🏠Job Growth Stalls and Rate Cut Hopes Rise

The July jobs report landed with a thud—just 73,000 jobs were added, making it the weakest monthly gain since the early pandemic days. Forecasters were expecting much more, and this miss has the markets on edge.

Meanwhile, May and June’s numbers were revised downward by 258,000, the largest such drop outside the COVID era. That revision prompted President Trump to fire the head of the Bureau of Labor Statistics, a move that’s stirred political and economic backlash alike.

🧨 Political Fallout at the BLS

President Trump abruptly fired BLS Commissioner Erika McEntarfer, accusing her of releasing "rigged" data. Economists and former officials pushed back hard, noting data revisions are standard and necessary. Critics say the firing threatens the independence of federal statistical agencies.

📉 Market Impact: Yields and Mortgage Rates Fall

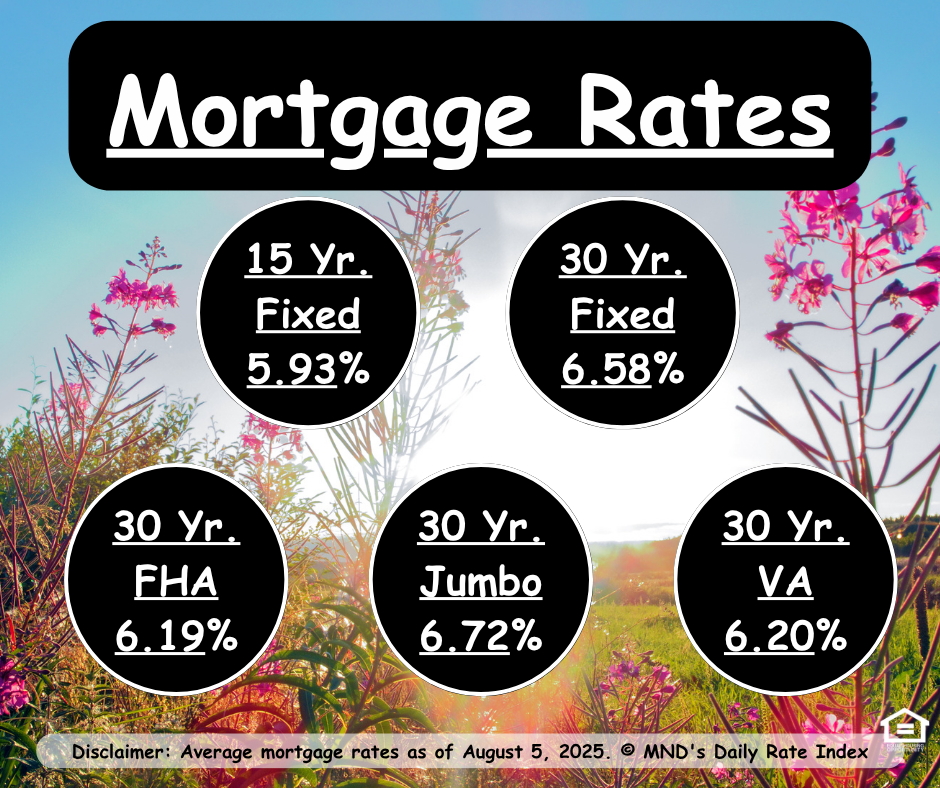

The disappointing report sent 10-year Treasury yields plunging to around 4.26%, dragging mortgage rates lower in the process. Wall Street swiftly recalibrated expectations, with many now betting on a half-point Fed rate cut in September.

But not everyone’s convinced. Morgan Stanley and Bank of America are urging caution, pointing to steady unemployment and ongoing consumer strength as reasons for the Fed to hold.

🏠 What This Means for Housing

Buyers May Re-Enter: Lower mortgage rates could boost affordability—at least in the short term.

Uncertainty Lingers: If more weak jobs data rolls in, we may see deeper rate cuts ahead. If not, the Fed may stay the course.

Eyes on August: The next jobs report and CPI reading will be crucial in shaping the Fed’s next move.

🐼 Let’s Chat

Mortgage rates are sliding—but for how long? If you are wondering is now to time to move, let’s talk strategy before the market shifts again.