How Much Cash Do You Really Need to Buy a Home?

One of the first questions buyers ask is, “How much cash do I actually need to buy a home?” The short answer: more than just the down payment—but not as much mystery as it sometimes feels like. Cash to close is simply the total amount a buyer brings to the closing table, and it’s made up of a few clearly defined pieces.

Once you understand what those pieces are—and why some of them change while others stay fairly predictable—it becomes much easier to plan, save, and move forward with confidence. Let’s break it down.

💰 What Is “Cash to Close”?

Cash to close is the total amount of money a buyer needs to bring to closing in order to complete the purchase.

It typically includes:

Down payment

Closing costs

Earnest money (already paid and credited back)

This is the number that matters most when you’re planning and saving for a home purchase.

🏠 Down Payment: Your Equity Contribution

The down payment is the portion of the purchase price you pay upfront.

Goes directly toward buying the home

Reduces the loan amount

Builds immediate equity

Down payment requirements vary by loan program—some allow as little as 3%–3.5%, while others require more depending on goals and qualifications.

🧾 Closing Costs: The Cost of the Transaction

Closing costs are the fees required to complete the mortgage and legally transfer ownership. They generally run:

👉 2%–5% of the loan amount

For many buyers, that percentage often translates to roughly $10,000–$15,000, depending on the situation.

What makes closing costs move up or down?

Closing costs aren’t fixed. They can vary based on:

Discount points (optional fees paid to lower the interest rate)

Property taxes and timing of closing

Homeowners insurance premiums

HOA dues and required prepayments

Loan type and purchase price

Even with these variables, planning for $10K–$15K on top of your down payment is a solid rule of thumb when preparing to buy.

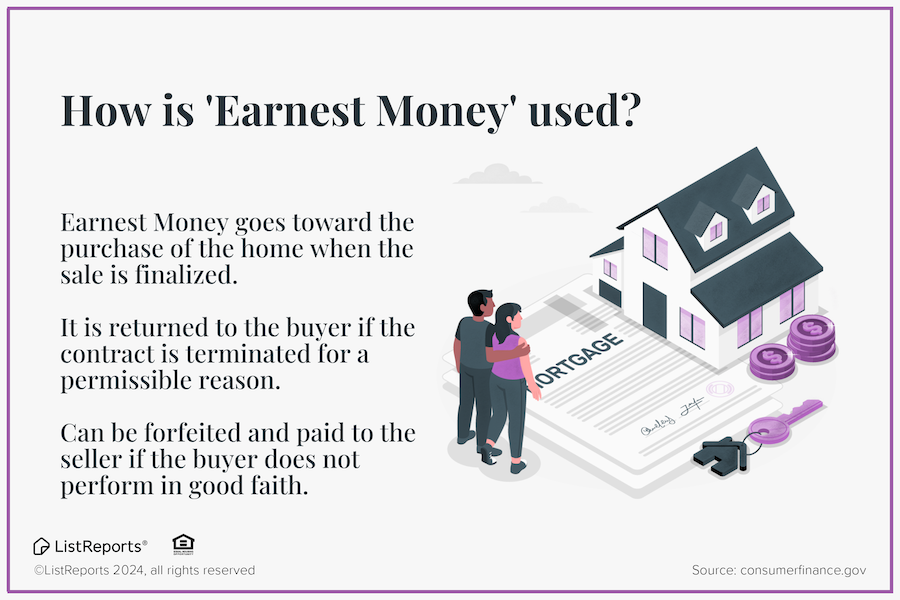

📝 Earnest Money: Showing Good Faith

Earnest money is a good-faith deposit submitted with your offer to show the seller you’re serious.

Typically 1%–3% of the purchase price

Paid shortly after offer acceptance

Held by escrow or title

How it’s applied

Earnest money is credited back to the buyer at closing and applied toward:

The down payment, or

Total cash to close

It’s not an extra fee—it’s part of the cash you were already planning to bring.

🧮 Cash-to-Close Examples (Putting It All Together)

These examples assume:

Estimated closing costs: ~$12,500

Earnest money: 1% of purchase price

🏡 Example 1: $400,000 Purchase | 3.5% Down

Down Payment: $14,000

Estimated Closing Costs: ~$12,500

Total Cash to Close: ~$26,500

If $4,000 was already paid as earnest money, remaining cash due at closing would be:

👉 ~$22,500

🏡 Example 2: $400,000 Purchase | 20% Down

Down Payment: $80,000

Estimated Closing Costs: ~$12,500

Total Cash to Close: ~$92,500

With $4,000 already submitted as earnest money:

👉 ~$88,500 due at closing

This is not an offer to lend. Numbers are only estimates. Prospective buyers should reach out and complete a mortgage application to have interest rates and corresponding numbers updated to their specific scenarios.

🐼 The Mama Bear Takeaway

Cash to close isn’t a mystery—it’s a math problem with clear parts:

Down payment builds equity

Closing costs complete the transaction

Earnest money strengthens your offer and gets credited back

When you plan for all three, the process feels far less intimidating and far more achievable.

👉🏼Want help estimating your cash to close—or seeing how different loan options and seller concessions could change the numbers? DM me or 🔗schedule a time to chat with me. Let’s run the numbers together so you can plan with confidence.