What Is an Appraisal Contingency?

📌 What Is a Contingency in a Purchase Contract?

A contingency is an “if/then” clause written into the contract.

It says the transaction will move forward if certain conditions are met—like financing approval, inspections, or an appraisal coming in at value. If the condition isn’t met within the agreed timeline, the buyer typically has options without risking their earnest money.

Think of contingencies as the contract’s safety net. You hope you don’t need it, but you’re very glad it’s there.

🏠 What Is an Appraisal Contingency?

An appraisal contingency specifically protects the buyer if the home’s appraised value is lower than the purchase price.

Because lenders base the loan amount on the lower of the purchase price or appraised value, a low appraisal can create a gap between what the buyer agreed to pay and what the lender is willing to finance.

This contingency defines what happens next—renegotiation, additional cash, or the ability to walk away.

⚖️ Why the Appraisal Contingency Matters

For Buyers

Helps avoid overpaying for a property

Prevents unexpected cash requirements

Creates leverage to renegotiate if value comes in low

For Sellers

A low appraisal can delay or derail closing

Strong offers may limit or waive the contingency

Understanding appraisal risk helps with pricing and negotiations

🎯Bottom line: this clause quietly determines who absorbs risk when value and price don’t align.

🔢 Example: How an Appraisal Contingency Works

Purchase Price: $500,000

Appraised Value: $475,000

The lender will calculate the loan based on $475,000, not $500,000.

With an appraisal contingency in place, the buyer can:

Ask the seller to reduce the price

Bring in $25,000 to cover the gap

Negotiate a split

Cancel the contract (within contingency timelines)

Without the contingency, the buyer may be obligated to cover the full difference—or risk losing earnest money.

