Proudly ServingThose Who've Served

For active-duty service members, Veterans, and eligible surviving spouses, the VA Home Loan is more than a mortgage option, it’s an earned benefit that helps turn the dream of homeownership into reality. With 100% financing, no private mortgage insurance, and some of the lowest interest rates available, VA loans continue to be one of the most valuable and impactful programs for those who have served.

Since its creation in 1944 under the GI Bill of Rights, the VA loan program has helped over 22 million Veterans and military families purchase or refinance homes. Designed to level the financial playing field for those returning from war, this program continues to provide long-term stability, affordability, and a well-deserved opportunity to build wealth through homeownership.

🎯 What is a VA Loan?

A VA loan is a mortgage insured by the U.S. Department of Veterans Affairs (VA) and issued by approved lenders. The VA guarantees a portion of the loan, allowing lenders to offer more favorable terms; including flexible underwriting, lower interest rates, and no required mortgage insurance.

Simply put, it’s a program built to honor service with financial empowerment helping Veterans and their families purchase homes with confidence, stability, and pride.

💰 Why the VA Loan Stands Out

Here’s why so many military families choose a VA loan:

0% Down Payment: Eligible borrowers can buy with no down payment and minimal out-of-pocket costs.

No PMI: No private mortgage insurance, ever.

Flexible Guidelines: Easier credit, debt ratio, and employment requirements.

Competitive Rates: VA loans often come with the lowest interest rates available.

Capped Fees: The VA limits closing costs and allows sellers to help cover expenses.

Reusable Benefit: Veterans can use their entitlement again and again — even after using it once.

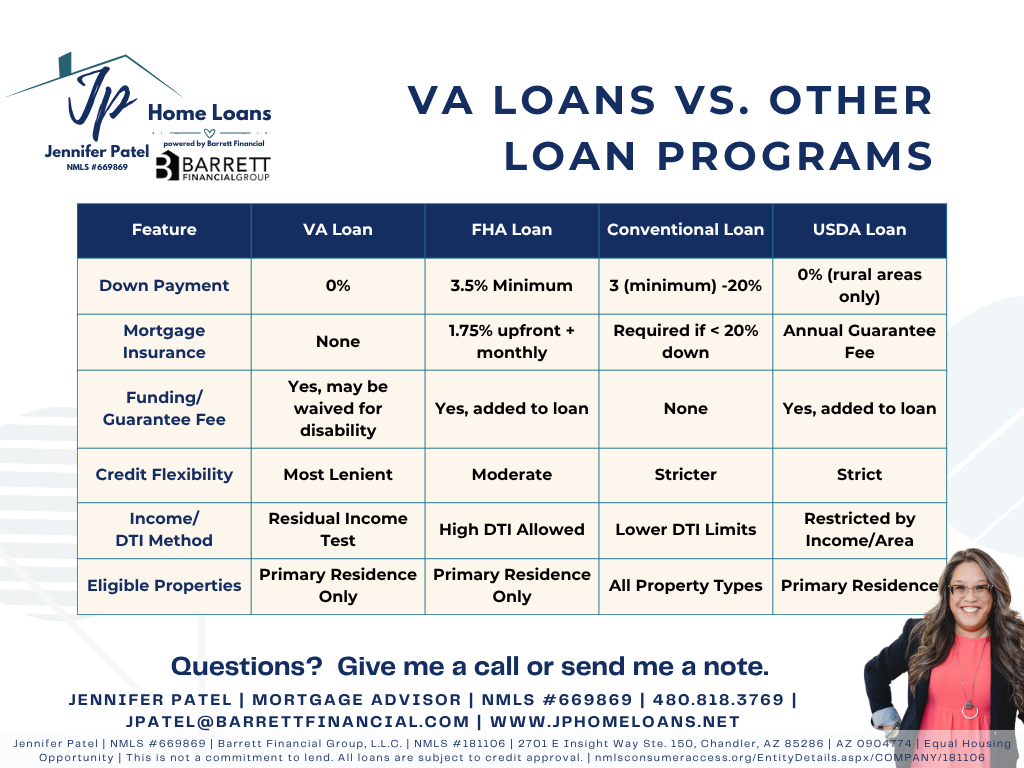

📊 VA Loans vs. Other Loan Programs

🏦 Funding Fees & Exemptions

Each VA loan includes a Funding Fee, which supports the program for future generations.

2.15% of the loan amount for first-time VA buyers

3.3% for subsequent uses

This fee can be rolled into the loan, and certain Veterans are exempt, including:

Those receiving compensation for a service-connected disability

Those entitled to compensation but receiving active duty or retirement pay

Eligible surviving spouses of Veterans who died in service or from a service-related disability

The VA also caps certain closing costs and allows sellers to contribute toward them — making it possible for some Veterans to buy a home with no money due at closing.

🧾 Getting Started

Before you start shopping, set yourself up for success.

If homeownership is on the horizon for you, talking to a lender early — like me — can make all the difference. Together, we’ll review your financial picture and create a clear game plan to reach your goal. Think of this step as Mortgage Boot Camp: before you’re out in the field, we’ll prepare you for what’s ahead. The sooner you start training, the smoother things will go when it’s “go time.”

Here’s what we’ll look at during this preparation stage:

Review your credit score (most lenders prefer 620+).

Pay down existing debt to improve your residual income.

Save for closing costs, even if your down payment is $0.

Obtain your Certificate of Eligibility (COE) — your lender can usually retrieve it instantly, or you can apply online through the VA’s eBenefits portal.

Once your foundation is set, I’ll help guide you through everything that comes next — from finding the right real estate partner who will take care of you, to finding the perfect home, and ensuring that we meet all of the other requirements needed for approvals with the VA loan.

❤️ Why It Matters

VA loans aren’t charity — they’re a thank-you. They were created to give those who’ve served a foundation to build on — literally and financially. Each one represents a story of service, sacrifice, and well-earned opportunity.

💬 A Personal Note from Jenn

Our family may not go all the way back to the American Revolution — but our ties to the military run deep. My family came to this country in the 1950s, and service has been part of our story ever since. From relatives who fought in the Korean War to loved ones who are currently enlisted today, that spirit of commitment and honor runs through generations.

I’m also the proud wife of a retired Air Force Captain who served our nation for 24 years. That experience gave me a firsthand understanding of the unique challenges military families face — the relocations, deployments, and financial transitions that come with service life.

Over the years, I’ve had the privilege of helping countless Veterans and active-duty families achieve homeownership — guiding them through the VA loan process with care, precision, and heart. I know this program inside and out, and I’m passionate about helping military families use this incredible benefit to build stability and wealth for their futures.

Minesh and I many moons ago before we both both old and gray. 😜

📞Our Mission: Homeownership

Whether you’re serving now, have served in the past, or love someone who has, I’m here to help make your homeownership goals a reality. You’ve earned this benefit — let’s make the most of it together.