Construction Loans 101

Building From the Ground Up

Construction loans are designed for buyers who want to build rather than buy an existing home. Instead of receiving all funds upfront, money is released in stages as construction progresses—keeping the project moving while adding structure and oversight.

While these loans involve more documentation and planning than a traditional mortgage, they offer flexibility, customization, and—in some cases—low or even zero down payment options. Understanding the different types of construction loans, including VA programs, can open doors many buyers don’t realize exist.

🏗️ What Is a Construction Loan?

A construction loan is a short-term, typically higher-interest loan designed to finance the building of a new home from the ground up. Instead of giving you all the money at once, the lender pays your contractor directly in stages, called draws, as construction milestones are completed.

Once the home is finished, the loan is either converted into a permanent mortgage or paid off with a separate loan—depending on the type of construction financing you choose.

🧱 What Do Construction Loans Cover?

Construction loans are designed to cover the actual cost of building, not the design phase or unrelated expenses. Depending on the loan structure, they may cover:

Land purchase

Contractor labor

Construction materials

Plans, permits, and fees

Contingency reserves

Closing costs

Interest reserves (in some cases)

Design costs—like hiring an architect—are typically paid out of pocket before the loan begins. Your plans, budget, and builder contract must already be in place to apply.

💸 Construction Loan Rates (What to Expect)

Construction loan rates are generally higher than standard mortgage rates—often around 1% higher. These loans usually have variable rates, meaning they can fluctuate during construction.

Your credit profile, loan amount, and loan type all influence pricing. The good news? You only pay interest on the funds that have actually been drawn—not the full loan amount.

🔧 How Construction Loans Work

Construction loans involve more lender oversight than traditional mortgages. Before approval, lenders review your plans, timeline, and budget to determine loan eligibility.

After closing:

Funds are released in draws (usually 5–7 total)

Each draw corresponds to completed construction phases

Inspections occur before additional funds are released

During construction, most borrowers make interest-only payments. Some loans include interest reserves, where estimated interest is built into the loan—meaning no payments are required during the build phase.

Once construction is complete, the loan either converts to a permanent mortgage or is paid off and replaced with one.

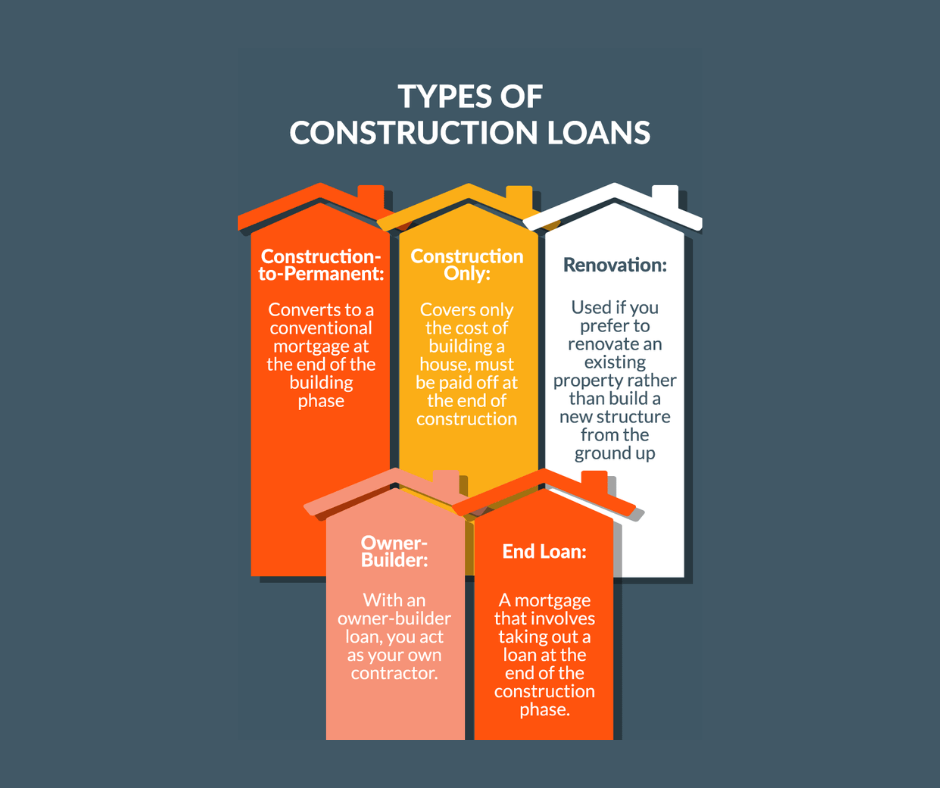

🧱 Types of Construction Loans

Not all construction loans work the same. Here are the most common options:

🏡 Construction-to-Permanent (One-Time Close)

One loan, one closing

Converts automatically to a 15- or 30-year mortgage

Avoids market risk during construction

Available for conventional, FHA, and VA loans

🏡 Construction-Only (Two-Time Close)

Covers construction only

Must be paid off or refinanced once the home is complete

Two closings and potentially higher total costs

🛠️ Renovation Construction Loans

Used for major renovations or rebuilds

Loan amount based on the future value of the home

FHA 203(k) is a common example

📋 What Do You Need to Qualify?

While requirements vary, most construction loans expect:

Credit score around 680+

Solid debt-to-income ratio (generally ≤45%)

Detailed plans, specs, and construction timeline

Licensed, vetted builder

Down payment typically 20–30% (VA loans may allow less)

The more detail you provide upfront, the smoother the process tends to be.

🤔 Is a Construction Loan Right for You?

You don’t always need a construction loan for a new home. Builder communities often require only a deposit and a standard mortgage once the home is complete.

A construction loan may make sense if:

You want full design flexibility

You prefer more land or fewer HOA restrictions

You plan to add future structures (guest house, workshop, etc.)

You want a home tailored to your lifestyle—not a template

🐼Mama Bear’s Takeaway

Construction loans aren’t complicated—they’re just intentional. 🏗️ With the right planning, builder, and loan structure, building a home can be a smart alternative to settling for “almost perfect.”

If you’re thinking about building, the best time to talk is before the land purchase and blueprints—not after.

👉🏼 Hit me up…let’s chat to see if this is right for you.