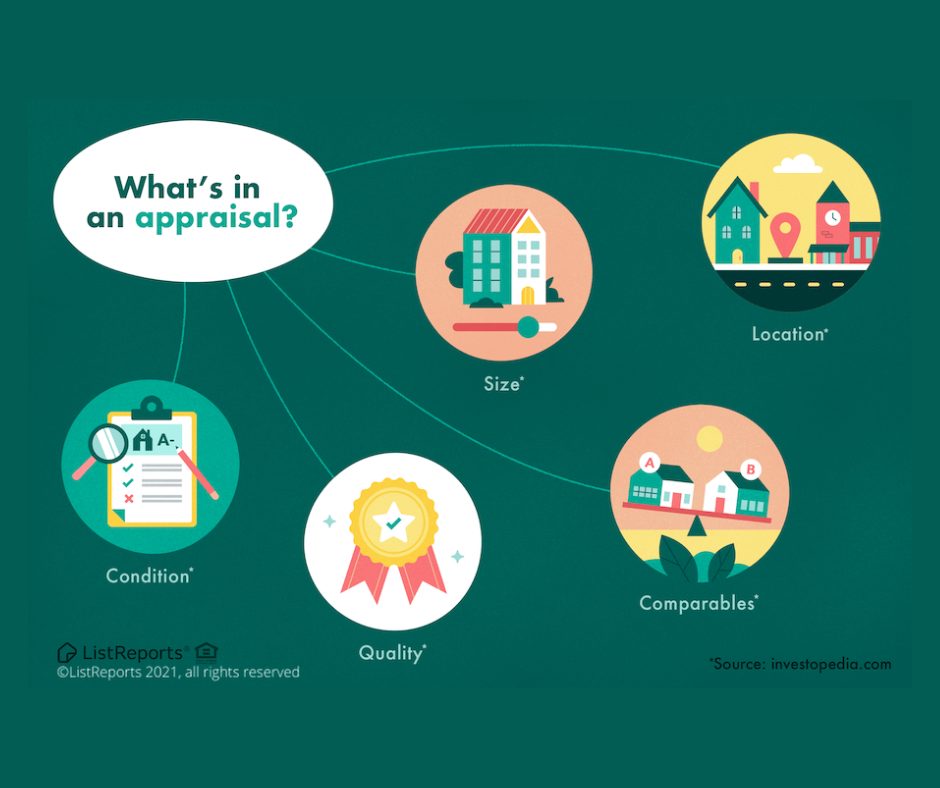

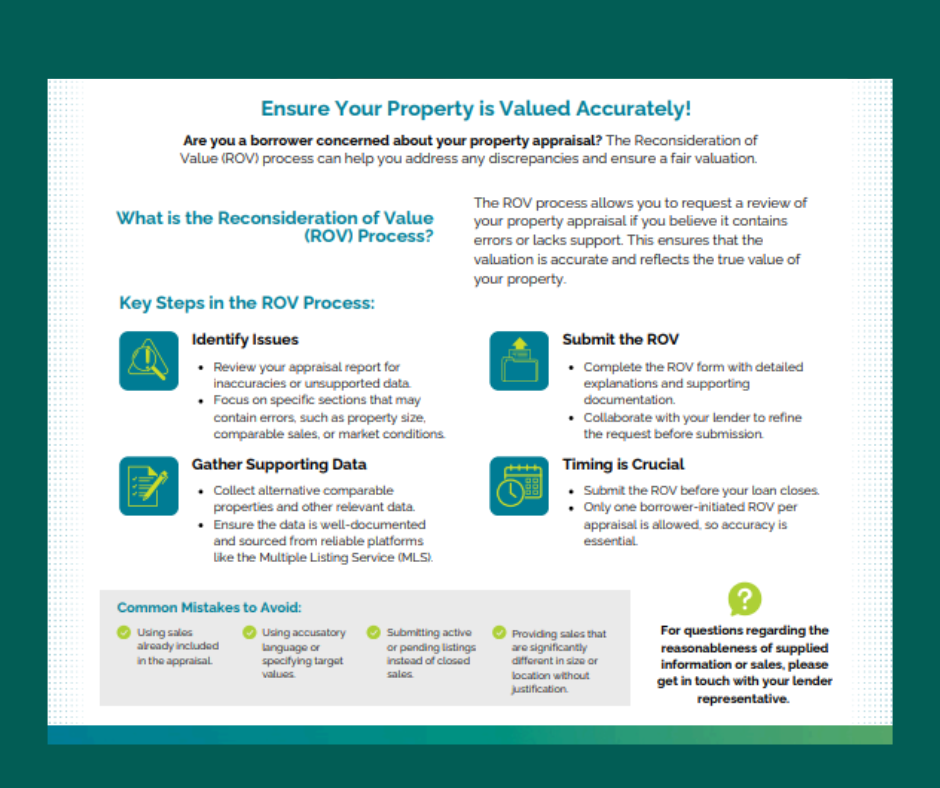

🔍 What Is a Review of Value (ROV)?

A Review of Value (ROV) is a formal request—submitted by the lender—to ask the appraiser to reconsider the appraised value.

Important note:

👉 Buyers and agents cannot contact the appraiser directly. All ROVs must go through the lender.

🧠 When Does an ROV Make Sense?

An ROV may be appropriate if:

Comparable sales were missed or outdated

Adjustments appear inconsistent

The appraiser overlooked upgrades or features

Nearby, relevant sales support a higher value

An ROV is not a guarantee of a higher value—but when supported by strong data, it can make a meaningful difference.

🛠️ What Happens During an ROV?

The agent provides additional comps or context

The lender submits the request to the appraiser

The appraiser reviews the new information

The value may stay the same or be revised

ROVs take time, which is why appraisal timelines matter so much in contract negotiations.

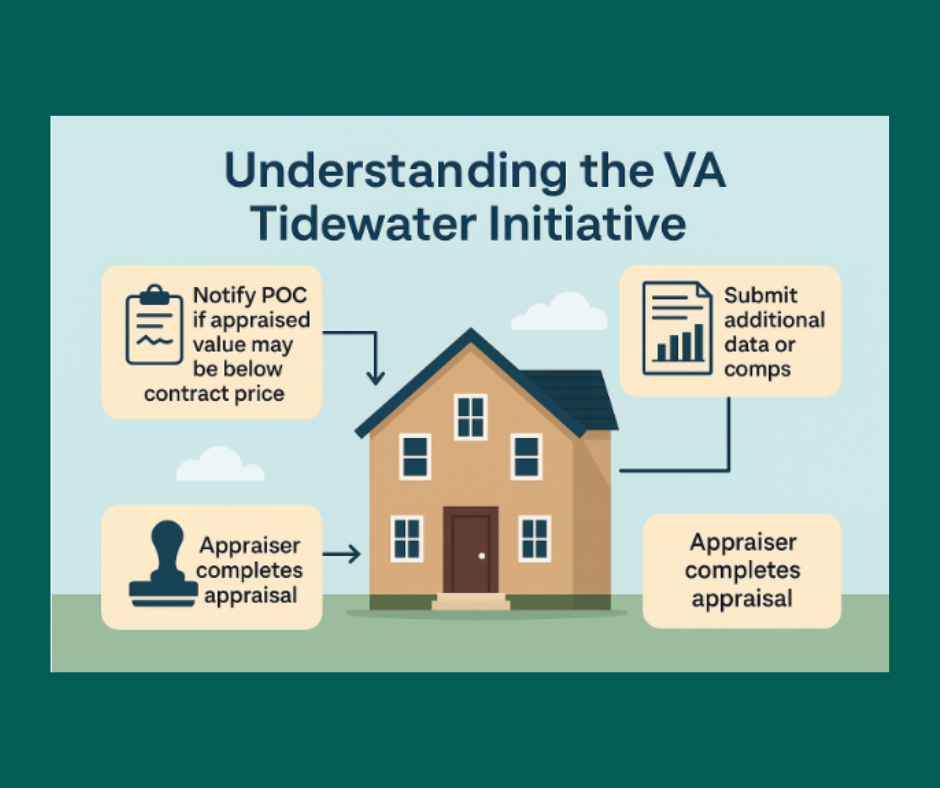

🫡VA Loans: What Is Tidewater?

Tidewater is a unique protection built into the VA appraisal process.

If a VA appraiser believes the home may not appraise at the contract price, they must pause the appraisal and trigger Tidewater before issuing a low value.

This gives all parties a chance to respond proactively instead of reacting after the fact.

🌊 How Tidewater Works

Once Tidewater is initiated:

The lender notifies the agent

The agent has a short window (typically 48 hours)

Additional comparable sales are submitted

The appraiser reviews the new data before finalizing value

Tidewater is essentially an early warning system—and a powerful one when used correctly.

🧩 Why Tidewater Matters

Gives VA buyers extra protection

Reduces surprise low appraisals

Creates a chance to support value before it’s final

Helps keep VA transactions competitive

It’s one of the many reasons VA loans remain an excellent option when properly structured.

🧩 The Big Picture

Appraisal contingencies, ROVs, and Tidewater all exist for the same reason: fair value and informed decisions.

Understanding these tools before you’re under contract can mean the difference between a smooth closing and a stressful scramble.

🐼Questions?

If you’re buying, selling, or reviewing an offer and want to understand how the appraisal contingency or an ROV applies to your situation, call me. I’m happy to help you read the fine print before it becomes a plot twist.