🗺️ Why Mortgage Rates Vary by State

📊 What Goes Into a Mortgage Rate?

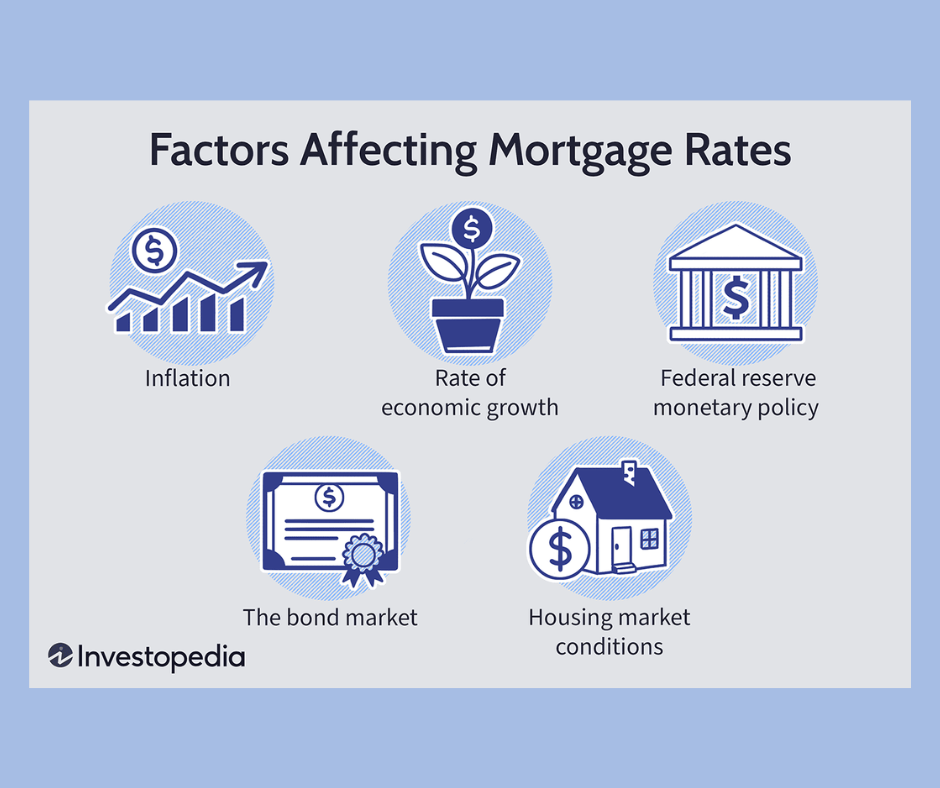

While national headlines talk about “average” mortgage rates, what you get depends on a mix of economic indicators and borrower risk. Here’s what drives rates:

Benchmark rates: Most lenders track the 10-year Treasury yield as a base.

Credit score & debt-to-income ratio: The better your profile, the better your rate.

Loan terms & type: FHA, VA, jumbo, and conventional all price differently.

Lender margins: Individual lenders add in their own profit margins, overhead, and risk buffer.

Market demand: Mortgage-backed security investors help steer daily rate shifts.

These factors explain why two buyers in the same week—but different zip codes—may see different offers for the same type of loan.

🌎 Why Do Rates Vary by State?

Today’s 🔗 Investopedia’s Zillow data shows:

Lowest averages (≈ 6.69% – 6.85%)

States like New York, California, New Jersey, North Carolina, Minnesota, Pennsylvania

Highest averages (≈ 6.93% – 7.00%)

West Virginia, Alaska, Washington D.C., Wyoming, Kansas, Mississippi, Missouri, New Mexico, North Dakota, Oklahoma

These numbers shift daily, but the patterns remain surprisingly consistent.

🧭 The Key Drivers

🏛️ Foreclosure Laws – Judicial foreclosure states (where court approval is required) often come with higher legal and timeline costs—leading to higher interest rates.

💼 Lender Competition – More lenders in competitive housing markets shrink margins and rates. Sparse competition? Higher prices.

📜 Local Fees & Regulations – State-specific transfer taxes, license fees, and title insurance vary—and get passed on to borrowers.

💳 Borrower Credit Quality – Stronger average credit health leads to lower rates; weaker credit profiles push state averages upward.

💰 Loan Size & Market Appeal – In high-balance markets (e.g., California), mortgages are larger, and investor demand for big loans can bring rates down slightly.

🐼 What It Means for You

Living in a higher-rate state doesn’t mean you’re stuck paying more. Here’s how to tilt the scales:

Compare quotes – Even lenders in your ZIP can differ. Let them bid for your business.

Polish your credit – A small credit score boost could cut hundreds off your monthly payment.

Pick the right program – FHA, VA, conventional, and jumbo loans don’t all price the same.

Lock smart – Watch the bond market and lock in when mortgage rates dip.

If you're buying in a high-rate area, let’s get strategic. I’ll help you compare lenders, level up your credit, and choose the best refinancing or purchasing approach—no matter where your home is.