September 2, 2025

Bonds & Rates: Month-End Mischief

Bonds started the new month weaker, with most of the selling after Europe opened. U.S. Treasuries followed EU bonds lower—common when nothing stronger drives the market. Some headlines blamed Trump tariff rulings, but that news was out Friday night, so the timing doesn’t add up.

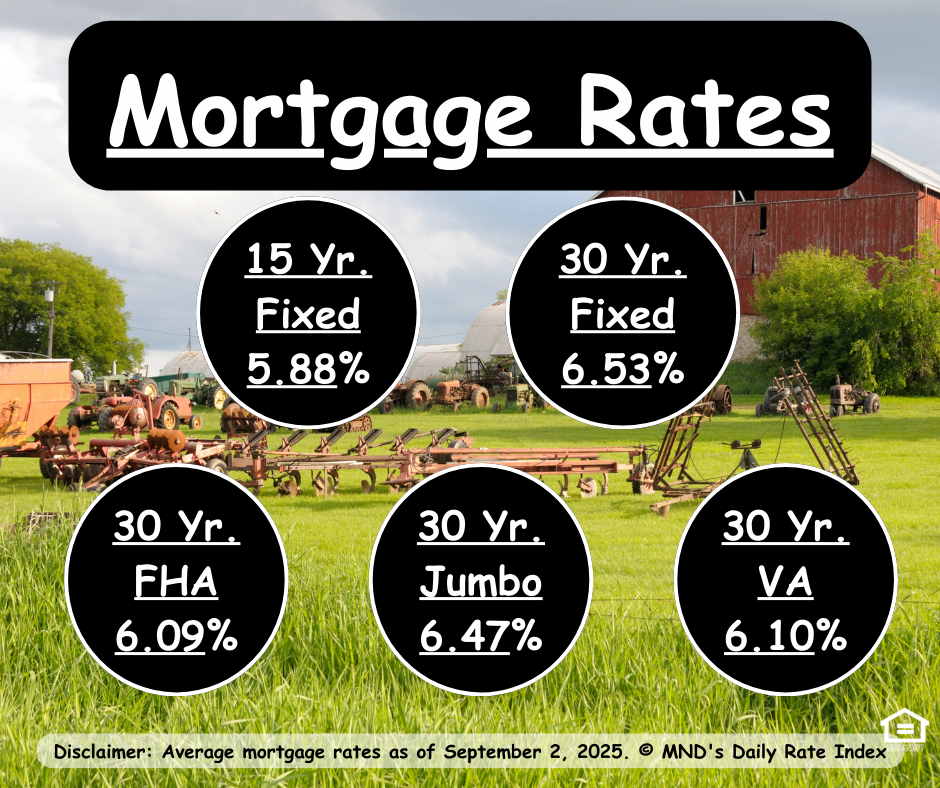

Mortgage rates ride these bond swings, and the first/last trading days of a month often bring quirky moves. Traders shuffle positions, and volatility shows up without the usual economic data triggers.

👉 The good news: the damage was tiny. Average 30-year fixed rates only ticked up by 0.03%, leaving lenders right around the lowest levels since October 2024.

✅ Bottom line: today’s bump was more “month-end noise” than a trend shift. The real action comes with this week’s economic reports.

📊 Looking Ahead:

This week brings the heavy hitters—jobs data, ISM reports, and Fed speakers. Any surprises there could push rates meaningfully higher or lower, unlike today’s background volatility.