The Garcias 👨👩👧👦 (Glendale, AZ):

Their growing multigenerational family needed space—without skyrocketing housing costs. They bought a fourplex. Mom and Dad live in one unit, Grandma and the kids each have their own. The rental income helps ease the monthly payment, and everyone gets a bit more breathing room.

Trevor the House Hacker (Tucson, AZ):

Trevor snagged a duplex with 5% down. He lives in one side and is fixing up the other to rent at a premium. Once it's leased, he’ll use that income to qualify for his next purchase. He’s building a real estate portfolio—starting with a primary residence and this clever loan strategy.

📝 Program Highlights

5% down for 2–4 unit primary residences

Conventional loan = comparable rates to FHA

No upfront mortgage insurance

Monthly PMI is removable at 20% equity

Projected rental income allowed for qualifying

Great fit for first-time buyers, multi-gen families, and house hackers

Requires 6 months of reserves, but gift funds can help

Subject to conforming loan limits (varies by county)

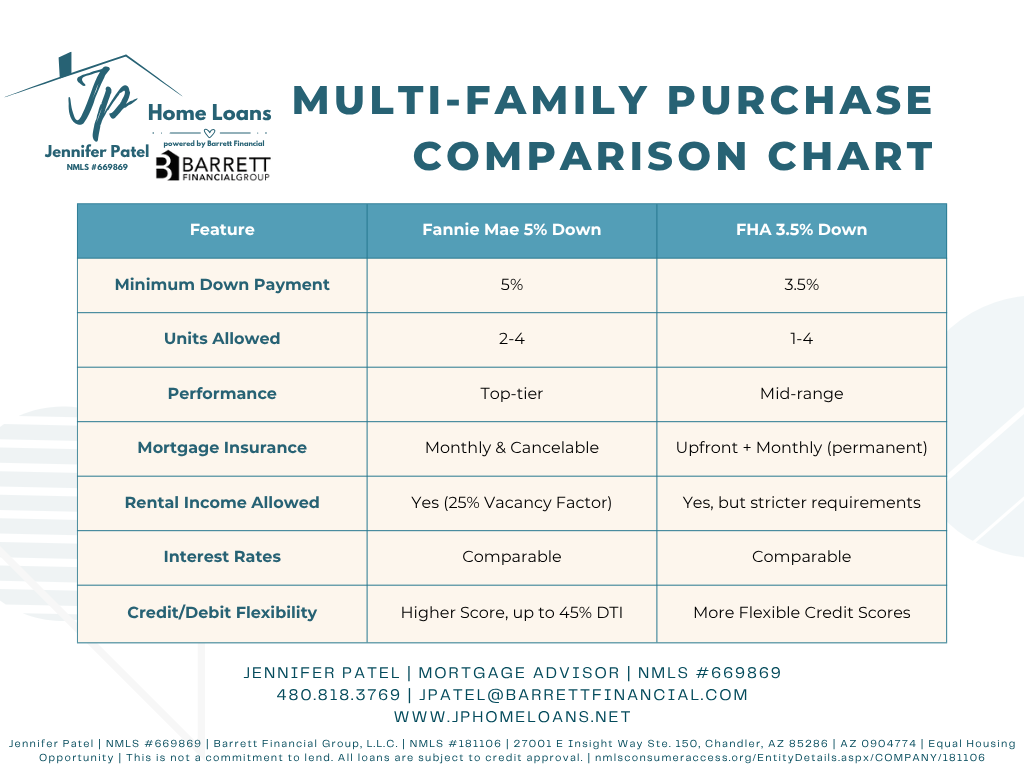

🆚 How It Compares to FHA

While FHA loans are known for their low 3.5% down payments and flexible credit requirements, they come with permanent mortgage insurance and more restrictive rental income rules—especially for 3–4 unit properties. Fannie Mae’s 5% down option gives buyers the ability to remove PMI once equity is reached, use market rents to qualify, and avoid the upfront mortgage insurance premium that FHA requires. Interest rates are generally comparable, and although Fannie Mae requires a slightly higher credit profile and more reserves, the long-term flexibility makes it an appealing option for buyers who plan to stay and grow.

🐼 Mama Bear’s Take

You don’t need to be a millionaire or seasoned investor to make a power move in real estate. This little-known loan option is how smart buyers make their money work harder. Whether you’re looking for affordability, flexibility, or a path to long-term wealth, this program is worth exploring.

Let me help you run the numbers and see if this fits your plan—I’ll guide you every step of the way.