🏦 CPI on Hold, Pressure Rising:

Inflation at 3.1% and What It Means for Mortgage Rates

With the government shutdown delaying fresh data, the September CPI report (now expected October 24) is set to show inflation holding around 3.1%. For most Americans, that number means the same things you’re buying now cost about 3 % more than they did a year ago. The problem? Paychecks haven’t kept up evenly — and that’s where the Fed’s challenge begins.

💡 The Big Picture

The CPI (Consumer Price Index) is the go-to measure for inflation — and it’s about to come in hot at around 3.1% year-over-year. While that’s cooler than the fiery 9% levels of 2022, it’s still well above the Fed’s 2% “comfort zone.”

To translate:

👉 Something that cost $100 last year now costs about $103.10.

👉 If your paycheck didn’t rise by 3%, your purchasing power dropped.

That gap — between prices and income — drives how the Fed, mortgage lenders, and markets decide what happens next.

🏛️ The Shutdown Shuffle

The ongoing government shutdown is creating an unusual kind of chaos for economists and markets:

📉 Data blackout: Many agencies are closed, meaning fewer reliable reports. The CPI is one of the few being “rescued” because it determines Social Security’s cost-of-living increase.

💸 Economic drag: Every week of the shutdown trims roughly 0.1%–0.2% off GDP growth, slowing the economy and dulling consumer confidence.

🕵️♀️ Fed’s data dilemma: With patchy info, the Fed has to rely more on forecasts than facts — meaning more cautious rate moves ahead.

Even with staff recalled for essential tasks, the delay adds fog to already cloudy economic skies.

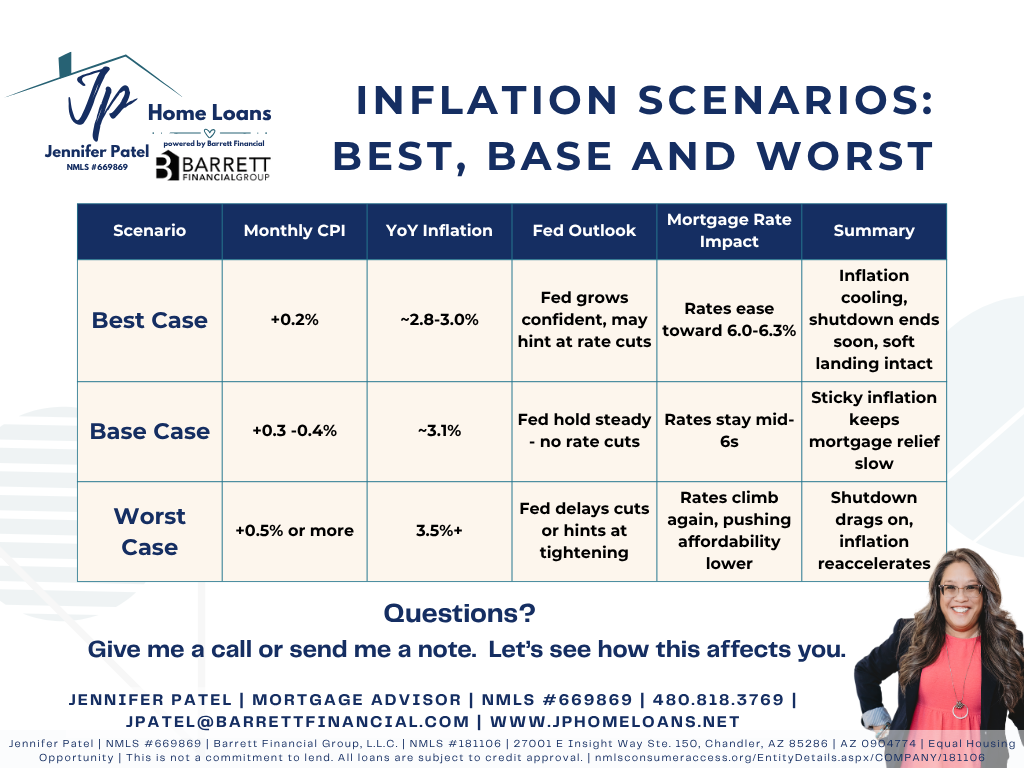

📊 Inflation Scenarios: Best, Base, and Worst

🏠 What This Means for Borrowers

Inflation eats into affordability: Even small changes in CPI shift how lenders price long-term rates.

Mortgage rates are hostage to the Fed: Until inflation cools below 3%, meaningful rate cuts stay off the table.

Refinance math matters more than ever: If rates drop even slightly, early movers benefit first — before the market readjusts.

Patience is a strategy: Waiting for the Fed to pivot could pay off, but only if inflation behaves.

🧭 Bottom Line:

This CPI report may not bring fireworks, but it’s a canary in the coal mine for how sticky inflation remains. Until the Fed sees consistent movement closer to 2%, mortgage rates are likely to hover in the 6–6.5% range — frustrating, yes, but also stable enough to plan around.

🐼 Mama Bear Translation: The economy’s throwing a tantrum, but this isn’t 2022. We’re still trending the right direction — just slower than we’d like.